$PROG has officially triggered ALL of my Short Exempt Squeeze Signals.

Utilization is over 95% since 9/22

Short Exempts were 6% of short volume today, 3rd day in a row above 3%

SMA is 5% up for the 10th day in a row

Short Vol 53M today

This will be a long-ish thread. Buckle up

Utilization is over 95% since 9/22

Short Exempts were 6% of short volume today, 3rd day in a row above 3%

SMA is 5% up for the 10th day in a row

Short Vol 53M today

This will be a long-ish thread. Buckle up

The short volume being over 53M today speaks volumes to the effor that was made to control the price today.

It didn't work.

Here's the FINRA Short volume data from today.

Meanwhile, @ORTEX is updating or their brokers are stalling for time while they manage the chaos.

It didn't work.

Here's the FINRA Short volume data from today.

Meanwhile, @ORTEX is updating or their brokers are stalling for time while they manage the chaos.

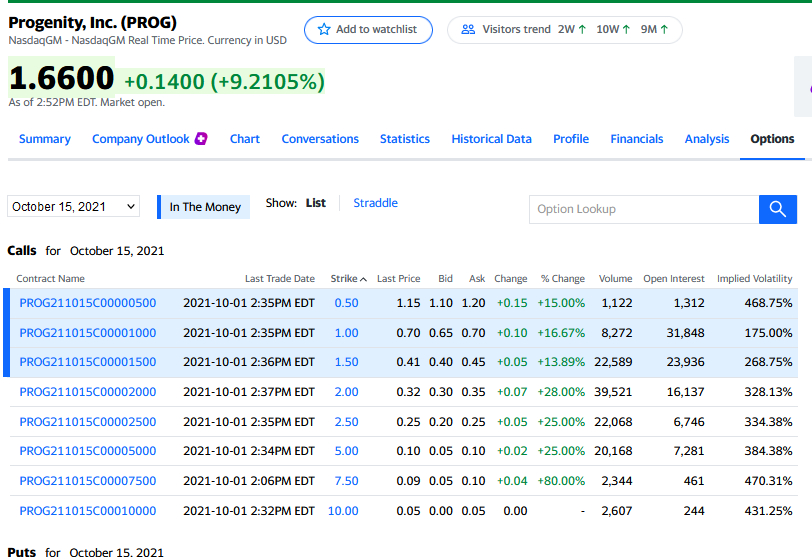

$PROG's call chain has been growing at an incredible rate over the past two months, where we began with less than 20k OI on the call side from October to January, all the way to over 100k calls just in November alone.

This image was taken Oct 13, just before Expiration

61.7k ITM

This image was taken Oct 13, just before Expiration

61.7k ITM

$2.00 is an incredibly strong base of support, with many more $PROG holders having bought in much, much lower at $1.50 and below.

With today's price action, we re-affirmed $2.00 as a base, and are working on breaking through $3 every single green day we have. Today makes the 3rd

With today's price action, we re-affirmed $2.00 as a base, and are working on breaking through $3 every single green day we have. Today makes the 3rd

Back to the options chain today, we have 44.5K calls ITM currently for 11/19 at $2.50 and below.

Near the money up to $4, we have an additional

70,539 calls, worth 7M shares, which is just incredible.

Just imagining the gamma potential gets my tits jacked.

Near the money up to $4, we have an additional

70,539 calls, worth 7M shares, which is just incredible.

Just imagining the gamma potential gets my tits jacked.

In total, on this chain, if we reach $4 before 11/19, that would be equal to 115k calls or 11.5M shares in all.

Oh, but it gets better. Max-pain for the Put chain sits above $3 at a tidy 28.8K puts, or 2.88M shares for $8,640,900 in lost equity at $3 or more per share.

Oh, but it gets better. Max-pain for the Put chain sits above $3 at a tidy 28.8K puts, or 2.88M shares for $8,640,900 in lost equity at $3 or more per share.

Given the weight of the put-call ratio massively favoring the bull side, it may simply be that most of these puts are probably hedges against any retracement, which seems less and less likely with each passing day.

$PROG and $PFE are increasingly being dicussed together as $PROG's ingestible delivery systems for drugs like Humira continue to make headlines. There is a rumor circulating of some kind of buy out.

Haven't confirmed anything of the sort, but even rumors can fuel speculation.

Haven't confirmed anything of the sort, but even rumors can fuel speculation.

Regardless, $PROG is moving ahead, and it's growing more and more evident every day that the stock is building momentum toward it's true valuation.

Shorts are fucked at this point. This stock isn't going back to where it was 2 months ago. The situation has completely turned.

Shorts are fucked at this point. This stock isn't going back to where it was 2 months ago. The situation has completely turned.

The shorts who have been in since below $1.60 have been bleeding daily, and everyone who still holds a position above $2 can breath a huge sigh of relief while we make our slow climb toward $5.

Long term, I see $PROG trading well above $20, but only after this squeeze settles.

Long term, I see $PROG trading well above $20, but only after this squeeze settles.

With 67% SI and 80% of all shorts underwater, no shares available for borrowing, and the average cost basis for shorts being at $1.60, $PROG is looking like a race for the door for short sellers.

My guess is they're hoping for another dilution to give them a chance at escape.

My guess is they're hoping for another dilution to give them a chance at escape.

As mentioned in official SEC filings made by $PROG, no dilution or even an announcement of plans for dilution can take place until 11/20 per $PROG's most recent 8-K filing.

Plenty of time.

But this dilution is what shorts are banking on taking place to escape before a squeeze.

Plenty of time.

But this dilution is what shorts are banking on taking place to escape before a squeeze.

For the record, this tool of a grinning idiot right here has 60% voting power over $PROG, so any vote to dilute is basically his decision. If he makes a move to filibuster a diliution, then we all know it's an attempt by Athyrium to squeeze out retail in order to buy-out $PROG

I intend to remind Mr. Ferrell in an email of his Fiduciary Duty to $PROG investors, that if he votes to dilute the stock of $PROG for a third time this year that he will be doing so in direct violation of his fiduciary duty to his fellow shareholders.

shareholderoppression.com/shareholder-di…

shareholderoppression.com/shareholder-di…

That aside, I wanted to say that I'm really proud to be with such a commited group of investors that believe in what $PROG can become as a company, and that I genuinely believe in it's future.

See ya'll on the moon. 🤘

See ya'll on the moon. 🤘

• • •

Missing some Tweet in this thread? You can try to

force a refresh