$PROG AH action only appears disappointing. I just went through the transcripts (I wasn't able to listen live), and the confirmed drug combinations for tofacitinib (or biosimilars) and adalimumab, which are manufactured by pfizer and Abbvie respectively.

Don't panic. 📉=🐂💩

Don't panic. 📉=🐂💩

This is AH accumulation, which may continue tomorrow, but I'm so bullish. Day trade puts if you want to play games with the intraday chart, but I'm just gonna hold.

Ya'll give way too much credit to AH.

There is no volume.

Shorts haven't covered

Even as the float grew.

Ya'll give way too much credit to AH.

There is no volume.

Shorts haven't covered

Even as the float grew.

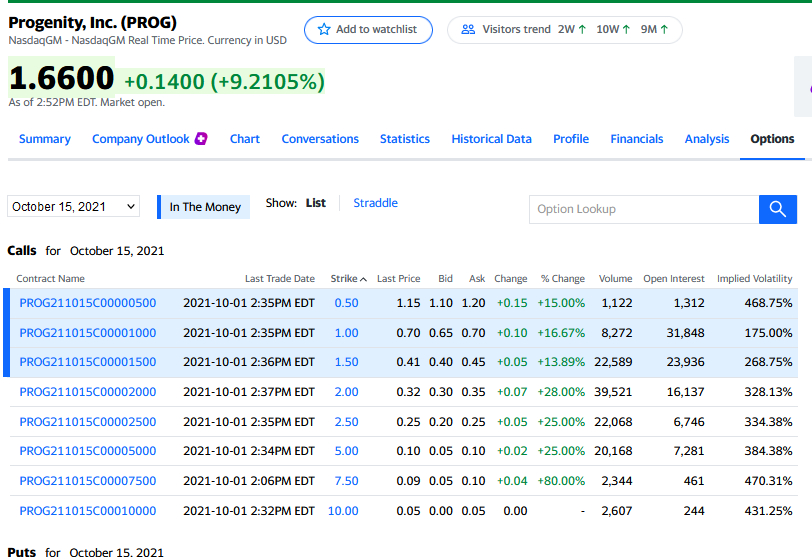

Let's just think for a second about the volume on $PROG this month.

Is there a single red candle in this chart with any kind of impressive volume?

No. Dumps happen after massive runs and we haven't hit the next level yet. Just be patient.

Is there a single red candle in this chart with any kind of impressive volume?

No. Dumps happen after massive runs and we haven't hit the next level yet. Just be patient.

Once in a lifetime opportunities don't happen on your schedule. They present themselves momentarily and give you the option to sieze them ONCE and once that moment is gone, the opportunity is lost forever.

If this is what you believe is your one in a lifetime... patience is

If this is what you believe is your one in a lifetime... patience is

By the way, congratulations to you all who bought the dip. I'm still taking a break for just a couple more days.

I'll be back for Monday opening bell.

See you then.

I'll be back for Monday opening bell.

See you then.

• • •

Missing some Tweet in this thread? You can try to

force a refresh