Why Gold could be 'The' asset to focus on and how to play it?

In 2021, gold hasn't done much. Its down 6% YTD. It was up a clean 20% in 2020.

What could be in store ahead. A thread 🧵 explaining drivers and way ahead.

In 2021, gold hasn't done much. Its down 6% YTD. It was up a clean 20% in 2020.

What could be in store ahead. A thread 🧵 explaining drivers and way ahead.

There are 4 factors that are key to watch

1. Massive financial debasement across the world

2. Negative Real Interest rates

3. Gold's unique diversification edge

4. Incremental demand Vs limited supply

1. Massive financial debasement across the world

2. Negative Real Interest rates

3. Gold's unique diversification edge

4. Incremental demand Vs limited supply

Financial debasement

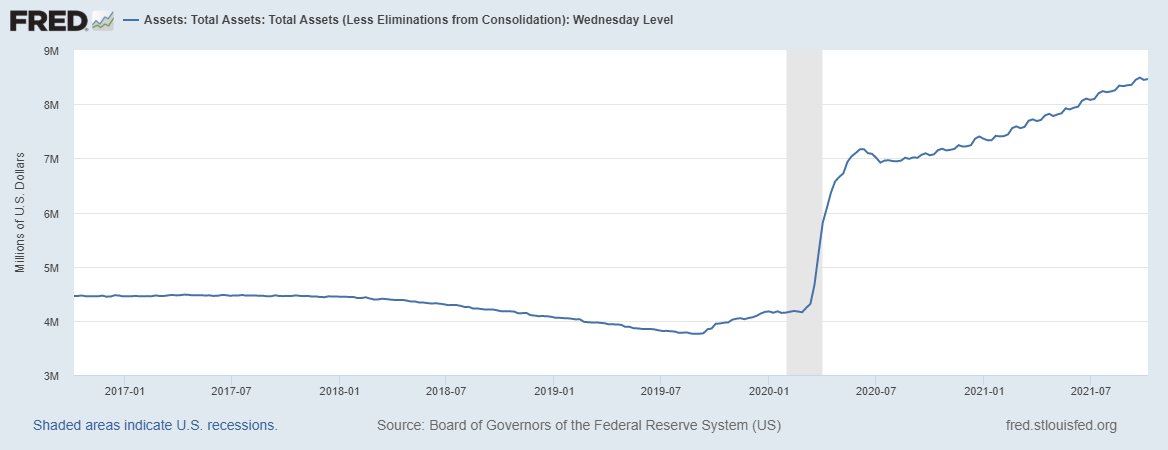

US Fed's balance sheet has doubled from $4.2 trn to $8.4trn since COVID began. Similarly ECB, BOJ, BOE and EM central banks have embarked on massive monetary stimulus.

This was used to finance Govt deficit. This monetization/debasement is bullish for Gold.

US Fed's balance sheet has doubled from $4.2 trn to $8.4trn since COVID began. Similarly ECB, BOJ, BOE and EM central banks have embarked on massive monetary stimulus.

This was used to finance Govt deficit. This monetization/debasement is bullish for Gold.

Negative real rates

Gold prices follow moves in interest rates. Real interest rates are the nominal level of interest rates minus the inflation rate. Negative real rates erode the value of money. Gold being a store of value benefits from this...

Gold prices follow moves in interest rates. Real interest rates are the nominal level of interest rates minus the inflation rate. Negative real rates erode the value of money. Gold being a store of value benefits from this...

Real rates are the most negative that they have been. Even junk bond yields have turned negative adjusted for inflation.

Gold moves inline with moves in real rates. With inflation still above normal trend and central banks likely to keep rates low, Gold is likely to benefit.

Gold moves inline with moves in real rates. With inflation still above normal trend and central banks likely to keep rates low, Gold is likely to benefit.

Gold's unique diversification edge

Gold does well when other markets aren't. In fact historically when equity markets fall or undergo consolidation, Gold performs very well.

This is because Gold prices move on the basis of incremental demand...

Gold does well when other markets aren't. In fact historically when equity markets fall or undergo consolidation, Gold performs very well.

This is because Gold prices move on the basis of incremental demand...

Given where equities are both in terms of performance (14th Yr of Nasdaq's +ve YTD) and valuations (S&P500 21X Fwd PE), Gold provides a natural hedge.

It has a unique track record as well. See image.

It has a unique track record as well. See image.

Demand/Supply

Gold mining output shrunk in 2019 & 2020. It is likely to shrink in 2021 as well. Gold reserves with global Gold miners are also falling since they peaked in 2013.

Gold's supply is limited and exploration is also slow paced. What moves gold is then demand.

Gold mining output shrunk in 2019 & 2020. It is likely to shrink in 2021 as well. Gold reserves with global Gold miners are also falling since they peaked in 2013.

Gold's supply is limited and exploration is also slow paced. What moves gold is then demand.

Three demand drivers

1. Jewelry / consumption demand

2. Central Banks

3. Investment demand (ETFs)

COVID caused all the three drivers to shrink. Now all three are coming back. India's festive seasons demand is back to 100tons and growing. CBs are buying Gold again.

1. Jewelry / consumption demand

2. Central Banks

3. Investment demand (ETFs)

COVID caused all the three drivers to shrink. Now all three are coming back. India's festive seasons demand is back to 100tons and growing. CBs are buying Gold again.

The investment demand for Gold is a combination of impact of real rates, performance of equity markets and price momentum for Gold.

Since supply is limited and other two demand drivers also nearly static, investment demand is the biggest driver. And this is the key.

Since supply is limited and other two demand drivers also nearly static, investment demand is the biggest driver. And this is the key.

Gold has been in a long, triangle type consolidation. This is likely to see a breakout above $1850 and a follow through could add momentum to gold prices. See image.

Another big driver for Gold is the trend in US Dollar. This year the US Dollar has risen, anti-consensus, by about 4%. Gold performers well even in a rising Dollar environment when real rates are negative and catches momentum when USD rise slows or reverses.

How to play this?

1. First it to play this move through a Gold ETFs or Sovereign Gold Bonds. Both are ideal instrument.

2. When Gold moves are structural it helps to play them through Gold mining shares or Gold mining equities.

1. First it to play this move through a Gold ETFs or Sovereign Gold Bonds. Both are ideal instrument.

2. When Gold moves are structural it helps to play them through Gold mining shares or Gold mining equities.

Gold equities offer a higher beta to gold. In bull markets this beta can expand and in bear markets it is detrimental. Its cuts both ways. In structural gold bull markets, it makes sense to have exposure to Gold mining equities. $1 move in gold is 1.7X in gold mining shares.

In conclusion

a. We are likely in or entering a structural uptrend in Gold

b. Momentum and performance may gain traction ahead

c. Way to participate in either trough tradition gold bullion or ETFs/SGBs or through Gold mining equities.

a. We are likely in or entering a structural uptrend in Gold

b. Momentum and performance may gain traction ahead

c. Way to participate in either trough tradition gold bullion or ETFs/SGBs or through Gold mining equities.

One fund which plays this theme is DSP World Gold Fund.

Check details here - invest.dspim.com/mutual-fund-pr…

and here - dsp.dzvdesk.com/IntFoFs.aspx?M…

---

Check details here - invest.dspim.com/mutual-fund-pr…

and here - dsp.dzvdesk.com/IntFoFs.aspx?M…

---

• • •

Missing some Tweet in this thread? You can try to

force a refresh