1/3

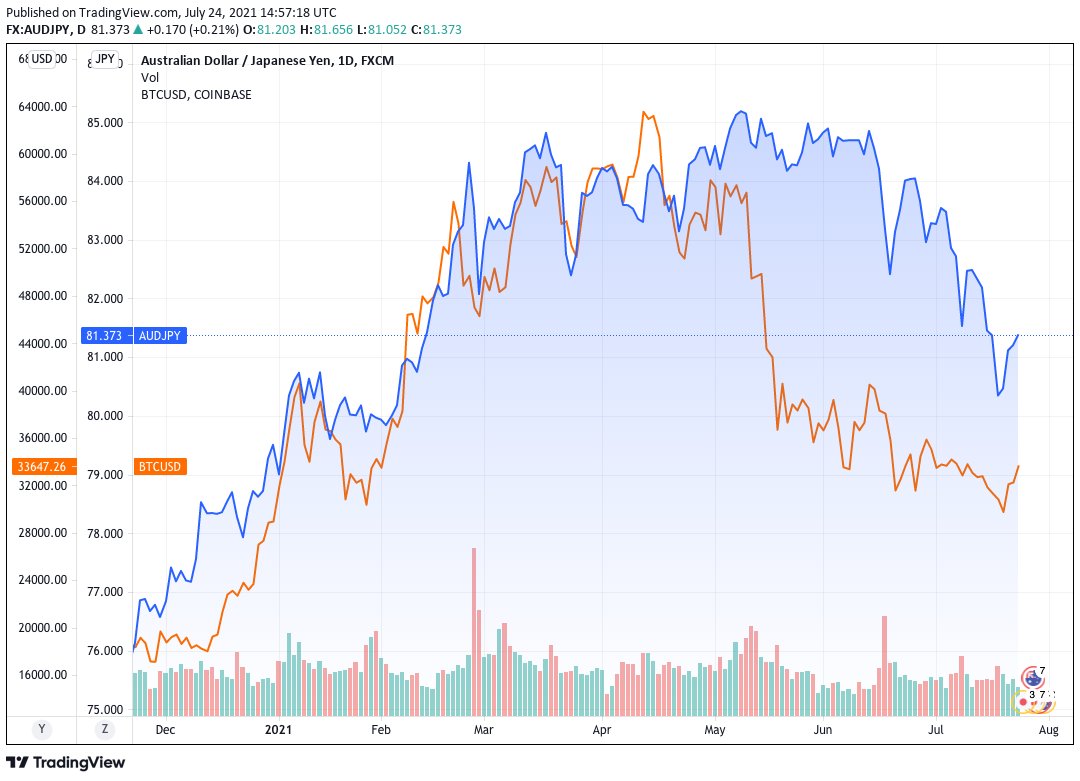

AUDJPY and BTC still both risky assets and somewhat joined at the hip with BTC leading more often and AUDJPY lagging.

Blue line is bitcoin, black is AUDJPY. Hourly since late August...

AUDJPY and BTC still both risky assets and somewhat joined at the hip with BTC leading more often and AUDJPY lagging.

Blue line is bitcoin, black is AUDJPY. Hourly since late August...

Why? Both pairs are risky assets that loosely (but not perfectly) reflect the current level of money sloshing around in the system. When money gets sucked out, AUDJPY and BTC go down. When money comes back in, they go up. There are always leads and lags.

• • •

Missing some Tweet in this thread? You can try to

force a refresh