Thread dedicated to Peter Lynch.🙏

Topic : "Co.'s making Products/Services you love and are increasingly using can make great potential investing candidates".

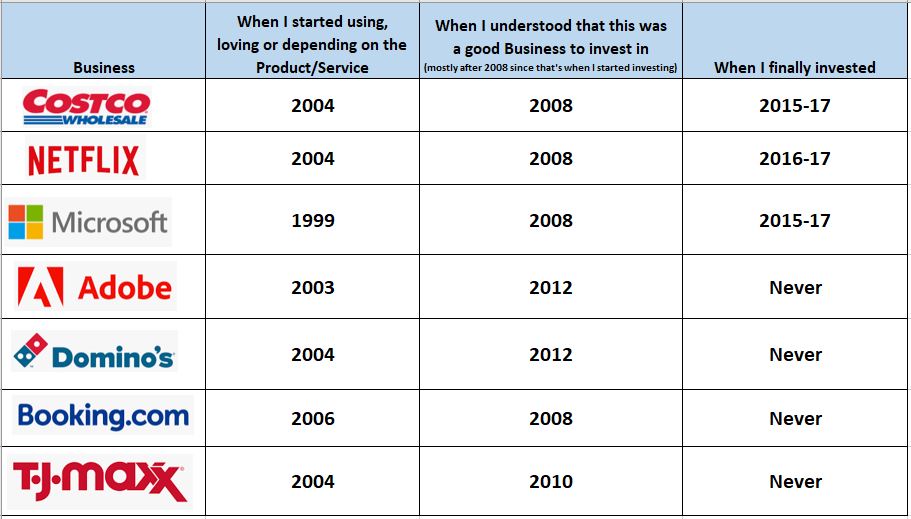

1⃣ My Laziness list : Consumer facing Co.'s that I used, loved & understood but still invested way too late.

Topic : "Co.'s making Products/Services you love and are increasingly using can make great potential investing candidates".

1⃣ My Laziness list : Consumer facing Co.'s that I used, loved & understood but still invested way too late.

Despite reading Peter Lynch in '08 and fully getting onboard (mentally) with his philosophy of investing in what you love/use, practically I still didn't apply this early enough. Why? Always getting attracted to some shiny new Co (I can't relate to) or an "amazingly cheap stock".

2⃣ My Crimes list : of selling great/relevant co.'s too early or never investing in other Co.'s I knew to be great for at least a decade.

3⃣ My Lessons list : Well, after making so many dumb mistakes you better learn something.

They taught me to be more alert to these products/services being used increasingly, run them thru DD, and start buying sooner instead of waiting for that "perfect valuation entry point".

They taught me to be more alert to these products/services being used increasingly, run them thru DD, and start buying sooner instead of waiting for that "perfect valuation entry point".

What about you? Maybe you work in the IT industry or an Entrepreneur and came across these companies 5-10 years ago?

$TEAM

$NOW

$TWLO

$SHOP

$HUBS

$TEAM

$NOW

$TWLO

$SHOP

$HUBS

OK, now the long winded lesson.

You (or your circle) using and liking the Product/Service is only the first step. Now begins the fun.

You (or your circle) using and liking the Product/Service is only the first step. Now begins the fun.

Remember that

✔️A good product doesn't always have to mean a good Business behind it.

✔️A good Business doesn't always mean a good stock going forward when there's a lot priced in (depends on durability, competitive strengths, growth runway...)

✔️A good product doesn't always have to mean a good Business behind it.

✔️A good Business doesn't always mean a good stock going forward when there's a lot priced in (depends on durability, competitive strengths, growth runway...)

As an individual investor who is starting out picking individual stocks, it's better to start your search for investable candidates from your own experiences.

✔️What Products/Services are you increasingly using as a Consumer or a Business user? Which ones are delighting you?

✔️What Products/Services are you increasingly using as a Consumer or a Business user? Which ones are delighting you?

✔️What is your family increasingly using/consuming?

Those (discretionary) recurring charges on the credit card bill are trying to tell you something. Listen closely.🙂

Those (discretionary) recurring charges on the credit card bill are trying to tell you something. Listen closely.🙂

✔️What about your friends, colleagues, online friends and wider media (learn how to discount the media hype though).

✔️You can then expand into your areas of interest and work on your circle of competence (and slowly expand it)

✔️You can then expand into your areas of interest and work on your circle of competence (and slowly expand it)

Below are some general and some specific questions to ask after you come up with a list of business you use/like.⬇️⬇️

1⃣ Dig more into why you like it specifically. Does it offer something cheaper/better/faster/more convenient than before? Does it let you do something that wasn't possible before? What pain points is it solving? What feeling/experience is it offering?

2⃣ Is the company increasingly doing the same for tons of other people/businesses?

3⃣ Is this Product/Service a fad or something more sustainable? It's not always easy to figure that out, but try to get out of the hype (if there is one) and analyze more clearly.

3⃣ Is this Product/Service a fad or something more sustainable? It's not always easy to figure that out, but try to get out of the hype (if there is one) and analyze more clearly.

4⃣ Is there some recurring nature to the relationship? By subscriptions, habit/routine, high mindshare....

5⃣ What is the Business Model exactly? How does the Company make money? Do you understand it and can you clearly explain it to someone else (outside of Finance)?

5⃣ What is the Business Model exactly? How does the Company make money? Do you understand it and can you clearly explain it to someone else (outside of Finance)?

6⃣ What other products/services does the company offer? Is it more than a one hit wonder? Is the Company building an Ecosystem, Platform or Community aspects?

7⃣ If this is a new company, product/service, after the early adopters are onboarded, what is the company's strategy for winning more customers? More/newer products, more Marketing, wider price options, collaborations...?

8⃣ Can you see the growth opportunity ahead of this company (based on the customer needs, ongoing trends, R&D/Innovation track record of the company)?

9⃣ Who are the people running the Business and what's driving them? Learn more about their background of how they came to run this business, their incentives, integrity, track record of capital allocation and execution.

🔟Going thru the Financials and seeing if they are making sense based on the life cycle of the company and it's strategy (Revenue growth trends, Margin trends, Expenses (S&M, R&D..) and if they are translating to sustainable growth,

Balance sheet breakdown, Inventory/Receivables/Asset turnovers if Retail based, Working capital ratios, what the Operating & Free cash slows looks like and in relation to reported Earnings...)

1⃣1⃣ Valuation is important, but you also have to consider it in the context of Quality of the Business & Management, track record of growth/execution, Financial position, Life cycle of the company, Competitive strength, TAM/Optionality, overall Market sentiment...

1⃣2⃣ Remember that you don't need to build an entire position once. You can always buy some, watch for execution, thesis progress, add slowly (at various Valuation points) to build a full position slowly, if this is a Company you believe will be much bigger in the future.

The joy you can get every time you sip that $SBUX coffee, dig into that $CMG bowl, walk in those $NKE shoes, open up that $AAPL iPhone, fire up the $NFLX App, see that $AMZN delivery box, watch a $DIS movie with kids, walk into a $COST or $HD

... as a (tiny) owner of that Company along with some big (or potential) gains makes investing in individual companies worth that much more.

(All these are purely examples only, you might have other Co'.s in your life).

(All these are purely examples only, you might have other Co'.s in your life).

OK, by now I think you get the point.

Before getting excited about an online stock tip (about which you know nothing) or a Pre Revenue Company (that just sounds so damn sexy)...

Before getting excited about an online stock tip (about which you know nothing) or a Pre Revenue Company (that just sounds so damn sexy)...

always look at all the good stuff that's right in front of your eyes (or around you) that you might be missing.

There are some awesome companies and massive potential gains right there.

/END

There are some awesome companies and massive potential gains right there.

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh