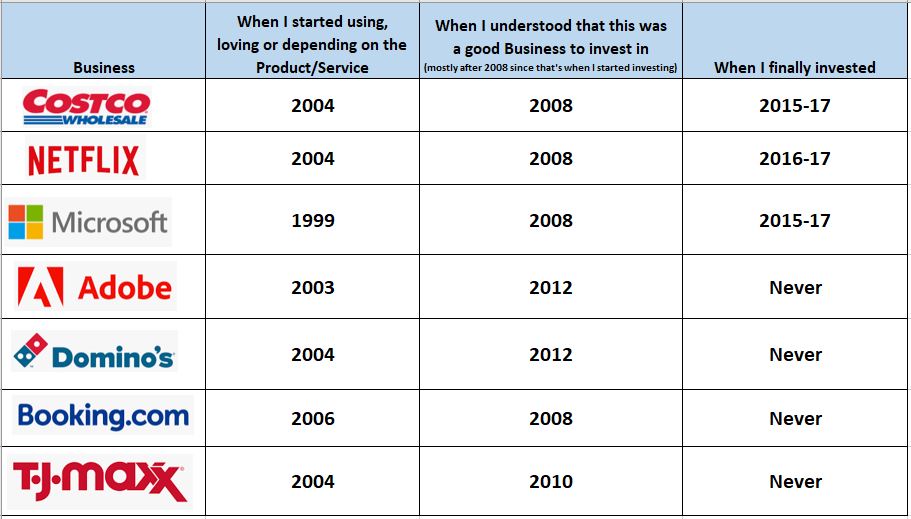

"The Investment Checklist" by Michael Shearn is an excellent book for individual investors. On a practicality & usefulness scale, it's right up there with Peter Lynch and Pat Dorsey's books imo.

cc: @dmuthuk @Gautam__Baid @saxena_puru @BrianFeroldi

Full checklist👇

cc: @dmuthuk @Gautam__Baid @saxena_puru @BrianFeroldi

Full checklist👇

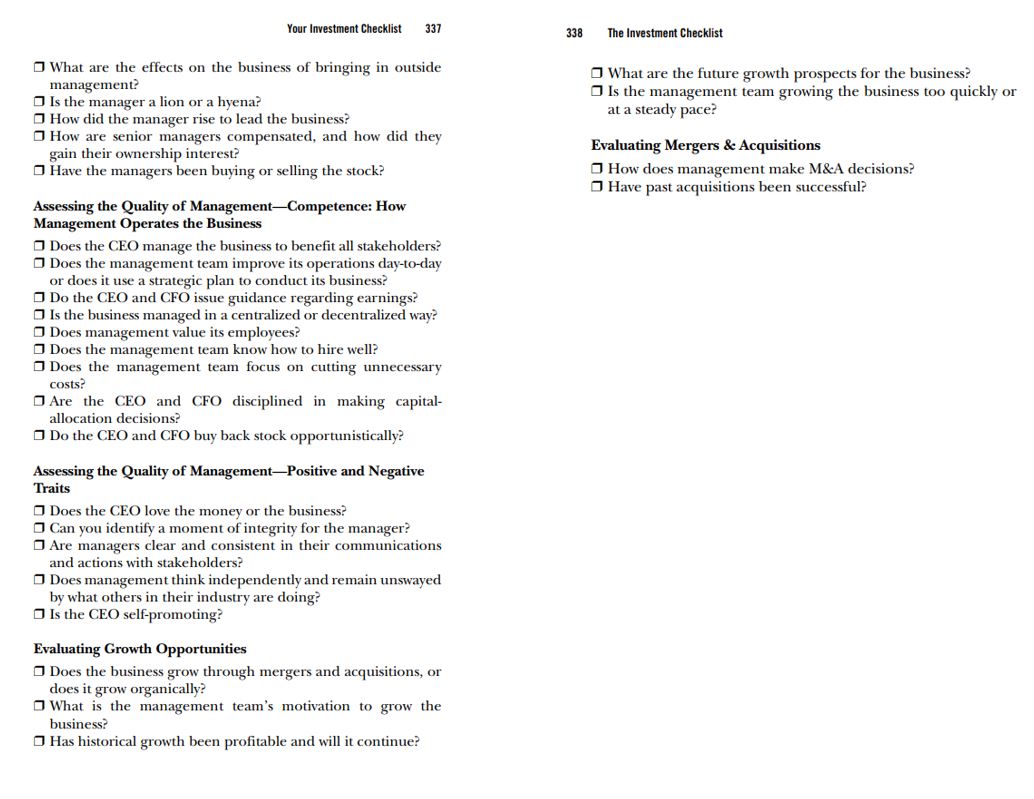

Checklist based on

✔️The Basics

✔️Customer perspective

✔️Strengths & Weaknesses

✔️Operating & Financial Health

✔️Quality of Earnings

✔️Quality of Management : Background, Competence, Positive & Negative traits

✔️Growth Opportunities

✔️Mergers & Acquisitions

✔️The Basics

✔️Customer perspective

✔️Strengths & Weaknesses

✔️Operating & Financial Health

✔️Quality of Earnings

✔️Quality of Management : Background, Competence, Positive & Negative traits

✔️Growth Opportunities

✔️Mergers & Acquisitions

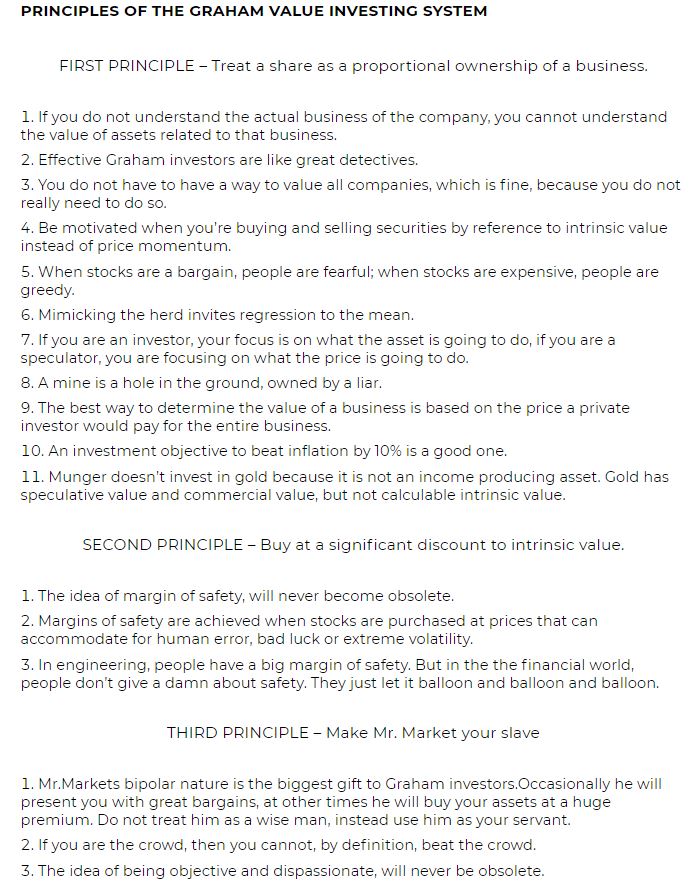

The Summaries at the end of each chapter are highly useful reminders too. Few of my fav ones.⬇️

✔️Understanding the Business from the Customer perspective

✔️Understanding the Business from the Customer perspective

The best part of the book is that it doesn't get much into any Quantitative & arbitrary numbers and ratios (w.r.t Financials and Valuation) that pretend to be universally relied upon for evaluating an investment.

Those are obviously important but also highly dependent and influenced by the particular industry, growth stage of the company, Quality & competitive positioning, Market/Macro sentiment etc.

So Fundamental and Qualitative research/analysis first, and then decide if the company is worth investing in, and if an action is warranted at the current prices (buy, hold, sell, add to watchlist etc....)

Checklists as you know are very important to combat the hype, noise, personal biases and to ensure that all current/prospective investments are meeting the quality thresholds and Portfolio requirements...

but they should be used after you do the overall analysis and due diligence of the Companies (within your circle of competence), and not as a quick task to finish off before you eagerly want to buy a stock.

The free version of this book is available here, but totally worth buying the physical copy if you can afford.

csinvesting.org/wp-content/upl…

csinvesting.org/wp-content/upl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh