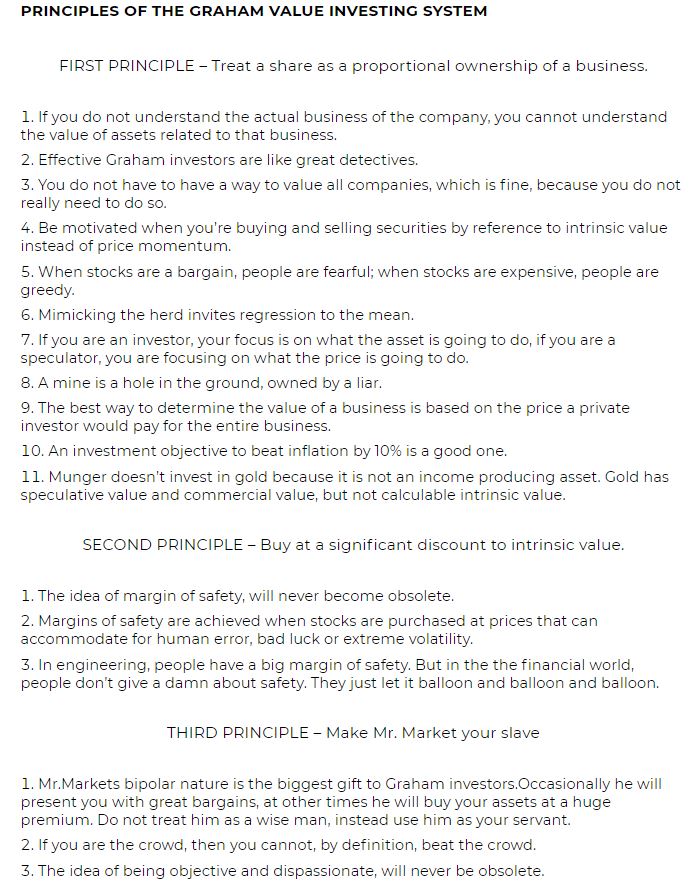

Good presentation on Buffett's investing style. Plenty of wisdom & common sense packed in, with many useful pointers for individual investors too.

(If ppt doesn't open/download on Mobile, try on PC).

Some of my fav slides combined in the below thread.⬇️

csus.edu/indiv/k/kuhlej…

(If ppt doesn't open/download on Mobile, try on PC).

Some of my fav slides combined in the below thread.⬇️

csus.edu/indiv/k/kuhlej…

• • •

Missing some Tweet in this thread? You can try to

force a refresh