💥 You are walking through your Maker Vault and suddenly this capybara has appeared!

⚔️ This is the Dai Protector, a capybara from @CryptopetsAR with a sword and a Dai-branded shield that is always ready to protect your collateral, your Dai and your entire Maker Vault.

⚔️ This is the Dai Protector, a capybara from @CryptopetsAR with a sword and a Dai-branded shield that is always ready to protect your collateral, your Dai and your entire Maker Vault.

🙌 Thanks to @CryptopetsAR for this custom MakerDAO NFT.

🔬 The Dai Protector capybara comes with a proprietary built-in CryptoTag that can be scanned to activate the augmented reality technology.

🔬 The Dai Protector capybara comes with a proprietary built-in CryptoTag that can be scanned to activate the augmented reality technology.

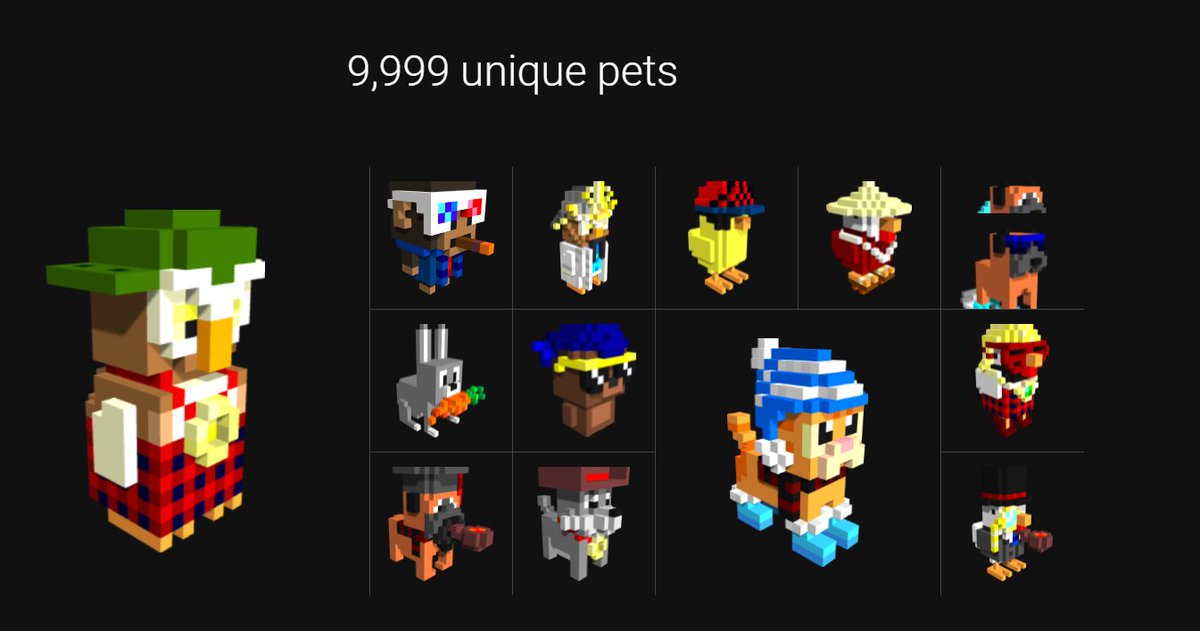

👾 In the same way, all of the 9,999 unique pets have this amazing feature!

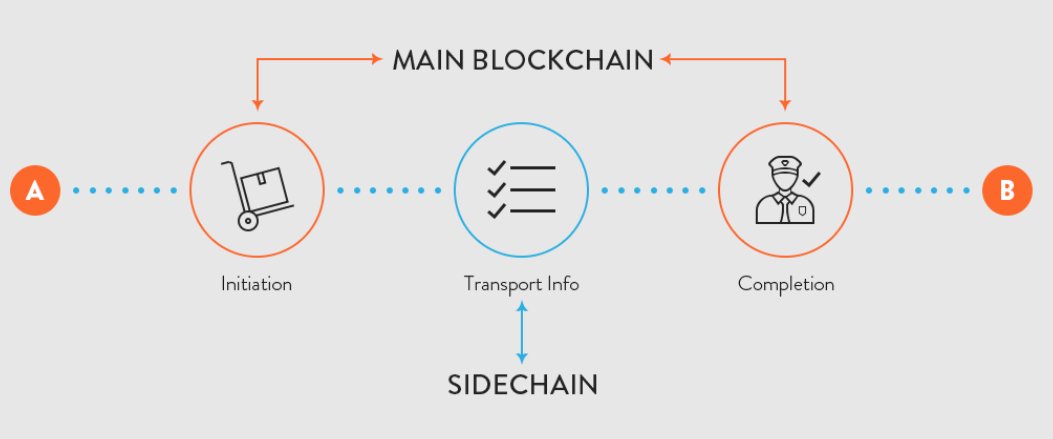

⛓️ All CryptoPets live in the Solana blockchain and can be viewed in augmented reality just by scanning their identifier QR code.

⛓️ All CryptoPets live in the Solana blockchain and can be viewed in augmented reality just by scanning their identifier QR code.

🔥 Test this out for yourself on their website (cryptopets.tech), and don't forget to sign-up for their pre-sale allocation while you're at it!

🦑 Actually, they are the first NFT augmented reality collection that leads the pack towards an interoperable and open-world blockchain! The team are building a 3D P2E CryptoPets game inspired by #SquidGame, and their NFTs will also join their follow-up metaverse project.

Looking forward for the drop! 🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh