1/21

⬆️ We all know that crypto is at its best: BTC and ETH at ATH, TVL on DeFi breaking records...

🌎 But, have you wondered what crypto could do for worldwide problems?

🌱 Here is the first thread about "The case for Clean Money", a piece by @RuneKek for the community.

⬆️ We all know that crypto is at its best: BTC and ETH at ATH, TVL on DeFi breaking records...

🌎 But, have you wondered what crypto could do for worldwide problems?

🌱 Here is the first thread about "The case for Clean Money", a piece by @RuneKek for the community.

2/21

🙌 To begin with, @MakerDAO has always had as its main purpose "to serving the underserved".

💲 We made this possible through access to a stable, decentralized currency that is free from governments that neglect their own currencies.

💪 But yes, there is more we can do.

🙌 To begin with, @MakerDAO has always had as its main purpose "to serving the underserved".

💲 We made this possible through access to a stable, decentralized currency that is free from governments that neglect their own currencies.

💪 But yes, there is more we can do.

3/21

🔬 It's because there are more problems that an open and decentralized monetary network can solve.

🌪️ One of them, one of the most worrying, is climate change.

🏞️ We all know that since we are living here, ecosystems, lands, resources and climate are not at their best.

🔬 It's because there are more problems that an open and decentralized monetary network can solve.

🌪️ One of them, one of the most worrying, is climate change.

🏞️ We all know that since we are living here, ecosystems, lands, resources and climate are not at their best.

4/21

🔄 World is changing.

🧊 World is melting.

🔥 World is on fire.

🐢 World is watching ecosystems disappear.

🤒 World is getting sick. The world where we live.

🔄 World is changing.

🧊 World is melting.

🔥 World is on fire.

🐢 World is watching ecosystems disappear.

🤒 World is getting sick. The world where we live.

5/21

🧠 Maker, as a purpose-driven DAO, must be thinking out of the box to be part of the cure.

🤔 The first question here is: What can we do?

💰 What we are doing now is a good start: Maker is a provider of monetary liquidity through overcollateralized debt.

🧠 Maker, as a purpose-driven DAO, must be thinking out of the box to be part of the cure.

🤔 The first question here is: What can we do?

💰 What we are doing now is a good start: Maker is a provider of monetary liquidity through overcollateralized debt.

6/21

⭐️ And we are good at what we do.

🌆 The Maker Protocol now, beyond working in crypto, is a liquidity provider for entities rooted in the traditional financial system.

⭐️ And we are good at what we do.

🌆 The Maker Protocol now, beyond working in crypto, is a liquidity provider for entities rooted in the traditional financial system.

7/21

🏡 A proof of it is the first overcollateralized debt that issues Dai through real world assets (RWA), such as real estate ones, as a guarantee.

➡️ forum.makerdao.com/t/real-world-f…

🏡 A proof of it is the first overcollateralized debt that issues Dai through real world assets (RWA), such as real estate ones, as a guarantee.

➡️ forum.makerdao.com/t/real-world-f…

8/21

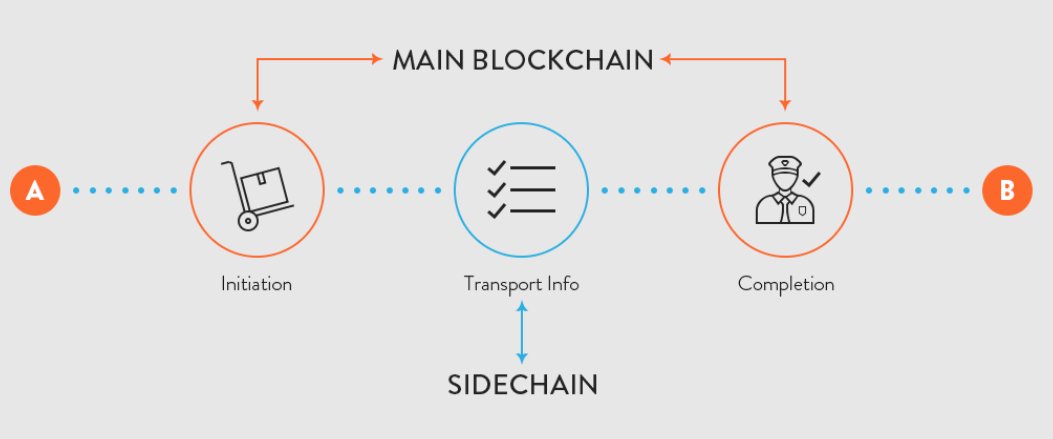

💵 In short, Maker is tokenizing the traditional financial instruments and putting it into work for creating a decentralized stable currency as an instant liquidity source.

💵 In short, Maker is tokenizing the traditional financial instruments and putting it into work for creating a decentralized stable currency as an instant liquidity source.

9/21

🏦 Another great example is the vault that one of the biggest european banks, @SocieteGenerale, has proposed to open with tokenized bonds.

➡️ forum.makerdao.com/t/security-tok…

🏦 Another great example is the vault that one of the biggest european banks, @SocieteGenerale, has proposed to open with tokenized bonds.

➡️ forum.makerdao.com/t/security-tok…

10/21

🤔 So, the question is: If there are real world assets that @MakerDAO can bring into crypto for generating liquidity through Dai, how can we use that value proposition to fund the world's cure?

🙌 It can't be too complicated at all.

🤔 So, the question is: If there are real world assets that @MakerDAO can bring into crypto for generating liquidity through Dai, how can we use that value proposition to fund the world's cure?

🙌 It can't be too complicated at all.

11/21

🔄 Imagine there's a company that is installing clean energy sources in emerging countries at an affordable cost for families living in the area who have never had access to electricity.

🔄 Imagine there's a company that is installing clean energy sources in emerging countries at an affordable cost for families living in the area who have never had access to electricity.

12/21

💰 What if Maker can provide liquidity to fund a project like this through a senior credit position that an investor can guarantee by tokenized assets of the project's company?

💰 What if Maker can provide liquidity to fund a project like this through a senior credit position that an investor can guarantee by tokenized assets of the project's company?

13/21

⚡️ What if @MakerDAO decides to ensure that its collateral from RWA is always coming from projects that removes its carbon footprint or that produce renewable energy?

⚡️ What if @MakerDAO decides to ensure that its collateral from RWA is always coming from projects that removes its carbon footprint or that produce renewable energy?

14/21

🤝 @MakerDAO and the blockchain can always assure that their collareal are following these purposes, and then, Dai will become a decentralized, stable and clean currency.

🤝 @MakerDAO and the blockchain can always assure that their collareal are following these purposes, and then, Dai will become a decentralized, stable and clean currency.

15/21

🔭 But it's not just about "fixing the problem that is in the public eye". It's about sustainability too.

🌎 The problem that we would tackle could have unintended consequences for the global economy.

🔭 But it's not just about "fixing the problem that is in the public eye". It's about sustainability too.

🌎 The problem that we would tackle could have unintended consequences for the global economy.

16/21

♻️ If the world as we know it could do a 180-degree turn, the financial system is also supposed to

If we assure that our entire system is backed by sustainable and climate-aligned collateral, we would be becoming a resilient financial system in the face of possible crises

♻️ If the world as we know it could do a 180-degree turn, the financial system is also supposed to

If we assure that our entire system is backed by sustainable and climate-aligned collateral, we would be becoming a resilient financial system in the face of possible crises

17/21

♻️🌎💰 Maker can be part of the solution and can be prepared for the futurist-sustained finance.

♻️🌎💰 Maker can be part of the solution and can be prepared for the futurist-sustained finance.

18/21

🍃 Dai could become the clean money for the world as a stable, decentralized and sustainable currency

Clean as they are funding the planet's cure

Clean as they are created through climate stability collateral

Clean as they are fully working by a decentralized governance

🍃 Dai could become the clean money for the world as a stable, decentralized and sustainable currency

Clean as they are funding the planet's cure

Clean as they are created through climate stability collateral

Clean as they are fully working by a decentralized governance

19/21

☀️ With a brighter future for a sustainable and climate focused economy, the Clean Dai would drive big benefits for $MKR holders, who would also execute this sustainable purpose by voting on the best projects with better risk, benefit and planet-oriented metrics.

☀️ With a brighter future for a sustainable and climate focused economy, the Clean Dai would drive big benefits for $MKR holders, who would also execute this sustainable purpose by voting on the best projects with better risk, benefit and planet-oriented metrics.

20/21

🏭 Remember that, as humanity, we have to reduce our CO2 emissions according to the graph below to prevent consequences that would be impossible to mitigate.

⚡️ Remember that, Dai can fund and be part of that graph.

🏭 Remember that, as humanity, we have to reduce our CO2 emissions according to the graph below to prevent consequences that would be impossible to mitigate.

⚡️ Remember that, Dai can fund and be part of that graph.

1⃣ This is the first thread that follows the "clean money" series.

✊ Stay tuned for more threads about the source article of @runekek

👇 You can read the entire article here:

forum.makerdao.com/t/the-case-for…

✊ Stay tuned for more threads about the source article of @runekek

👇 You can read the entire article here:

forum.makerdao.com/t/the-case-for…

• • •

Missing some Tweet in this thread? You can try to

force a refresh