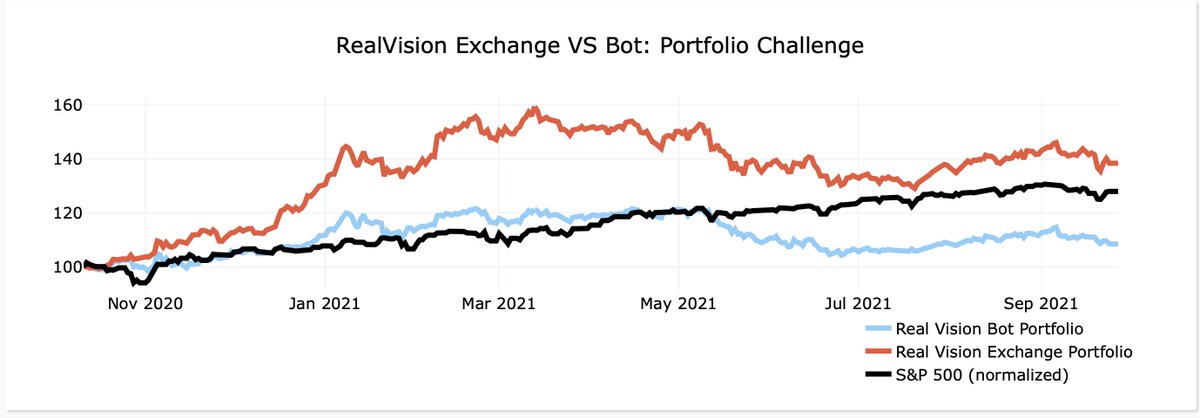

Just a few small excerpts from todays Real Vision Pro (like a cut down Global Macro Investor created with my partner @JulianMI2of @MI2Partners - different perspectives add huge value, just ask our members).

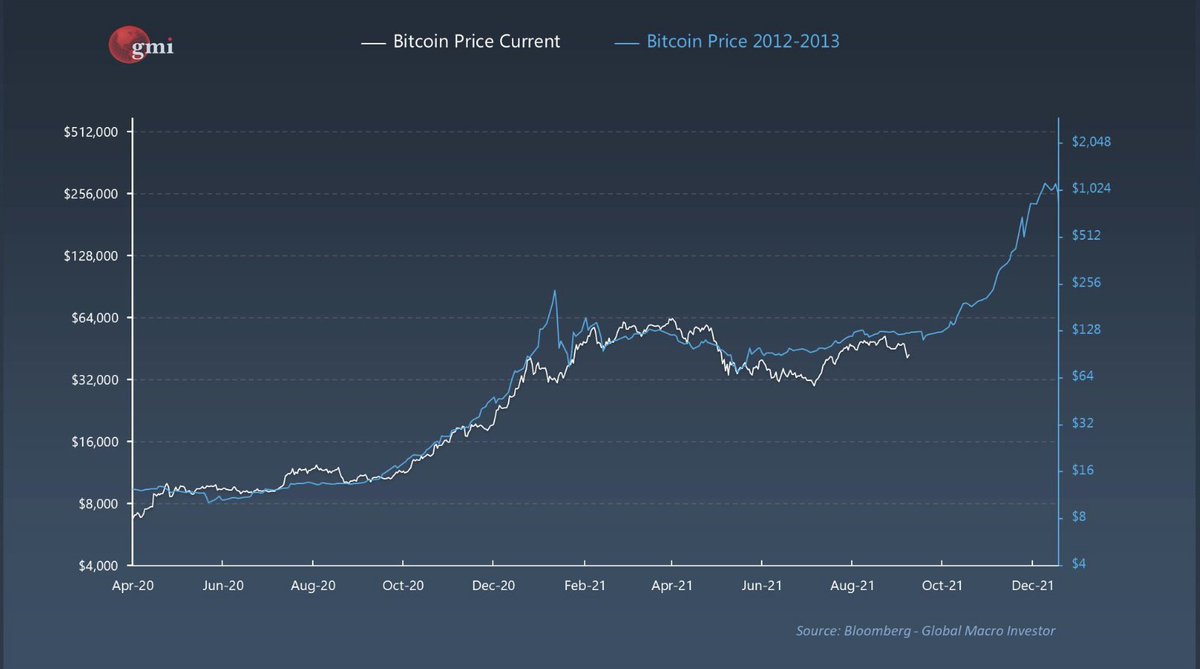

BTC continues to follow 2013 very well.

BTC continues to follow 2013 very well.

I think there is a decent chance (not a certainty) that this BTC cycle extends longer in time and higher in price...

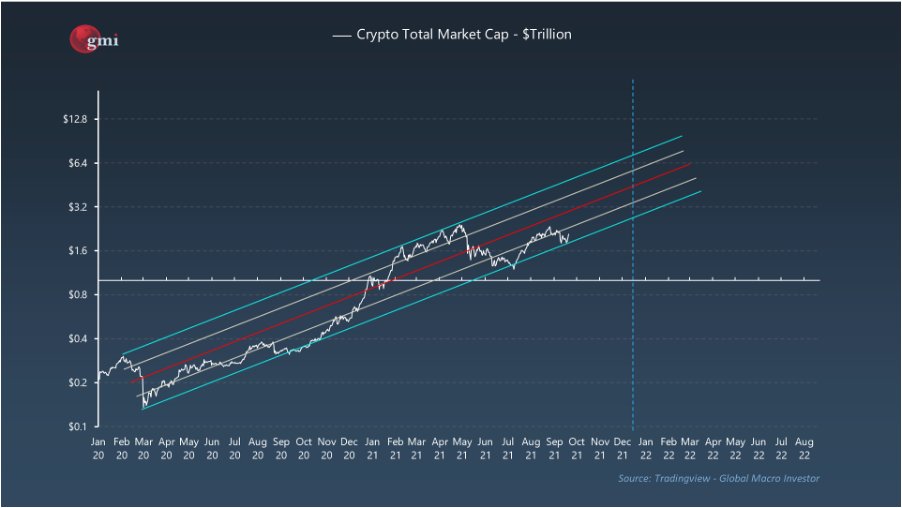

And ETH...bigger move...$40k by March/June would only be 1 standard deviation overbought versus trend.

This is not a certainty. It is a probabilistic outcome. For me, $20k ETH and $200k BTC is a shoe in (70% + chance)

What outperforms and how this plays out is anyones guess...

What outperforms and how this plays out is anyones guess...

• • •

Missing some Tweet in this thread? You can try to

force a refresh