US- Russia a thread

Worlds largest oil and gas producers? ✅✅

Military budgets many times larger than green investment? ✅✅

Grains in drought?✅✅

Massive forests going up in smoke? ✅✅

Massive chutzpah to create carbon offsets with said forests? ✅✅

bloomberg.com/news/articles/…

Worlds largest oil and gas producers? ✅✅

Military budgets many times larger than green investment? ✅✅

Grains in drought?✅✅

Massive forests going up in smoke? ✅✅

Massive chutzpah to create carbon offsets with said forests? ✅✅

bloomberg.com/news/articles/…

2/“You wouldn’t always know it, but it went up every year I was president. That whole, suddenly America’s like the biggest oil producer & the biggest gas — that was me, people"-@BarackObama

Energy Independence/Dominance is a hell of a drug in both US (green line) & Russia (blue)

Energy Independence/Dominance is a hell of a drug in both US (green line) & Russia (blue)

3/ Biden's infrastructure bill is now ~$2 Trillion over 10 years. Sounds like a lot right? $200 billion each year. But just about $30B each year is for Climate

US spends ~$750B p.a on the military,25 TIMES more than all climate programs #GeopoliticsOfGHGs

US spends ~$750B p.a on the military,25 TIMES more than all climate programs #GeopoliticsOfGHGs

https://twitter.com/stephensemler/status/1425194506467614727

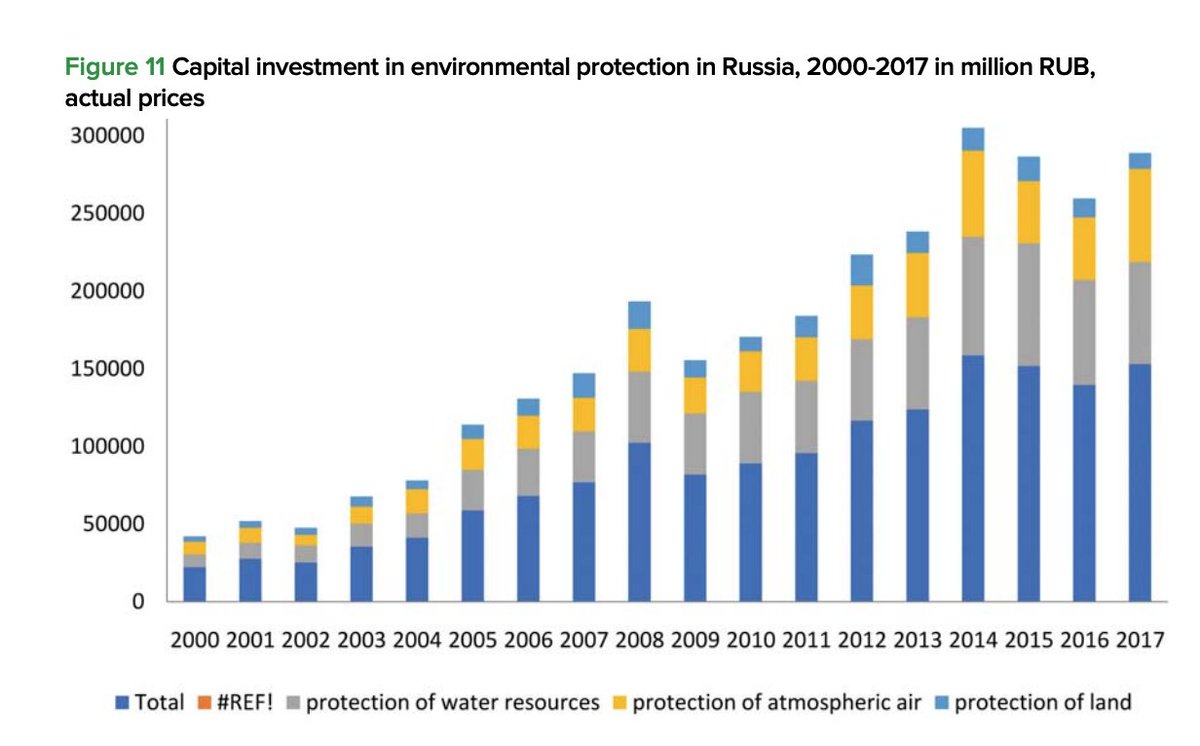

4/ Russia's military spending per year is about $65 billion. Its green investments are about $4 billion. Military 15 TIMES more than green.

documents1.worldbank.org/curated/en/103…

#GeopoliticsOfGHGs @b_judah

sipri.org/commentary/top…

documents1.worldbank.org/curated/en/103…

#GeopoliticsOfGHGs @b_judah

sipri.org/commentary/top…

5/ GRAINS IN DROUGHT.

US and Russia are the breadbaskets of the world.

Extreme heat is baking most of the U.S. North Dakota, South Dakota, Minnesota, Iowa and Nebraska all in extreme drought. Wheat wilting in Russia too.

farmpolicynews.illinois.edu/2021/08/drough…

US and Russia are the breadbaskets of the world.

Extreme heat is baking most of the U.S. North Dakota, South Dakota, Minnesota, Iowa and Nebraska all in extreme drought. Wheat wilting in Russia too.

farmpolicynews.illinois.edu/2021/08/drough…

5/ Russia is the world's 4th biggest carbon emitter. Its oil & gas firms partner with BP/Exxon etc. But don't worry, It has an India's worth of trees! That are also burning up in wildfires, but don't kill the greenwashing buzz maaan. bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh