#Hdfc

Week-Day-Hour aligned to take out ATH.

2 scenarios:

1. A 5th to complete soon to bring back time consuming consolidation.

2. A major 3rd wave as was seen in #NiftyIT few months ago and is being seen in #Banknifty last few weeks

ST Holding "2825"

Week-Day-Hour aligned to take out ATH.

2 scenarios:

1. A 5th to complete soon to bring back time consuming consolidation.

2. A major 3rd wave as was seen in #NiftyIT few months ago and is being seen in #Banknifty last few weeks

ST Holding "2825"

#Hdfc

Week-Day-Hour "aligned" to take out ATH

Making ATH

From Day's low 2856 to "2905" so far..

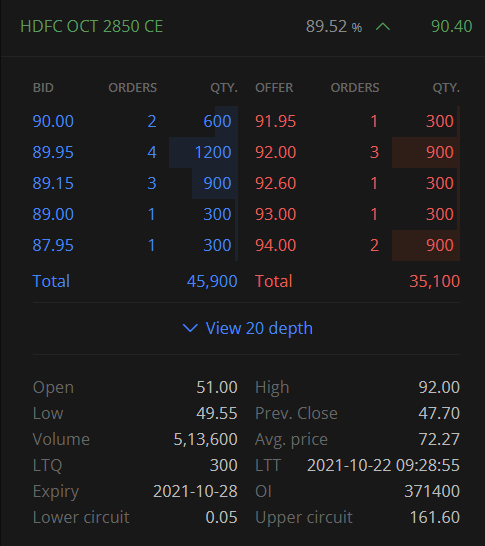

2850CE 50 to 81.

Week-Day-Hour "aligned" to take out ATH

Making ATH

From Day's low 2856 to "2905" so far..

2850CE 50 to 81.

Generally, #Hdfc "Top Gainer" remains in Top position unless challenged by any other.

#Hdfc 2850CE

Part booking makes sense, Now @ "66"

Reason being, it never featured in Top IV gainers for the day.

Part booking makes sense, Now @ "66"

Reason being, it never featured in Top IV gainers for the day.

• • •

Missing some Tweet in this thread? You can try to

force a refresh