When luck/timing masquerades as skill.

My Portfolio snapshot from 04/14/2010. All these positions were acquired between late Dec'08 and 03/06/2009 (GFC bottom).

A hard look and few lessons from that time. ⬇️

My Portfolio snapshot from 04/14/2010. All these positions were acquired between late Dec'08 and 03/06/2009 (GFC bottom).

A hard look and few lessons from that time. ⬇️

Some background :

After dabbling in some rookie trading in 07-08 (tiny portfolio) and getting my fingers burnt from a trade in Crocs (Oct'07, long story), I was mostly on the sidelines and just watched the Financial meltdown starting Sep'08.

After dabbling in some rookie trading in 07-08 (tiny portfolio) and getting my fingers burnt from a trade in Crocs (Oct'07, long story), I was mostly on the sidelines and just watched the Financial meltdown starting Sep'08.

Was lucky enough to read some Seth Klarman, Peter Lynch and Buffett stuff during Fall 2008 which put things in perspective.

Armed with this new knowledge and understanding that much of the drawdowns (esp for good & non Financial Co's) were due to forced redemptions/liquidations from big funds rather than company fundamentals and long-term outlook, I went on a buying spree from 12/20/08 to 03/06/09.

The process was

-Buy from 7-8 sectors for the sake of diversification (mix of domestic & international).

-Pick a company that you think is strong or looks interesting in that sector.

-Buy from 7-8 sectors for the sake of diversification (mix of domestic & international).

-Pick a company that you think is strong or looks interesting in that sector.

-Must have had a big drop already

-No immediate bankruptcy risk (at least based on my limited knowledge from reading the Fin Statements and any debt covenant news at that time).

-No immediate bankruptcy risk (at least based on my limited knowledge from reading the Fin Statements and any debt covenant news at that time).

I came close to exhausting the cash position by 03/06/09 and since the Market started rising from 03/09 (fresh from Buffett/Graham school of contrarianism) did not buy anything for the next one year. Lo and behold 13 months later you can see how the Portfolio positions looked.

Now comes the hard part. You can imagine my confidence at this point and I kept dumpster diving (in 52 week lows) from 2010-12 into random companies, expecting to repeat the magic only to be disappointed with the results.

The few biggest takeaways from that time were

1⃣ I got lucky and bought cheap during GFC, but didn't necessarily buy all good (except for few like $ISRG $NVDA $LULU $V $USB).

1⃣ I got lucky and bought cheap during GFC, but didn't necessarily buy all good (except for few like $ISRG $NVDA $LULU $V $USB).

That comes with experience, but if you are allocating capital as a long-term investor, make sure you allocate that to Companies that are protected on the downside and can continue increasing the intrinsic value for a long time.

For that you'll need to have a circle of competence to understand why this company is special, an understanding of the trends the business is riding on if any, and the Management teams running these Co.'s.

2⃣ Don't get attracted to a Company primarily because of it's valuation. Get attracted to the Business/quality/future prospects first and then see if the valuation is presenting you an opportunity.

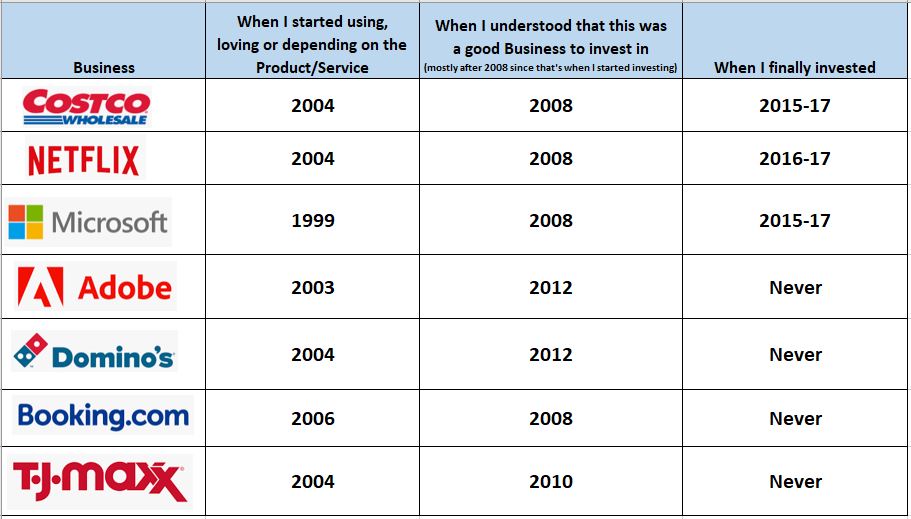

At this time in 1Q'09, I understood, loved & considered @AMZN $AAPL $GOOG $BKNG $CMG $MELI but wanted them cheaper & thought they were too many in the same sector. So I ended up buying bunch of Co.'s I wasn't interested in, but because they were cheaper & in diversified sectors.

3⃣ The companies in your Portfolio are getting better or getting worse with time. So your thesis should evolve based on the recent operating results and then correlate it to the current stock price to see if you should sell/hold/buy/add.

If you instead anchor only to the purchase price, or the peak (& your max gain) in recent time, you're inviting trouble.

4⃣ If there are positions in your Portfolio bought primarily for under-valuation reasons & not quality/LT IV growth, make sure those positions don't overstay their welcome (when price->value gap closes or value itself drops). If not, you'll be left with a bunch of loiters/losers.

5⃣ Luck (& unexpected upside) is always welcome in our Portfolios, but you have to have a good foundation of process, competence , and understanding (of what you are doing) thereby improving your chances of positive & bigger outcomes.

If not, recent Portfolio gains could lead to over-confidence, excessive risk taking, leaving you very vulnerable for Market curveballs.

6⃣ Market conditions change (based on the monetary conditions, sector sentiment) and you have to adapt to them. You don't have to change the core philosophy (good Co.'s -> reasonable valuations -> LT holding) but adjust a little between the defensive and offensive postures.

Anyway, what's the point I'm trying to make?

For any new comers to the Market that were lucky enough to start investing around March 2020 (investing/ trading/options), and having big gains in their Portfolios (or many positions, or from 1-2 sectors)..

For any new comers to the Market that were lucky enough to start investing around March 2020 (investing/ trading/options), and having big gains in their Portfolios (or many positions, or from 1-2 sectors)..

try to detach your confidence from the Portfolio performance.

If your process, risk levels, understanding of the holdings/thesis are well thought out, that's great.

If your process, risk levels, understanding of the holdings/thesis are well thought out, that's great.

If not, spend some time (during the good times) on what can be improved upon. Markets are not always this accommodative to low quality growth Co.'s, money losing businesses and story stocks.

/END

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh