@dandolfa

What causes this run on stablecoins that you worry about? And it seems your concern is they will exposure weakness in the current financial system, so those weaknesses must be protected, not that stablecoin growth means it should be corrected.

marketnews.com/region/north_a…

What causes this run on stablecoins that you worry about? And it seems your concern is they will exposure weakness in the current financial system, so those weaknesses must be protected, not that stablecoin growth means it should be corrected.

marketnews.com/region/north_a…

You wrote: "History shows very recently that the might get into trouble if they experience a wave of redemptions than they can't honor the dollar peg, and might feel compelled to dump a whole pile of CP on the market."

Sounds like the problem is CP, not stablecoins ...

Sounds like the problem is CP, not stablecoins ...

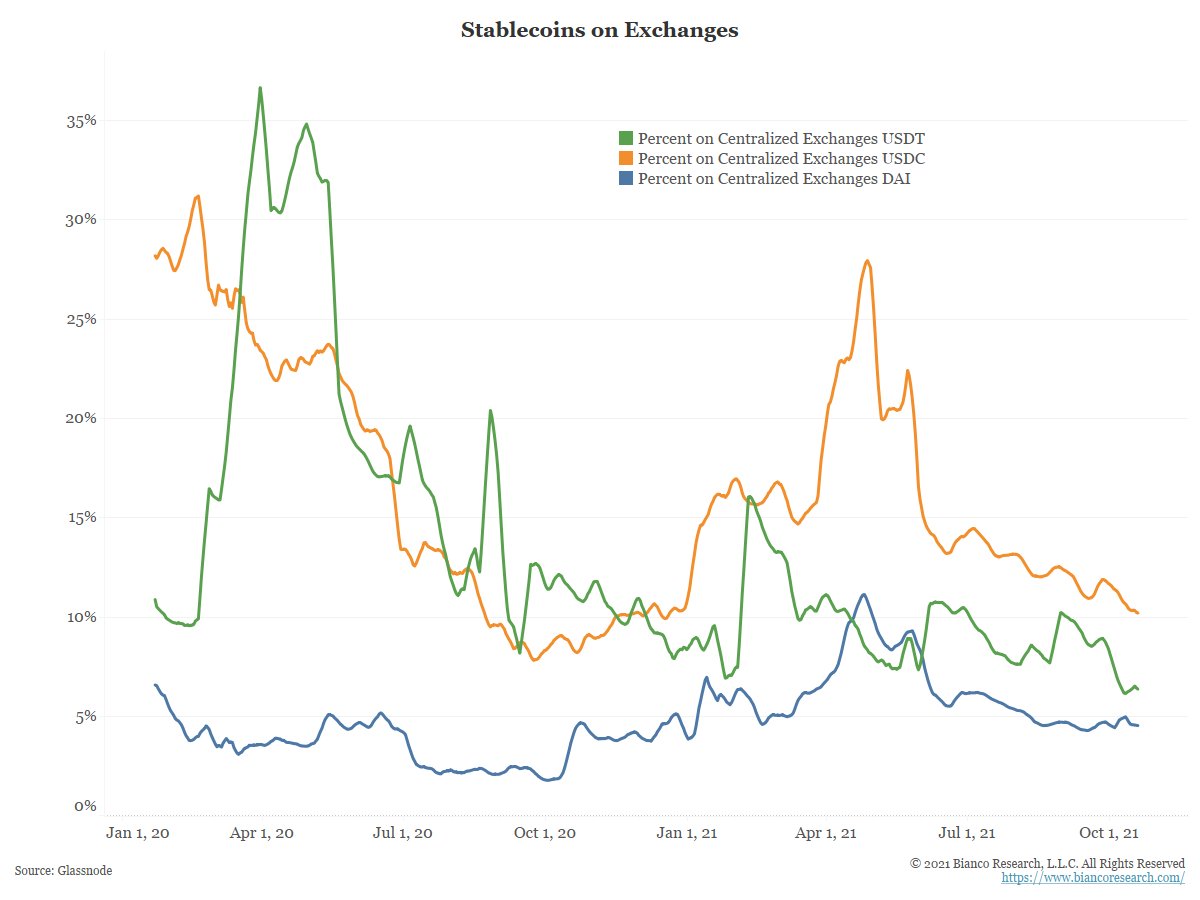

What history are you referring to? Seem like USDT has spent most of its life NOT holding its peg (green), yet, the growth of stablecoins has not been bothered by this at all.

Stablecoins are tied up in smart contracts, and very few are held on centralized exchanges (CEFI).

To dump them, investors would knowing take the burden of taxes/reporting, and willingly unwind smart contract transactions(such as staking) and transfer the, to a CEFI.

Why?

To dump them, investors would knowing take the burden of taxes/reporting, and willingly unwind smart contract transactions(such as staking) and transfer the, to a CEFI.

Why?

So to repeat, what makes investors say I want to exit the crypto space altogether even it means taking a loss and opening up to a tax burden?

This idea that one day they trade at 70 cents and everyone panics out and crashes the CP market is not realistic.

This idea that one day they trade at 70 cents and everyone panics out and crashes the CP market is not realistic.

One could argue the "Tether Truthers" are already having an impact. They are running away from USDT, to USDC, and algo/crypto backed coins. So regulation will not be needed and far too late as the market is now correcting.

• • •

Missing some Tweet in this thread? You can try to

force a refresh