The importance of taking profit and actively managing your trade - $MATIC

Love a 5M chart bash - such quick feedback with your trading ideas, & so much further opportunity to continually refine the edge.

Hopefully this helps you.

Please share if it can help someone else too.

Love a 5M chart bash - such quick feedback with your trading ideas, & so much further opportunity to continually refine the edge.

Hopefully this helps you.

Please share if it can help someone else too.

Price has run down, and a range has formed.

We've tested the range high with a deviation up to the bearish orderblock, but also swept some highs while we were up there

We've tested the range high with a deviation up to the bearish orderblock, but also swept some highs while we were up there

Retest of the range high occurs, which presents a great shorting opportunity with our fibs (that we've just looked at how to use on the recent vid I shared)

Target of beyond range low (as you do)

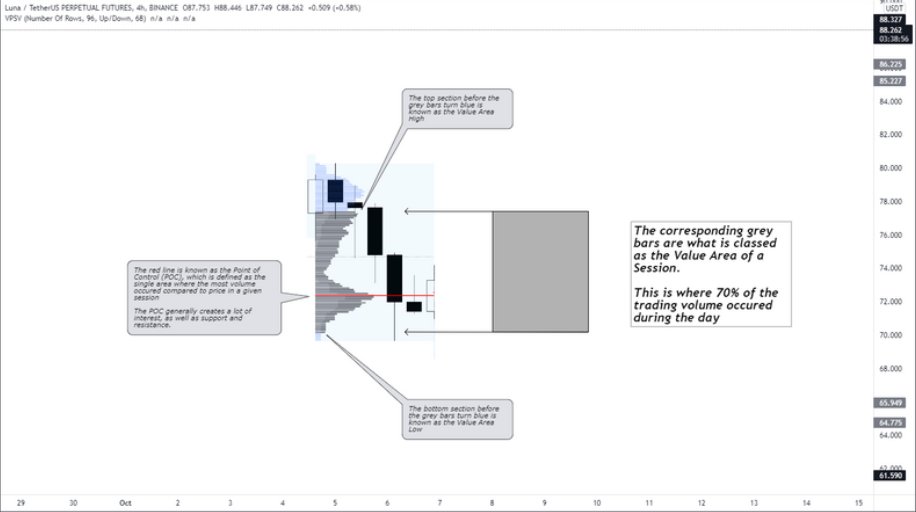

Further confluence is presented when we check the VPVR for VAH

Target of beyond range low (as you do)

Further confluence is presented when we check the VPVR for VAH

The '0' level of our fibs are hit, and we then bring SL to BE and also take some profit (25% of pos size for me in this case)

You also get an opportunity to then also take further profit at the -0.27 fib level before BTC effery kicks in and price runs back up

You also get an opportunity to then also take further profit at the -0.27 fib level before BTC effery kicks in and price runs back up

Price then runs through to a BE SL.

So we've taken profits, managed our trade, protected our capital, & lived to fight another day with some moolah in the back burner.

No one else is going to look after your capital better than you.

Make sure you are aggresive in doing so.

So we've taken profits, managed our trade, protected our capital, & lived to fight another day with some moolah in the back burner.

No one else is going to look after your capital better than you.

Make sure you are aggresive in doing so.

• • •

Missing some Tweet in this thread? You can try to

force a refresh