Hm. China is trying experiments to see if they can set policies that result in a more equal distribution of wealth while preserving market incentives.

The key new thing is that they are doing this zone by zone, as Deng did, rather than opting in the whole country at once.

The key new thing is that they are doing this zone by zone, as Deng did, rather than opting in the whole country at once.

https://twitter.com/RealNatashaChe/status/1451624481001119749

As described below, I was instantly skeptical.

But if I think about setting parameters in two-sided marketplaces like Uber or eBay, it is true that you can experiment by varying incentives within different cohorts or geographies.

But if I think about setting parameters in two-sided marketplaces like Uber or eBay, it is true that you can experiment by varying incentives within different cohorts or geographies.

https://twitter.com/RealNatashaChe/status/1451624478937542658

This is related to the problem of doing “social engineering” without even doing “social science”.

Where is the control group when a new regulation is rolled out? How do you select a representative test cohort? And what do you use to account for time-varying behavior?

Where is the control group when a new regulation is rolled out? How do you select a representative test cohort? And what do you use to account for time-varying behavior?

https://twitter.com/balajis/status/1405820323476369415

On the current path, a centralized China is going to be testing new economic policy regimes via top-down imposition within physical zones.

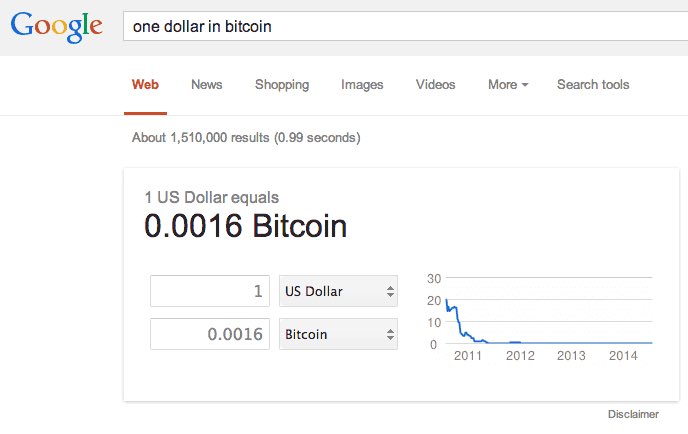

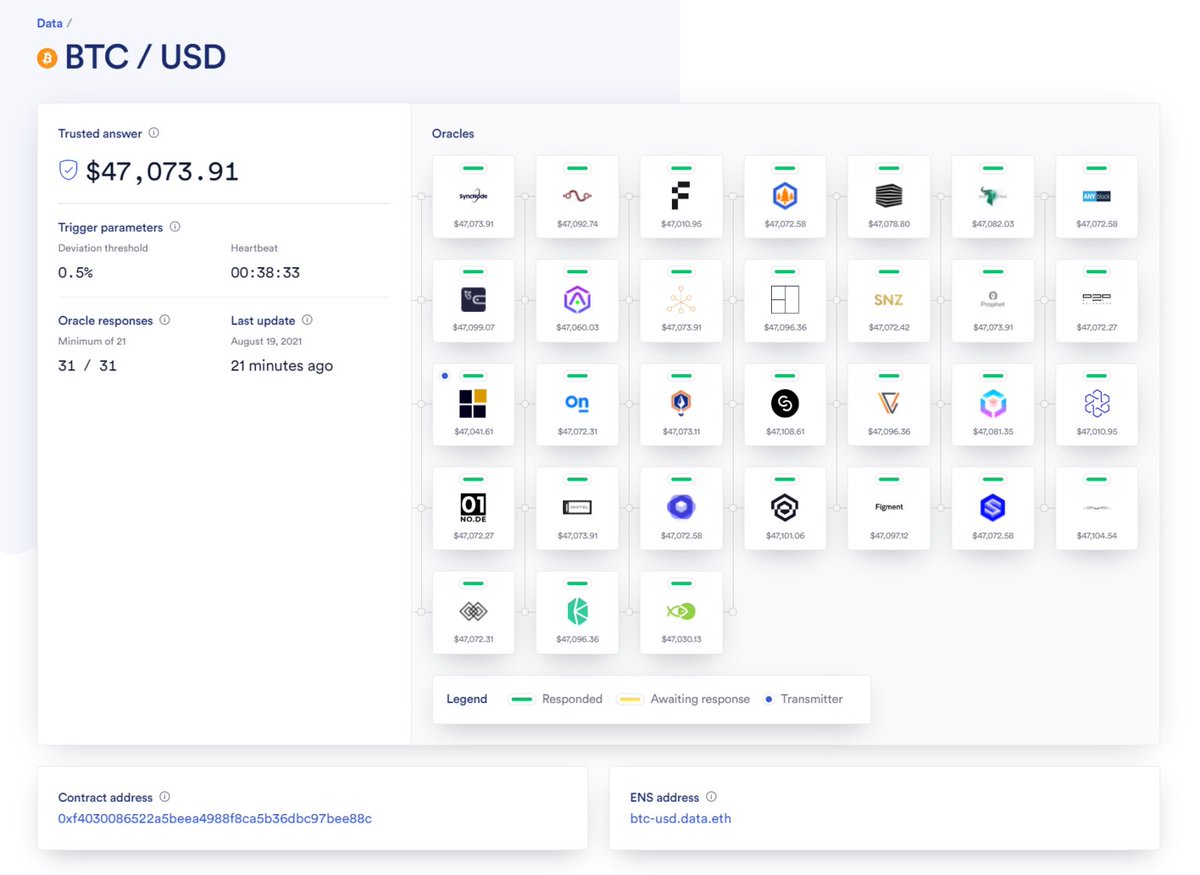

And a decentralized West will be testing them via bottom-up selection of crypto networks.

And a decentralized West will be testing them via bottom-up selection of crypto networks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh