Good but no traction: angel investment

Bad but no traction: tulips

Good with high traction: new paradigm

Bad with high traction: threat to democracy

Bad but no traction: tulips

Good with high traction: new paradigm

Bad with high traction: threat to democracy

The establishment mindset flips between apathy and panic.

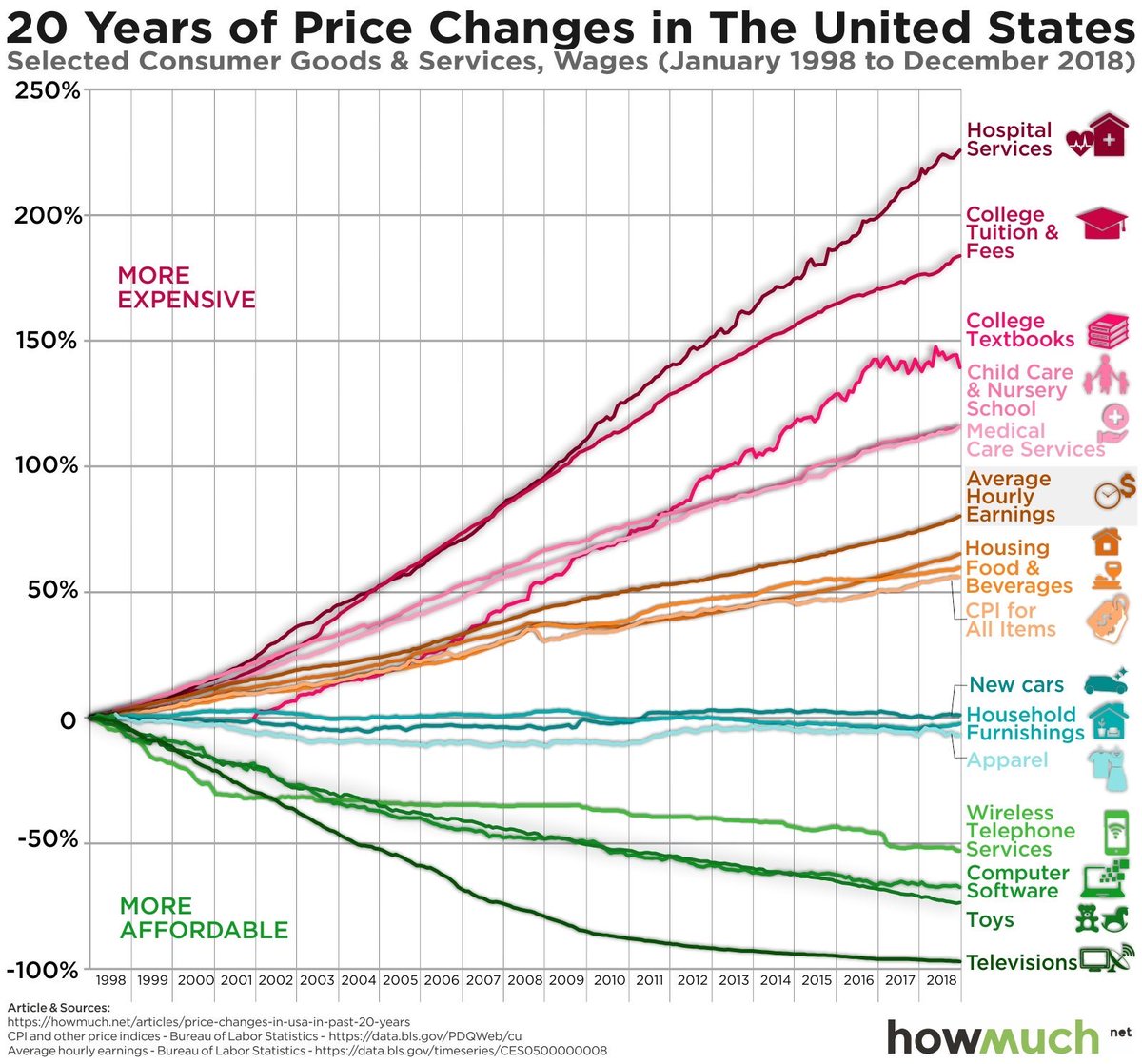

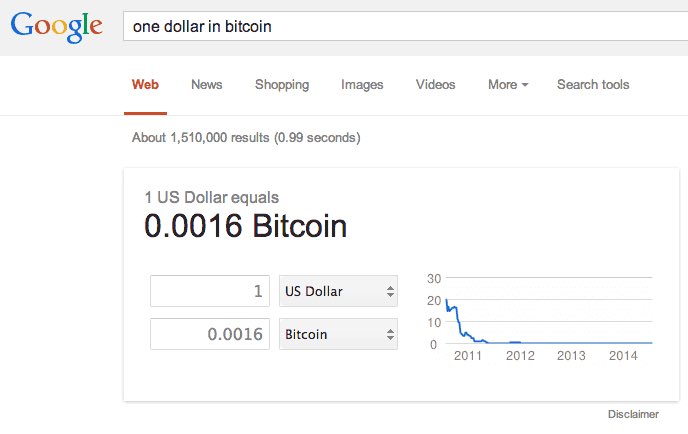

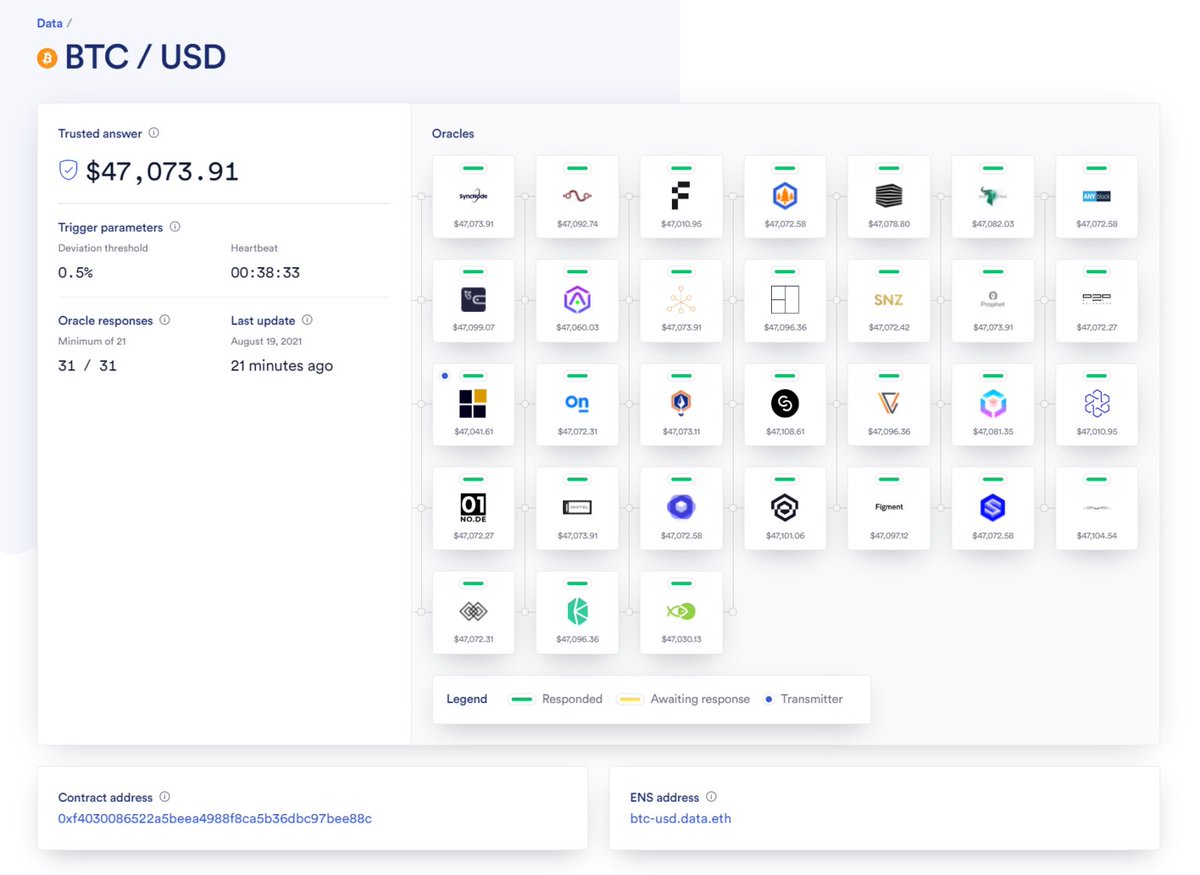

Facebook is a fad, then it’s a threat to democracy. COVID is dismissed as paranoia by preppers, then you have to wear a mask even when vaxxed. Bitcoin is tulips, then they start advocating seizures.

Facebook is a fad, then it’s a threat to democracy. COVID is dismissed as paranoia by preppers, then you have to wear a mask even when vaxxed. Bitcoin is tulips, then they start advocating seizures.

Every disruption like this has, so far, been sort of integrated into the establishment — albeit in a reactionary way. Facebook censorship, COVID lockdowns, Bitcoin-motivated CBDC efforts.

But the less the foresight, the greater the cost of that integration. Eventually too great.

But the less the foresight, the greater the cost of that integration. Eventually too great.

That is, eventually a set of foreseeable disruptions may come about — and happen so fast that the establishment can’t even erect its typical lean-tos, can’t even preserve a basic order.

Partly because they are only capable of blocking rather than building and funding the future.

Partly because they are only capable of blocking rather than building and funding the future.

https://twitter.com/balajis/status/1411334184220520451

The slower you are to see it, the more expensive the mitigation. Eventually too expensive, especially when state capacity is in decline.

• • •

Missing some Tweet in this thread? You can try to

force a refresh