I actually don’t think they will.

Jack and Zuck didn’t build their $100B+ companies from scratch to bow to the East Coast establishment, whether that be Trump or the Fed.

The rematch will surprise people.

Jack and Zuck didn’t build their $100B+ companies from scratch to bow to the East Coast establishment, whether that be Trump or the Fed.

The rematch will surprise people.

https://twitter.com/nic__carter/status/1451924277754748929

Tech CEOs don’t win by fighting the last war.

In 2015-2016, the tweeting took many by surprise.

In 2020-2021, the censorship took many by surprise.

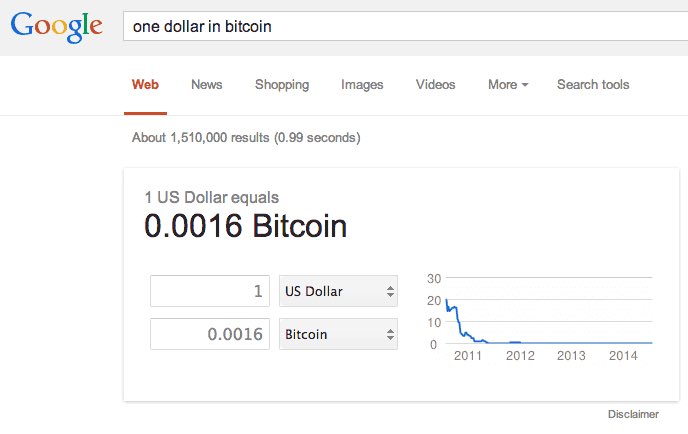

But in 2024, or whenever the inflation comes, the censorship-resistance will take everyone by surprise.

In 2015-2016, the tweeting took many by surprise.

In 2020-2021, the censorship took many by surprise.

But in 2024, or whenever the inflation comes, the censorship-resistance will take everyone by surprise.

https://twitter.com/micsolana/status/1376919541914107907

To be clear, the companies run by non-founders may buckle. I don’t expect Google, Microsoft, Apple, Amazon to hold any line.

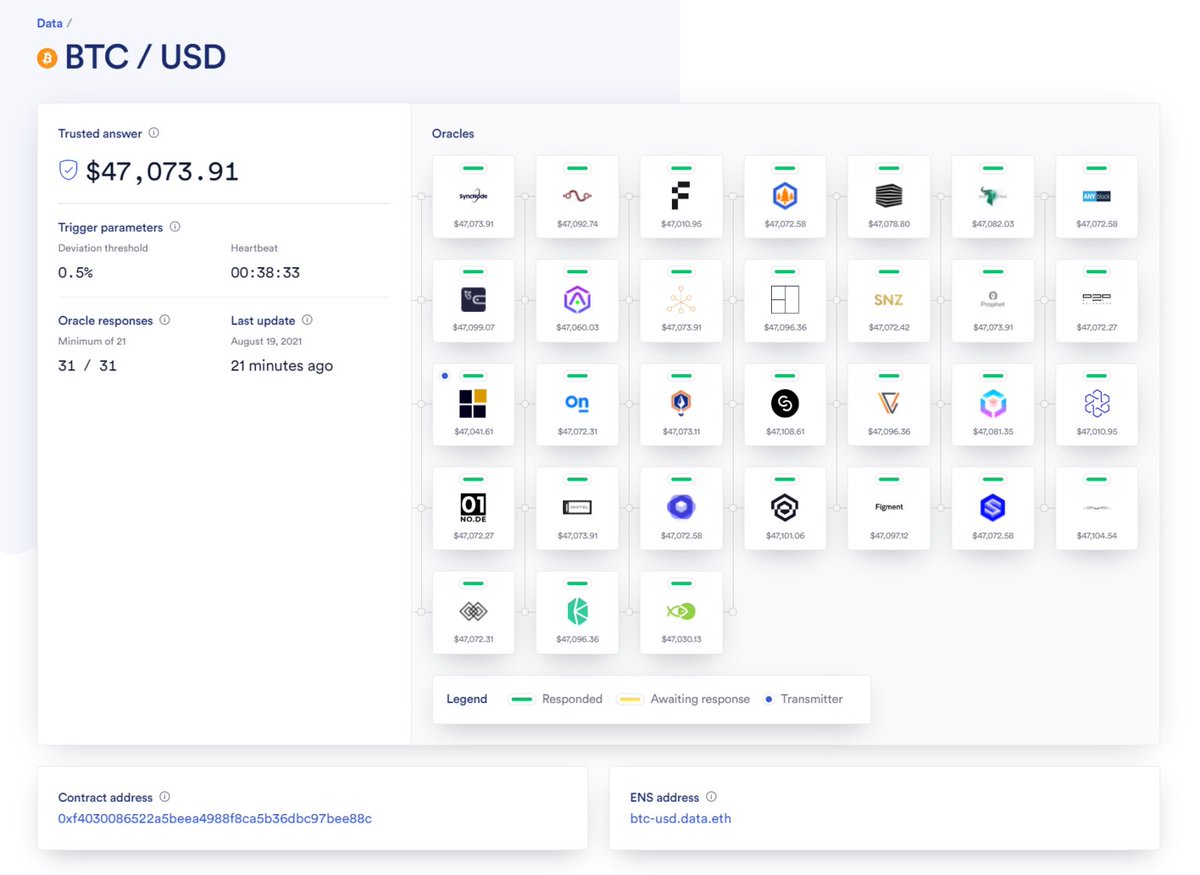

But Zuck & Jack still control their companies. In different ways, they are adopting cryptocurrency. And they aren’t backing down. m.facebook.com/zuck/posts/101…

But Zuck & Jack still control their companies. In different ways, they are adopting cryptocurrency. And they aren’t backing down. m.facebook.com/zuck/posts/101…

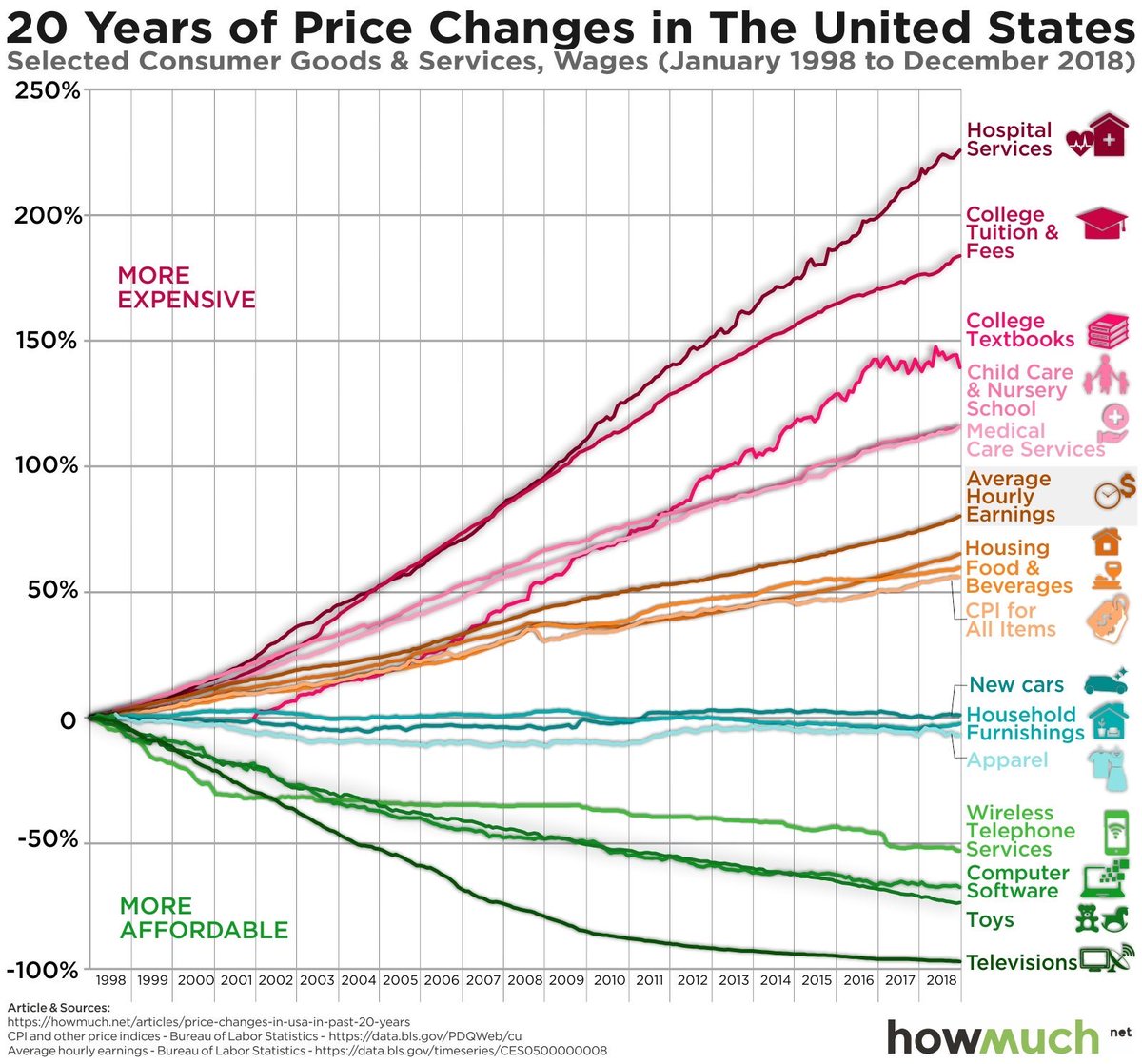

People also aren’t thinking about how the battle lines get drawn in a time of true inflation.

It isn’t Republican vs Democrat anymore. It is the unmasked state vs the people — of all colors and backgrounds — losing their savings to inflationary seizure.

It isn’t Republican vs Democrat anymore. It is the unmasked state vs the people — of all colors and backgrounds — losing their savings to inflationary seizure.

The regime is also losing steam. Its best writers have left for places like Substack. Its best efforts can no longer control world events. The governing ideology is a poor fit for governing. And it is facing powerful challenges from many directions.

https://twitter.com/balajis/status/1450611265722728451

For all these reasons and more, I think the coalition that wants uncensored information on inflation will prove stronger than the coalition that wants to ban it.

Especially because the establishment labors under the impression that high inflation surely won’t happen…

Especially because the establishment labors under the impression that high inflation surely won’t happen…

Btw, I’ve changed my mind on this. We still need decentralized social. But on the specific issue of BTC, and related issues like inflation, I no longer think Twitter will silence maximalists.

With somewhat lower probability, I don’t expect it on FB either. But we will see.

With somewhat lower probability, I don’t expect it on FB either. But we will see.

https://twitter.com/balajis/status/1401906212426469379

• • •

Missing some Tweet in this thread? You can try to

force a refresh