Institutions tend to censor inflation stats. This happened in Argentina, Venezuela, Zimbabwe.

Twitter should prepare for the moment when it must fact check the establishment on inflation. That will require shadow stats on inflation from consumer purchases, perhaps from Square.

Twitter should prepare for the moment when it must fact check the establishment on inflation. That will require shadow stats on inflation from consumer purchases, perhaps from Square.

https://twitter.com/jack/status/1451733913961783299

I wrote a spec for a censorship-resistant inflation index. It’s framed for a startup, but Square could easily do this. In a crisis, accurate inflation info would be something people checked Twitter for every day. @milessuter @moneyball @jack 1729.com/inflation

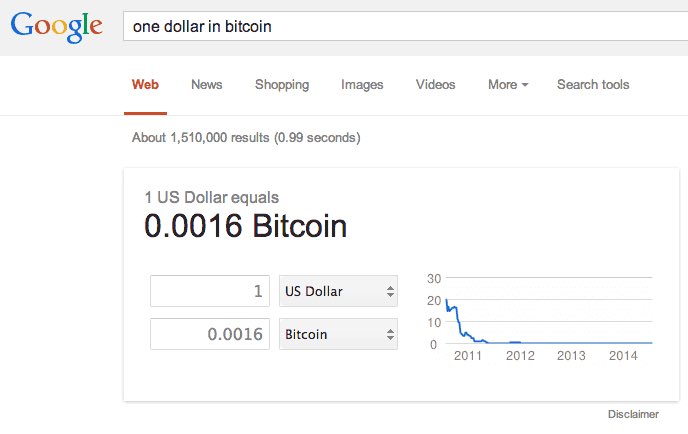

In a pinch, the price of BTC vs each fiat currency may be the best single measure of inflation.

But it is possible that Google may stop showing this info, and centralized exchanges may come under pressure.

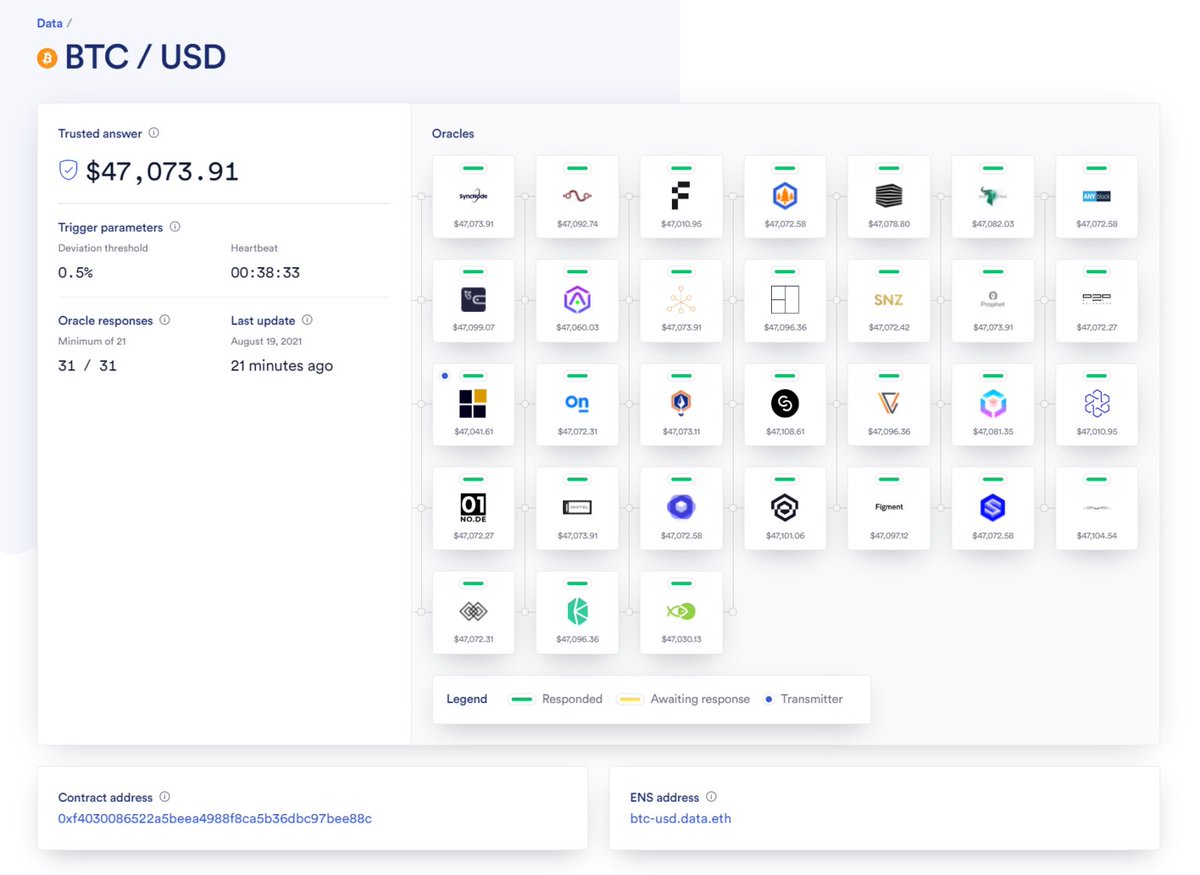

This is why on-chain price feeds are more important than many think.

But it is possible that Google may stop showing this info, and centralized exchanges may come under pressure.

This is why on-chain price feeds are more important than many think.

Can someone update this for 2021, ideally with data and graph in a public Google Sheet?

https://twitter.com/100trillionusd/status/942386354910097408

• • •

Missing some Tweet in this thread? You can try to

force a refresh