𝐃𝐈𝐆𝐆𝐈𝐍𝐆 𝐃𝐄𝐄𝐏𝐄𝐑 𝐈𝐍𝐓𝐎 𝐃𝐎𝐖 𝐓𝐇𝐄𝐎𝐑𝐘 - 𝐀 𝐠𝐮𝐢𝐝𝐞 𝐭𝐨 𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐦𝐚𝐫𝐤𝐞𝐭𝐬 𝐛𝐞𝐭𝐭𝐞𝐫!📊

A THREAD 🧵

Please RT this tweet for more reach 🤞

@ProdigalTrader @SouravSenguptaI @PAlearner @Puretechnicals9 @AnandableAnand @AdityaTodmal

A THREAD 🧵

Please RT this tweet for more reach 🤞

@ProdigalTrader @SouravSenguptaI @PAlearner @Puretechnicals9 @AnandableAnand @AdityaTodmal

1/

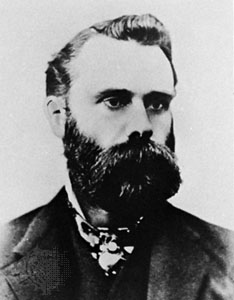

Dow Theory was introduced to the world by Charles H. Dow, who also founded the Dow-Jones financial news service (Wall Street Journal).

The Dow Theory forms an important part of technical analysis.

Dow Theory was introduced to the world by Charles H. Dow, who also founded the Dow-Jones financial news service (Wall Street Journal).

The Dow Theory forms an important part of technical analysis.

2/

The principles of Dow Theory help traders understand the market better and identify price and volume movements accurately. The Dow Theory primarily helps traders identify market trends with great accuracy, so they can take advantage of potential price action points.

The principles of Dow Theory help traders understand the market better and identify price and volume movements accurately. The Dow Theory primarily helps traders identify market trends with great accuracy, so they can take advantage of potential price action points.

3/

It also helps traders act with caution and not move against the market trends.

𝗧𝗵𝗲𝗿𝗲 𝗮𝗿𝗲 6⃣ 𝗯𝗮𝘀𝗶𝗰 𝘁𝗲𝗻𝗲𝘁𝘀 𝗼𝗳 𝗗𝗼𝘄 𝗧𝗵𝗲𝗼𝗿𝘆.

It also helps traders act with caution and not move against the market trends.

𝗧𝗵𝗲𝗿𝗲 𝗮𝗿𝗲 6⃣ 𝗯𝗮𝘀𝗶𝗰 𝘁𝗲𝗻𝗲𝘁𝘀 𝗼𝗳 𝗗𝗼𝘄 𝗧𝗵𝗲𝗼𝗿𝘆.

4/

𝐓𝐞𝐧𝐞𝐭 𝟏: 𝐓𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐬 𝐞𝐯𝐞𝐫𝐲𝐭𝐡𝐢𝐧𝐠

Stock prices factor in new information as soon as it is available. As soon as some news is released, the prices change to reflect the new information.

𝐓𝐞𝐧𝐞𝐭 𝟏: 𝐓𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐬 𝐞𝐯𝐞𝐫𝐲𝐭𝐡𝐢𝐧𝐠

Stock prices factor in new information as soon as it is available. As soon as some news is released, the prices change to reflect the new information.

4/

Prices represent the sum total of all information bites such as the hopes, fears and expectations of all participants.

Prices represent the sum total of all information bites such as the hopes, fears and expectations of all participants.

5/

𝐓𝐞𝐧𝐞𝐭 𝟐: 𝐓𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐡𝐚𝐬 𝐭𝐡𝐫𝐞𝐞 𝐭𝐫𝐞𝐧𝐝𝐬

This is perhaps one of the most popular tenets of the Dow Jones Theory. It explains that the market moves in three main trends: (a) Primary, (b) Secondary, (c) Minor.

𝐓𝐞𝐧𝐞𝐭 𝟐: 𝐓𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐡𝐚𝐬 𝐭𝐡𝐫𝐞𝐞 𝐭𝐫𝐞𝐧𝐝𝐬

This is perhaps one of the most popular tenets of the Dow Jones Theory. It explains that the market moves in three main trends: (a) Primary, (b) Secondary, (c) Minor.

6/

🔸Primary trends are the main movements in the market, and can last for more than 1 year.

🔸Secondary trends are those price patterns that act as corrective points within major primary trends,

🔸Minor trends occur over a very short range of time

🔸Primary trends are the main movements in the market, and can last for more than 1 year.

🔸Secondary trends are those price patterns that act as corrective points within major primary trends,

🔸Minor trends occur over a very short range of time

7/

𝐓𝐞𝐧𝐞𝐭 𝟑: 𝐌𝐚𝐫𝐤𝐞𝐭 𝐭𝐫𝐞𝐧𝐝𝐬 𝐡𝐚𝐯𝐞 𝐭𝐡𝐫𝐞𝐞 𝐩𝐡𝐚𝐬𝐞𝐬

Whether the market is moving upward or downward, every trend is marked by three phases namely:

🔸𝗔𝗰𝗰𝘂𝗺𝘂𝗹𝗮𝘁𝗶𝗼𝗻

🔸𝗠𝗮𝗿𝗸-𝘂𝗽

🔸𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻

𝐓𝐞𝐧𝐞𝐭 𝟑: 𝐌𝐚𝐫𝐤𝐞𝐭 𝐭𝐫𝐞𝐧𝐝𝐬 𝐡𝐚𝐯𝐞 𝐭𝐡𝐫𝐞𝐞 𝐩𝐡𝐚𝐬𝐞𝐬

Whether the market is moving upward or downward, every trend is marked by three phases namely:

🔸𝗔𝗰𝗰𝘂𝗺𝘂𝗹𝗮𝘁𝗶𝗼𝗻

🔸𝗠𝗮𝗿𝗸-𝘂𝗽

🔸𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻

8/

I have already written a thread on this, so please do check that out. It should clear every doubts you have.

I have already written a thread on this, so please do check that out. It should clear every doubts you have.

https://twitter.com/sarosijghosh/status/1436951844266262528?s=20

9/

𝐓𝐞𝐧𝐞𝐭 𝟒: 𝐓𝐡𝐞 𝐢𝐧𝐝𝐢𝐜𝐞𝐬 𝐦𝐮𝐬𝐭 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐞𝐚𝐜𝐡 𝐨𝐭𝐡𝐞𝐫

We cannot confirm a trend based on just one index. For example, the market is bullish only if CNX Nifty, CNX Nifty Midcap, CNX Nifty Smallcap etc. all move in the same upward direction.

𝐓𝐞𝐧𝐞𝐭 𝟒: 𝐓𝐡𝐞 𝐢𝐧𝐝𝐢𝐜𝐞𝐬 𝐦𝐮𝐬𝐭 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐞𝐚𝐜𝐡 𝐨𝐭𝐡𝐞𝐫

We cannot confirm a trend based on just one index. For example, the market is bullish only if CNX Nifty, CNX Nifty Midcap, CNX Nifty Smallcap etc. all move in the same upward direction.

10/

𝐓𝐞𝐧𝐞𝐭 𝟓: 𝐓𝐡𝐞 𝐭𝐫𝐚𝐝𝐢𝐧𝐠 𝐯𝐨𝐥𝐮𝐦𝐞 𝐦𝐮𝐬𝐭 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐰𝐢𝐭𝐡 𝐩𝐫𝐢𝐜𝐞

The volume must confirm along with the price. The trend should be supported by volume. The volume must increase as the price rises and should reduce as the price falls in an uptrend.

𝐓𝐞𝐧𝐞𝐭 𝟓: 𝐓𝐡𝐞 𝐭𝐫𝐚𝐝𝐢𝐧𝐠 𝐯𝐨𝐥𝐮𝐦𝐞 𝐦𝐮𝐬𝐭 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐰𝐢𝐭𝐡 𝐩𝐫𝐢𝐜𝐞

The volume must confirm along with the price. The trend should be supported by volume. The volume must increase as the price rises and should reduce as the price falls in an uptrend.

11/

𝐓𝐫𝐞𝐧𝐝 𝟔: 𝐓𝐫𝐞𝐧𝐝𝐬 𝐩𝐞𝐫𝐬𝐢𝐬𝐭 𝐮𝐧𝐭𝐢𝐥 𝐭𝐡𝐞𝐫𝐞 𝐢𝐬 𝐚 𝐜𝐥𝐞𝐚𝐫 𝐫𝐞𝐯𝐞𝐫𝐬𝐚𝐥

Dow believed that trends exist despite “market noise”. The market may temporarily move in the direction opposite to the trend, but it will soon fall in line.

𝐓𝐫𝐞𝐧𝐝 𝟔: 𝐓𝐫𝐞𝐧𝐝𝐬 𝐩𝐞𝐫𝐬𝐢𝐬𝐭 𝐮𝐧𝐭𝐢𝐥 𝐭𝐡𝐞𝐫𝐞 𝐢𝐬 𝐚 𝐜𝐥𝐞𝐚𝐫 𝐫𝐞𝐯𝐞𝐫𝐬𝐚𝐥

Dow believed that trends exist despite “market noise”. The market may temporarily move in the direction opposite to the trend, but it will soon fall in line.

12/ The trend should be given the benefit of the doubt during these reversals.

High volumes at significant bottoms and breakouts usually indicate the trend. However a stock may at times fall on lower volumes and hence at significant market tops you can't depend only on volumes

High volumes at significant bottoms and breakouts usually indicate the trend. However a stock may at times fall on lower volumes and hence at significant market tops you can't depend only on volumes

13/ 𝗧𝗛𝗔𝗡𝗞 𝗬𝗢𝗨!

Please Re-Tweet the first tweet in this thread and follow @sarosij_ghosh for more stuff on trading & investing. 🙏

Here is a link to my previous thread:

Please Re-Tweet the first tweet in this thread and follow @sarosij_ghosh for more stuff on trading & investing. 🙏

Here is a link to my previous thread:

https://twitter.com/sarosijghosh/status/1449041560939601928?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh