So, you are mad at the Fed for inflation?

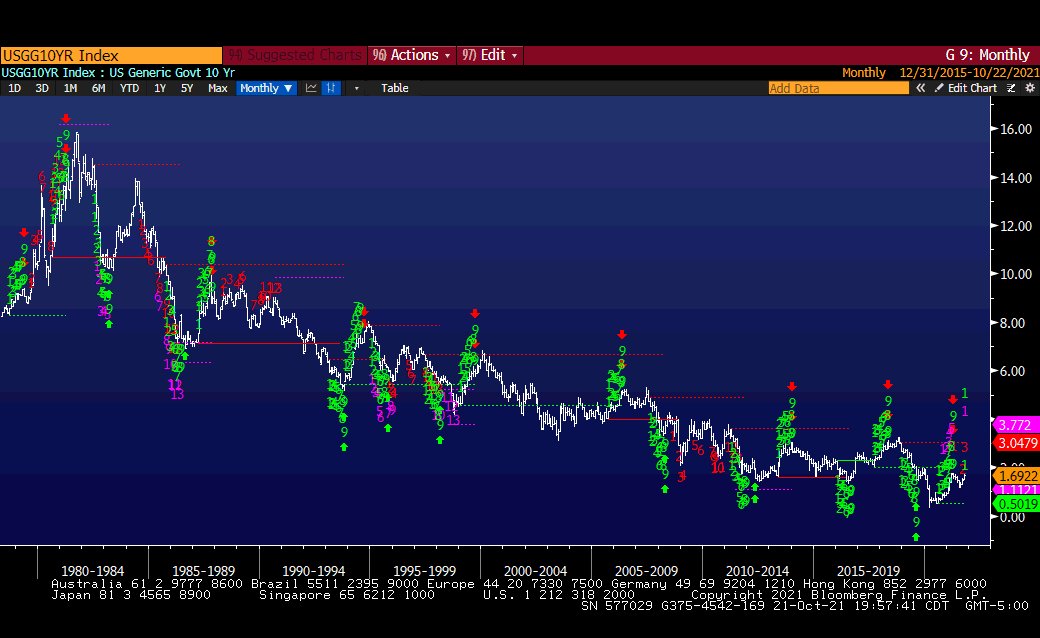

They should raise rates? Get back to something more reasonable according to past history, right?

But debts are too high vs GDP and higher rates will kill EVERYTHING... 1/

They should raise rates? Get back to something more reasonable according to past history, right?

But debts are too high vs GDP and higher rates will kill EVERYTHING... 1/

But Im a saver and nearing retirement and I want my yield! Tough shit. You aren't getting it. You simply cant. Im sorry. Its all your faults for taking on too much debt. If you didn't, then it's everyone else's fault.

But inflation is high!! Yes, but it is driven by supply issues. Raise rates on that and you get high prices due to supply constraints and you get a consumer that is killed. You can see this by the fear in the UM Consumer Indices...

Then the odds are that things slow down fast. Even if supply shortages keep prices high, growth will slow.

So, what can the Fed do? Taper and see. And that will slow things further.

So, what can the Fed do? Taper and see. And that will slow things further.

I don't see a quality bet on rate rises.

I see the quality bet on rates falling.

If you did get your "The Fed are bastards for creating inflation - raise rates now!", you will just destroy the economy. That ship sailed in 1997. too late lamenting over past times.

I see the quality bet on rates falling.

If you did get your "The Fed are bastards for creating inflation - raise rates now!", you will just destroy the economy. That ship sailed in 1997. too late lamenting over past times.

I don't have the bond bet on meaningful because I see crypto right now as a win/win. If inflation = win, if economy slows and Fed print = win.

Later, there will be Goldilocks for a bit and crypt0 will underperform but it's too early for that.

Later, there will be Goldilocks for a bit and crypt0 will underperform but it's too early for that.

If I am wrong and bonds go up, the Fed will impose Yield Curve Control (see Japan, EU (sort of) and Aus for details, which bizarrely is a form of money printing into an inflation cycle. Crypto wins.

To my mind, monetary condition are tightening too as the dollar slowly rises.

2022 is going to be a very different year and my bet is more QE and fiscal into an economic slowdown.

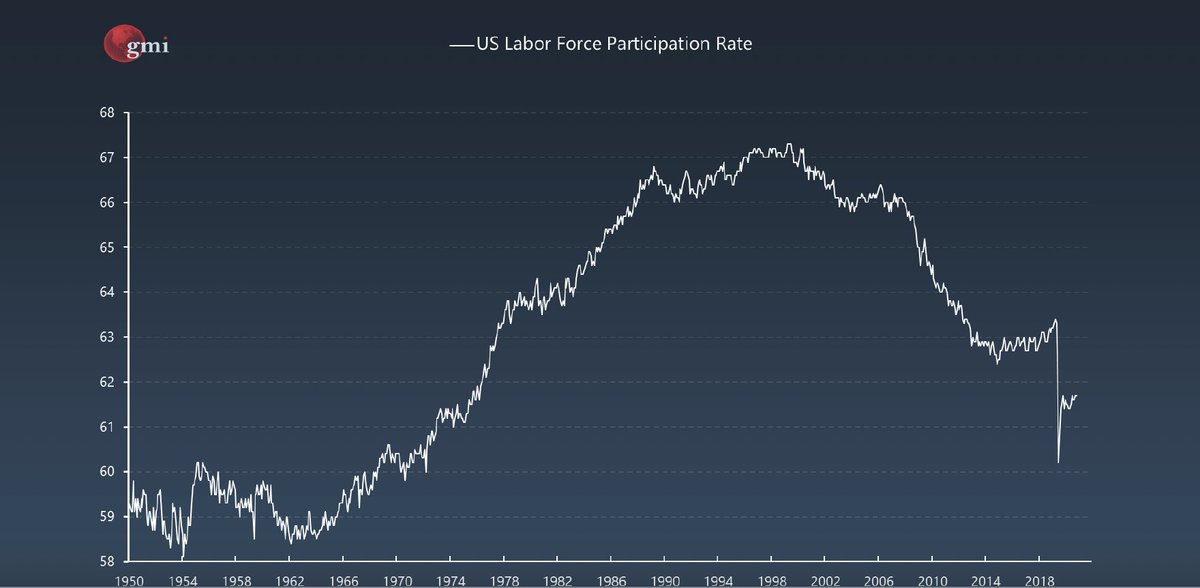

Shout inflation all you want. But see the demand side too. It ain't pretty.

2022 is going to be a very different year and my bet is more QE and fiscal into an economic slowdown.

Shout inflation all you want. But see the demand side too. It ain't pretty.

• • •

Missing some Tweet in this thread? You can try to

force a refresh