With the Fed's taper imminent, rates were on the move again last week, both in nominal and real terms. The TIPS break-even spread continues to test its upper bound of the past five years or so. Are inflation expectations ready to break out? (THREAD)

TIPS break-evens have rebounded from the depths of the pandemic. History shows a tendency to mean-revert around 2%, with the top of the range around 2.3% in recent years. But further back, break-evens spent a fair amount of time near 3%. /2

Given that the CPI is north of 5%, a breakout to 3% would not surprise me. /3

If inflation expectations do accelerate from here, it could very well happen without an acceleration in growth. That may stoke some fears of stagflation. You can see in the chart below that inflation breaks are clearly diverging from economic momentum. /4

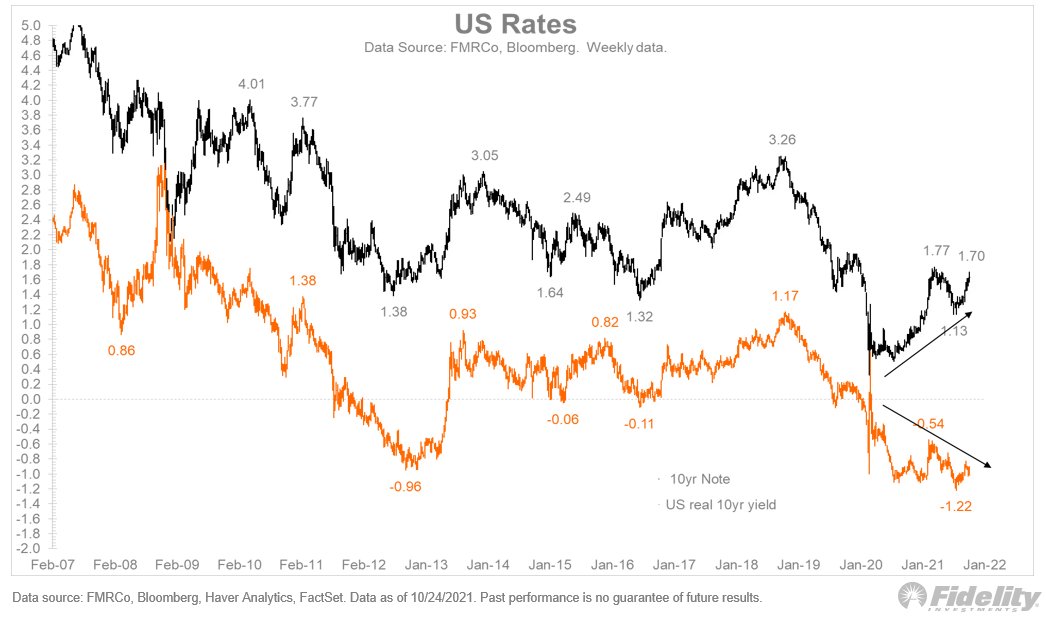

It’s interesting that both nominal yields and TIPS break-evens are rallying here, leaving real rates firmly in negative territory. /5

This final chart highlights the divergence between nominal and real rates. One would be forgiven for expecting real rates to be above zero, considering where we are in the market cycle. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh