The next token that will be onboarded in @MakerDAO as collateral is... 🥁

💧 stETH from @LidoFinance 💧

Yeah, Ethereum 2.0 is closer to Maker than ever 💥

And now, your best source of info about Maker and DeFi with memes and GIFs is ready for a new thread 🧵👇

1/19

💧 stETH from @LidoFinance 💧

Yeah, Ethereum 2.0 is closer to Maker than ever 💥

And now, your best source of info about Maker and DeFi with memes and GIFs is ready for a new thread 🧵👇

1/19

An Executive Vote for onboarding $WSTETH as collateral in the Maker Protocol was approved on Oct 26.

The vote breakdown closed at:

🟢 53,674.41 MKR for YES 🥂

😎 The Maker Community has decided. That's how governance works, baby.

2/19

The vote breakdown closed at:

🟢 53,674.41 MKR for YES 🥂

😎 The Maker Community has decided. That's how governance works, baby.

2/19

First of all: What is @LidoFinance and how it works? 🤓

🌐 Lido is a decentralized service that allows you to participate in staking blockchains without locking assets or maintaining a complicated infrastructure.

🧿 It started along with Phase 0 of Ethereum 2.0

3/19

🌐 Lido is a decentralized service that allows you to participate in staking blockchains without locking assets or maintaining a complicated infrastructure.

🧿 It started along with Phase 0 of Ethereum 2.0

3/19

🤑 You can put your $ETH through Lido's smart contracts into the beacon chain and receive staking rewards from Ethereum 2.0.

⛓️ The beacon chain is the consensus mechanism of Ethereum 2.0, responsible for creating blocks, validate them and rewarding validators with $ETH.

4/19

⛓️ The beacon chain is the consensus mechanism of Ethereum 2.0, responsible for creating blocks, validate them and rewarding validators with $ETH.

4/19

🌞 What a nice! So, you can participate in the consensus of Ethereum 2.0 without needing an entire validator.

🙌 You'll be participating in the creation of new blocks for Eth 2.0.

👏 You'll be earning $ETH rewards.

🧐 But that's not ending here.

5/19

🙌 You'll be participating in the creation of new blocks for Eth 2.0.

👏 You'll be earning $ETH rewards.

🧐 But that's not ending here.

5/19

🔄 When you put your $ETH in Lido you receive $STETH, an ERC20 token that represents the user's staked $ETH balance of beacon chain.

🤝 When transactions are enabled on Eth 2.0 everyone will be able to redeem $STETH for their $ETH + their accumulated staking rewards.

6/19

🤝 When transactions are enabled on Eth 2.0 everyone will be able to redeem $STETH for their $ETH + their accumulated staking rewards.

6/19

🪙 $STETH is a token like any ERC20.

🤩 While your $ETH staked directly to a beacon chain validator is fully locked, your $ETH staked with Lido give you $STETH back that you can use across all DeFi ecosystem to trade and earn more yield (or issue Dai with Maker 😉).

7/19

🤩 While your $ETH staked directly to a beacon chain validator is fully locked, your $ETH staked with Lido give you $STETH back that you can use across all DeFi ecosystem to trade and earn more yield (or issue Dai with Maker 😉).

7/19

👏 Another advantage from Lido is that you don't necessarily need to stake a minimum of 32 $ETH

📏 Remember that's the minimum $ETH needed to staking in Eth 2.0 directly in the beacon chain contract

🤑 But with Lido there's no minimum! You can stake any amount of $ETH

8/19

📏 Remember that's the minimum $ETH needed to staking in Eth 2.0 directly in the beacon chain contract

🤑 But with Lido there's no minimum! You can stake any amount of $ETH

8/19

⛓️ Lido made it possible distributing those random amounts of deposited $ETH in chunks of 32 $ETH and using them between all active node operators in the beacon chain.

It's teamwork, bro 👊

9/19

It's teamwork, bro 👊

9/19

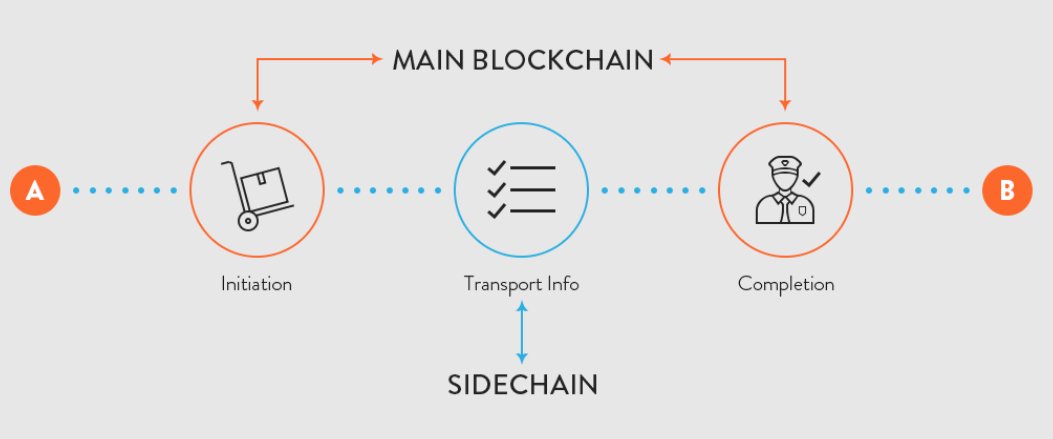

⚒️ Technically speaking, @LidoFinance is composed by 3 structural components: the staking pool, the $STETH token and the DAO.

🔌 Below the staking pool, the node operators are responsible of plugging the $ETH into the Eth 2.0 main staking contract.

10/19

🔌 Below the staking pool, the node operators are responsible of plugging the $ETH into the Eth 2.0 main staking contract.

10/19

🏭 Lido will maintain a set of node operators who are responsible for validating the $ETH staked with Lido.

🗳️ The addition and removal of node operators will be voted on by Lido community governance.

11/19

🗳️ The addition and removal of node operators will be voted on by Lido community governance.

11/19

🏭 Node operators are selected by the DAO to run Eth 2.0 full validators

🏦 When an user deposits $ETH, the same amount of $STETH is minted

🏭 The node operators receive the chunks of 32 $ETH to deposit it directly to the beacon chain and that's how the core system works

12/19

🏦 When an user deposits $ETH, the same amount of $STETH is minted

🏭 The node operators receive the chunks of 32 $ETH to deposit it directly to the beacon chain and that's how the core system works

12/19

💻 The staking pool is the core smart contract of Lido.

⛓️ It's responsible for $ETH deposits and withdrawals; minting and burning $STETH tokens, delegating funds to node operators, applying fees to staking rewards and accepting updates from the oracle.

13/19

⛓️ It's responsible for $ETH deposits and withdrawals; minting and burning $STETH tokens, delegating funds to node operators, applying fees to staking rewards and accepting updates from the oracle.

13/19

👀 Oracles keeps track of balances of the DAO's validators on the beacon chain.

📊 These balances are dynamic because of reward accumulation and slashing and staking penalties.

14/19

📊 These balances are dynamic because of reward accumulation and slashing and staking penalties.

14/19

🤑 When there are rewards, a small amount of $STETH are minted to the node operators and to the DAO's insurance and development fund, representing a reward fee.

15/19

15/19

🙌 The whole system is controlled by a DAO that works with decentralized governance through the $LDO as the governance token.

🗳️ By holding $LDO tokens, one is granted voting rights within the Lido DAO.

16/19

🗳️ By holding $LDO tokens, one is granted voting rights within the Lido DAO.

16/19

🤔 Now, what's the difference between $STETH and $WSTETH?

💱 $WSTETH is an ERC20 token that represents the account's share of the total supply of $STETH tokens.

17/19

💱 $WSTETH is an ERC20 token that represents the account's share of the total supply of $STETH tokens.

17/19

📈📉 $WSTETH token's balance only changes on transfers, unlike $STETH that is also changed when oracles report rewards and penalties.

👊 Lido calls it a "power user" token for DeFi which doesn't support rebasable tokens. That's why $WSTETH is the selected token for Maker

18/19

👊 Lido calls it a "power user" token for DeFi which doesn't support rebasable tokens. That's why $WSTETH is the selected token for Maker

18/19

So, what's your $ETH doing? Just static, or earning double-rewards?

It's easy:

🤑 Stake your $ETH in @LidoFinance and earn staking rewards.

🤑 Wrap your received $STETH into $WSTETH

🤑 Use your $WSTETH for minting DAI and let's earn more through DeFi.

It's easy:

🤑 Stake your $ETH in @LidoFinance and earn staking rewards.

🤑 Wrap your received $STETH into $WSTETH

🤑 Use your $WSTETH for minting DAI and let's earn more through DeFi.

• • •

Missing some Tweet in this thread? You can try to

force a refresh