1/4

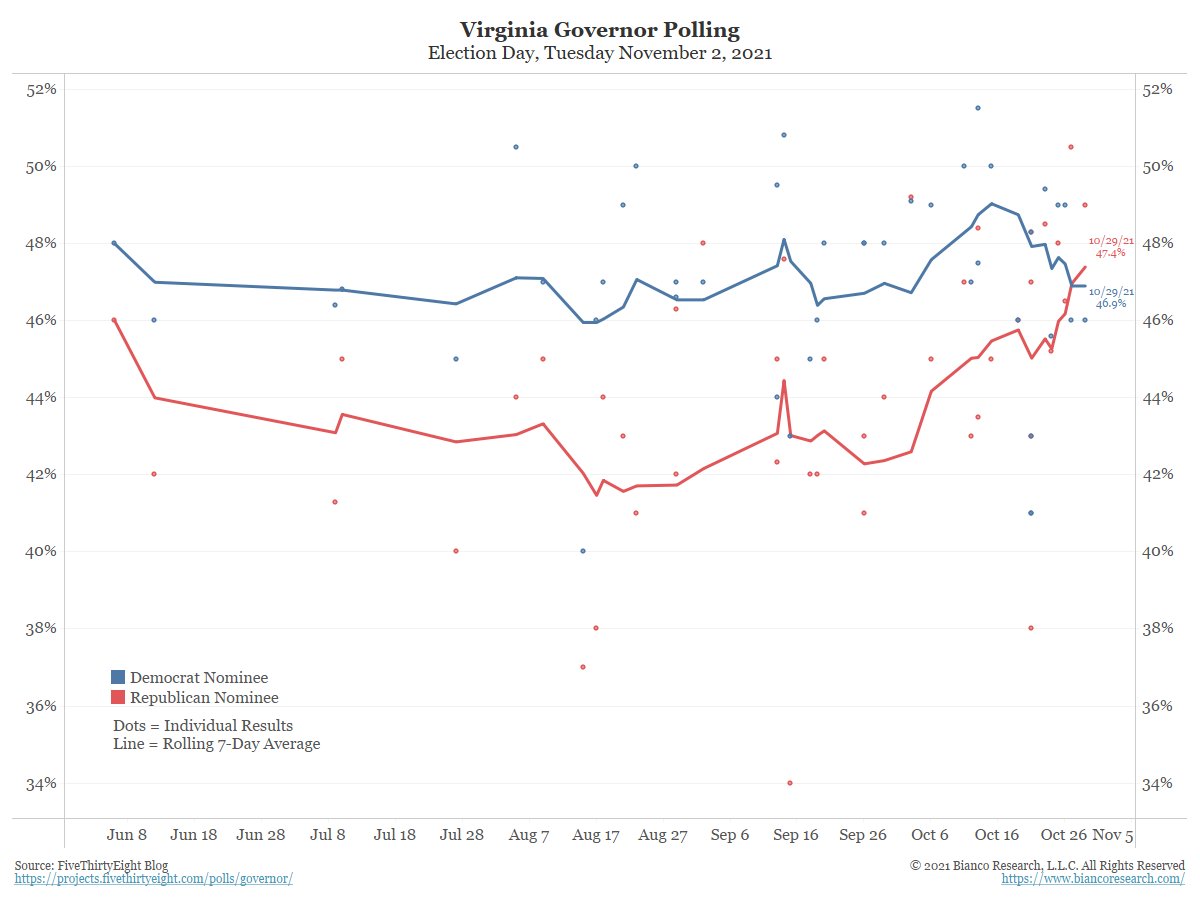

The election to watch this week is the Virginia Governor Race. Election day is Tuesday, Nov 2.

Biden won Virginia by 10 pts just a year ago.

The Democrat, Terry McAuliffe, might be staging what some political wags are calling 1 of the greatest collapses in a generation.

The election to watch this week is the Virginia Governor Race. Election day is Tuesday, Nov 2.

Biden won Virginia by 10 pts just a year ago.

The Democrat, Terry McAuliffe, might be staging what some political wags are calling 1 of the greatest collapses in a generation.

2/4

As late as a month ago, the McAuliffe had as much as a 15 pt lead over (R) Glenn Youngkin. Now, not only is that lead gone, but it might have reversed.

McAuliffe was a former Governor so he is hardly some obscure figure in Virginia politics. Youngkin has never held office.

As late as a month ago, the McAuliffe had as much as a 15 pt lead over (R) Glenn Youngkin. Now, not only is that lead gone, but it might have reversed.

McAuliffe was a former Governor so he is hardly some obscure figure in Virginia politics. Youngkin has never held office.

3/4

Youngkin was at Carlyle for 25 years, rising to Co-CEO. He left in September 2020 to run for Governor.

We've seen numerous examples of the polls/bettors getting it wrong. So, maybe, McAuliffe wins by a bunch? We'll know in three days.

Youngkin was at Carlyle for 25 years, rising to Co-CEO. He left in September 2020 to run for Governor.

We've seen numerous examples of the polls/bettors getting it wrong. So, maybe, McAuliffe wins by a bunch? We'll know in three days.

4/4

Should McAuliffe lose, the Ds will be in total panic.

Moderate Ds, of which there is 50 to 75 in the House/Senate, that vote for the spending/infrastructure/budget/debt ceiling might be voting to end their political career.

This matters for the economy and the midterms.

Should McAuliffe lose, the Ds will be in total panic.

Moderate Ds, of which there is 50 to 75 in the House/Senate, that vote for the spending/infrastructure/budget/debt ceiling might be voting to end their political career.

This matters for the economy and the midterms.

Bonus

Is the T-Bill market already fearing a "mess" around a potential technical default on the Dec 3 debt ceiling date?

This date is still five weeks away, which is a long way away for the market to be showing such a concern.

Is this a signal of real worry about this event?

Is the T-Bill market already fearing a "mess" around a potential technical default on the Dec 3 debt ceiling date?

This date is still five weeks away, which is a long way away for the market to be showing such a concern.

Is this a signal of real worry about this event?

• • •

Missing some Tweet in this thread? You can try to

force a refresh