TESLA REPORT - HOLON INVESTMENT 20211000

Here is the report that we have mentioned previously

This thread includes several charts that we have prepared to show their viewpoint

patreon.com/posts/tesla-re…

Here is the report that we have mentioned previously

This thread includes several charts that we have prepared to show their viewpoint

patreon.com/posts/tesla-re…

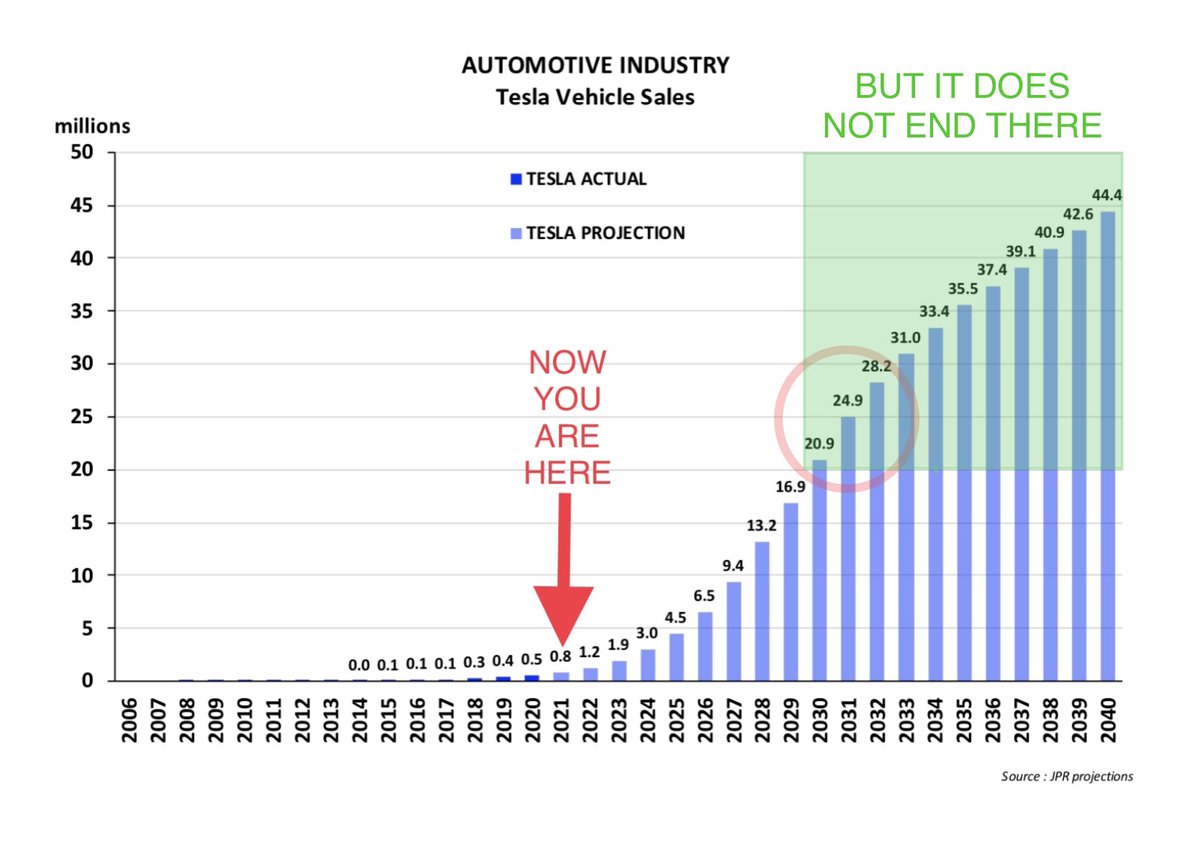

Telsa has repeatedly stated targets of 20 million units and a continuous growth rate of +50% per annum

We are currently projecting 20 million units in 2030 and 25 million units in 2031

We are currently projecting 20 million units in 2030 and 25 million units in 2031

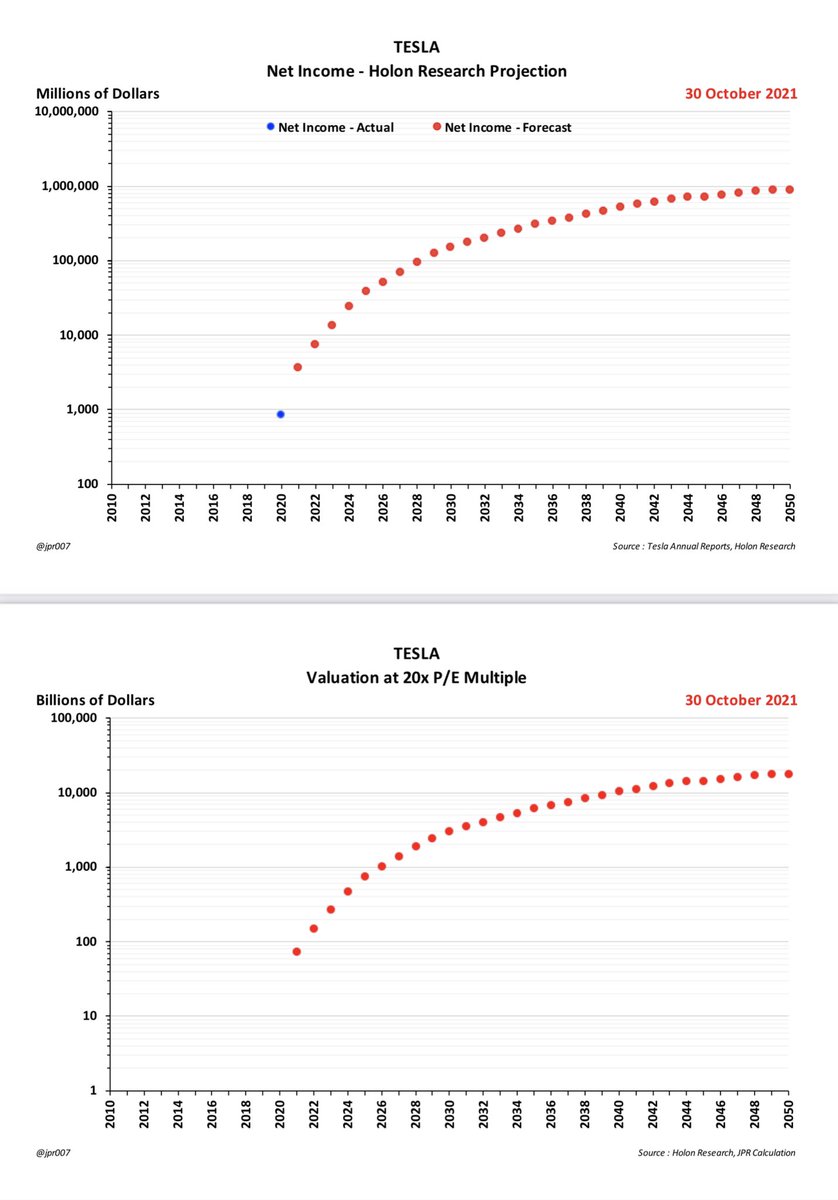

This shows Holon's projection for Tesla's Net Income through 2050

We have converted this to the equivalent of a Market Capitalization using a constant P/E Multiple of 20x

As you can see, this shows Tesla passing $10 trillion in Market Cap around 2040

We have converted this to the equivalent of a Market Capitalization using a constant P/E Multiple of 20x

As you can see, this shows Tesla passing $10 trillion in Market Cap around 2040

• • •

Missing some Tweet in this thread? You can try to

force a refresh