note that this is not wishful/deluded thinking

but a political commitment to abandon Green New Deal/ state-led decarbonisation

and to put in place subsidies for 'escorting' the market into climate solutions without penalising it for systemic greenwashing

but a political commitment to abandon Green New Deal/ state-led decarbonisation

and to put in place subsidies for 'escorting' the market into climate solutions without penalising it for systemic greenwashing

https://twitter.com/ninalakhani/status/1455188469400195082

for a second, another Biden seemed possible.

https://twitter.com/BJMbraun/status/1381649835930042369?s=20

same 'the market will deliver, with a bit of help from governments' message from @KGeorgieva of IMF:

https://twitter.com/IMFNews/status/1455190502534352896?s=20

the IMF take #COP26:

1. Develop metrics for climate vulnerability.

2. Eliminate barriers to adaptation (insurance markets)

3. Incentives for the private sector (derisking state)

1. Develop metrics for climate vulnerability.

2. Eliminate barriers to adaptation (insurance markets)

3. Incentives for the private sector (derisking state)

in fairness, there is no explicit 'market will deliver' in Biden's speech, not for rich countries.

But no reading between the lines on the vision for the Global South: #WallStreetConsensus rhetoric of Billions to Trillions

But no reading between the lines on the vision for the Global South: #WallStreetConsensus rhetoric of Billions to Trillions

we stand corrected, at least for the US that statement is not correct

https://twitter.com/70sBachchan/status/1455469055855497228?s=20

well @70sBachchan I may un-un-correct myself, since is seems a lot of the Biden energy investment is technically derisking private sector via tax credits, not public investment.

the Biden Third Way:

https://twitter.com/Matthuber78/status/1455479184982151170?s=20

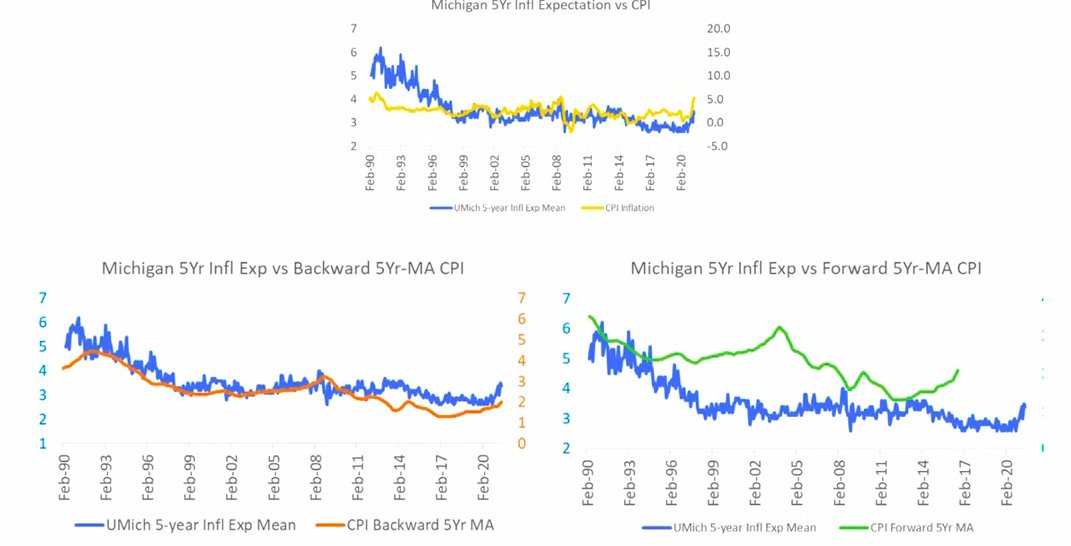

market-led decarbonisation does not preclude (niche) green industrial policies, but keeps status-quo macrofinancial script - central banks targeting inflation, + fiscally 'disciplined' state

state does not do large-scale green macrofinancial planning

journals.sagepub.com/doi/full/10.11…

state does not do large-scale green macrofinancial planning

journals.sagepub.com/doi/full/10.11…

• • •

Missing some Tweet in this thread? You can try to

force a refresh