Today is private finance day #COP26. It’s a big day, because private finance keeps fossil fuel companies alive and polluting despite commitments to net zero.

If policy makers were serious about shrinking dirty lending, this is what you’d be reading in the press release 1/n:

If policy makers were serious about shrinking dirty lending, this is what you’d be reading in the press release 1/n:

1. Today, central banks led by Bank of England have collectively agreed on framework to penalize dirty lending.

This will be developed and introduced within the next two years, upgrading escalation-approach pioneered by the Bank of England.

bankofengland.co.uk/-/media/boe/fi…

This will be developed and introduced within the next two years, upgrading escalation-approach pioneered by the Bank of England.

bankofengland.co.uk/-/media/boe/fi…

2. By ending their historical carbon bias forged by commitment to 'market neutrality', central banks will ensure that the cost of capital for fossil fuel companies goes up significantly, shaping credit price signals to redirect flows to green activities.

3. We now recognise that carbon bias has been hardwired into our monetary policy operations.

For too long, we have accommodated the failure of the market to price climate crisis, and thus incentivised dirty lending.

It is time to end this bias.

For too long, we have accommodated the failure of the market to price climate crisis, and thus incentivised dirty lending.

It is time to end this bias.

https://twitter.com/GreenpeaceEU/status/1369953502810750976?s=20

4. To minimize dirty arbitrage, central banks agreed to include private equity and other shadow banks within the scope of the new ‘penalties first, incentives later’ regime.

https://twitter.com/DanielaGabor/status/1440546119595880465?s=20

5. To minimize transition risks and preserve an orderly transition, central banks agreed to revise accounting rules for stranded assets (suspending mark to market) in systemic institutional portfolios.

https://twitter.com/BBonizzi/status/1455585361866936320?s=20

6. To address structural shortage of green assets, central banks & fiscal authorities agreed on new regime of green macro-coordination.

This accelerates issuance of green sovereign bonds to absorb capital leaving dirty assets.

It finances national green industrial strategies

This accelerates issuance of green sovereign bonds to absorb capital leaving dirty assets.

It finances national green industrial strategies

7. By correcting the market mispricing of dirty assets, central banks will effectively redirect the trillions of institutional capital towards green PUBLIC infrastructure in the Global South, and close infrastructure gaps.

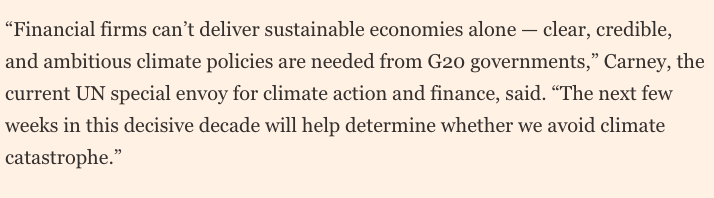

8. Mark Carney, UN Envoy for Climate Finance

'Glasgow Financial Alliance for Net Zero (GFANZ) welcomes this ambitious plan to green finance. For too long, regulators trusted voluntary decarbonisation, knowing well it cant deliver for 1.5C or even 2C'

'Glasgow Financial Alliance for Net Zero (GFANZ) welcomes this ambitious plan to green finance. For too long, regulators trusted voluntary decarbonisation, knowing well it cant deliver for 1.5C or even 2C'

https://twitter.com/DanielaGabor/status/1447835984427683844?s=20

Unfortunately, this is not the press release you will read today.

The actual press release is another exercise in pretending that voluntary decarbonisation - 24 major initiatives - is 'revolutionary' or will end systemic greenwashing.

The actual press release is another exercise in pretending that voluntary decarbonisation - 24 major initiatives - is 'revolutionary' or will end systemic greenwashing.

only mandatory measure #COP26 - our last collective chance to reverse climate crisis - is to ask companies to disclose net zero transition plans.

6 years after Carney's Tragedy of Horizon speech, we are still at 'all hail disclosure' step, most toothless in central bank toolkit

6 years after Carney's Tragedy of Horizon speech, we are still at 'all hail disclosure' step, most toothless in central bank toolkit

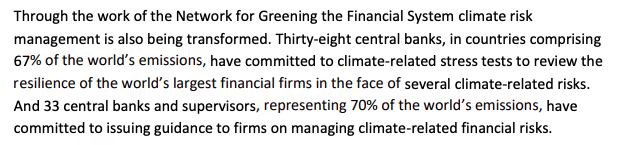

central bank measures? climate stress tests.

no regulation of dirty assets, no mention of market neutrality, of greening collateral framework or corporate bond purchases.

the Green central bank Revolution literally has no Revolutionaries.

no regulation of dirty assets, no mention of market neutrality, of greening collateral framework or corporate bond purchases.

the Green central bank Revolution literally has no Revolutionaries.

climate stress tests are central banks stuck in pre-Lehman microprudential mode, thinking that no systemic view or double materiality necessary to address their role in the climate crisis.

this is an abdication of public responsibility.

this is an abdication of public responsibility.

instead of public regulation, we have private catalytic initiatives to render climate crisis profitable for private finance, under motto:

'new asset classes for us, new risks for the state'

'new asset classes for us, new risks for the state'

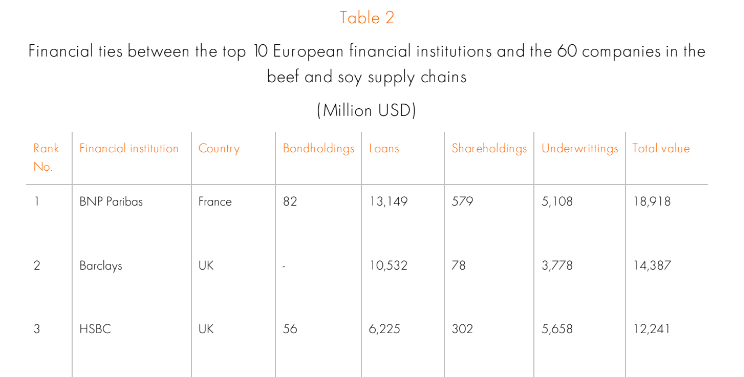

what other word but impunity to use when HSBC and Innovative Finance for the Amazon, Cerrado and Chaco (IFACC) mentioned in the same breath

HSBC a well known financier of beef and soy companies destroying Amazon/Cerrado

HSBC a well known financier of beef and soy companies destroying Amazon/Cerrado

the FAST-Infra initiative continues #WallStreetConsensus project of creating and derisking Infrastructure as an Asset Class for private finance -

Coding Infrastructure Capital a la @KatharinaPistor

Coding Infrastructure Capital a la @KatharinaPistor

the Global Energy Alliance for People and Planet (GEAPP) will 'save' Global South from energy poverty, with money from well-known billionaire climate activists

the Derisking Alliance will, it needs to be pointed out, derisk renewable energy assets for investors, not for citizens in the Global South #WallStreetConsensus

and I hear you: shouldnt we want private investors to finance renewable energy projects in Global South?

Isnt this the area where derisking makes sense, for governments w balance of payment constraints?

But look at experience of Kingdom of Morocco w derisking solar energy

Isnt this the area where derisking makes sense, for governments w balance of payment constraints?

But look at experience of Kingdom of Morocco w derisking solar energy

Morocco has bet big on renewable energy - not via green public investments but derisking private investments in Noor mega projects (the strategy of the Alliance)

ft.com/content/bcce9c…

ft.com/content/bcce9c…

Noor projects are a perfect derisking blueprint a la the Alliance for People and Planet:

co-financed by Alliance Members (AfDB, KfW, AfD) and MASEN, the derisking arm of the Moroccan state

built by Spanish companies.

co-financed by Alliance Members (AfDB, KfW, AfD) and MASEN, the derisking arm of the Moroccan state

built by Spanish companies.

let me introduce you to a white derisking elephant, the Noor Ouazarate solar plant - saddling Moroccan state and its citizens with outdated, expensive and water-intensive renewable technology

FT blames MASEN, but shouldnt Germans at KfW, or French at AfD know better?

FT blames MASEN, but shouldnt Germans at KfW, or French at AfD know better?

what mechanisms has Alliance put in place to ensure that it doesnt sanction such white elephants in the future?

incentives are not aligned: Alliance wants mega projects to legitimise its existence (and to play geopolitics of European Green Deal)

incentives are not aligned: Alliance wants mega projects to legitimise its existence (and to play geopolitics of European Green Deal)

and the central banks' network for greening the financial @NGFS_ Glasgow Declaration is out,

it's a close mirror of the GFANZ statement, in case you wonder who's writing the rules of decarbonising finance game

it's a close mirror of the GFANZ statement, in case you wonder who's writing the rules of decarbonising finance game

and @FT this is irresponsible reporting: a lot of those $130 trillion asset are actually dirty loans to fossil fuel companies and activities that are tearing down ecosystems across the Global South.

can we please at least not indulge the greenwashing

can we please at least not indulge the greenwashing

look who's #COP26 @nssylla - Macron's favourite #WallStreetConsensus ally and spearheader in African countries

seriously, FAST Infra panel #COP26 is non stop #WallStreetConsensus bingo

derisking (4X), blended finance (2X), risk gap, catalytic capital, PPP, dynamic label, scaling up, blended finance as an asset class, catalytic value of label, bankable project

derisking (4X), blended finance (2X), risk gap, catalytic capital, PPP, dynamic label, scaling up, blended finance as an asset class, catalytic value of label, bankable project

(the technology gap is not inspiring a great deal of trust in FAST infra)

finally for today, Andrew Bailey's #COP26 speech confirms suspicions that under his rule @bankofengland is retreating on climate despite an explicit environmental mandate.

bankofengland.co.uk/-/media/boe/fi…

bankofengland.co.uk/-/media/boe/fi…

@bankofengland Bailey mentions three pivots of 'ambition'

1. Micropru/capital requirements

2. Scenario analysis

3. TCFD disclosures.

Not one word on greening CBPS, or collateral, from central bank supposedly leading on climate.

2021 is the year our hopes from 2019 and 2020 were laid to rest.

1. Micropru/capital requirements

2. Scenario analysis

3. TCFD disclosures.

Not one word on greening CBPS, or collateral, from central bank supposedly leading on climate.

2021 is the year our hopes from 2019 and 2020 were laid to rest.

@bankofengland and yes, some in ECB claim that it is strategic to be quiet on double materiality (reducing carbon footprint of mon policy/private finance) for political reasons.

that may be the case in Euroarea, but why does Bank of England need to pretend, when it has an environmental mandate?

that may be the case in Euroarea, but why does Bank of England need to pretend, when it has an environmental mandate?

@bankofengland we have a new report on how to upgrade the Bank of England's escalation approach for a substantive decarbonisation - tune in tomorrow #COP26

https://twitter.com/YannisDafermos/status/1455929898657267713?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh