October's payrolls report shows a resumption to growth: +XX351Xk jobs added, which changes the narrative a bit after a disappointing September.

Unemployment is down a touch to 4.6%, which is pretty remarkable after it fell dramatically last month.

THIS IS A GOOD JOBS REPORT.

Unemployment is down a touch to 4.6%, which is pretty remarkable after it fell dramatically last month.

THIS IS A GOOD JOBS REPORT.

Revisions are a game changer.

Previous we had thought employment growth had slowed to +194k in September. Revised to +312k. Likewise August revised from +366k to +483k.

Employment growth has now averaged +442k over the past three months.

Previous we had thought employment growth had slowed to +194k in September. Revised to +312k. Likewise August revised from +366k to +483k.

Employment growth has now averaged +442k over the past three months.

If you don't revise your views about the state of the recovery after this jobs report, you're not really evidence-based.

The Fall hiccup is now at best a Fall deep breath.

The Fall hiccup is now at best a Fall deep breath.

Household survey largely confirms the top line from the establishment survey, with employment up +359k. The labor force grew, so this decline in unemployment is both notable, and not due to people giving up hope.

Recent employment growth hasn't just been leisure and hospitality and re-opening. Really solid job gains across the board, with gains evident in both goods- and services sectors.

Average hourly earnings rose an unremarkable 0.35%. October included Walmart's 7% pay hike, so this doesn't point to any trend break.

Over the year hourly earnings have risen at a rate of 4.9%, although these numbers are still hard to interpret given changes in composition.

Over the year hourly earnings have risen at a rate of 4.9%, although these numbers are still hard to interpret given changes in composition.

Monthly changes in education continue to puzzle (and possibly distort monthly movements) a bit, as some of it is due to changing seasonality.

But since Feb 2020, we have lost -370k workers in local govt education, -205k in state education, and -148k in private education.

But since Feb 2020, we have lost -370k workers in local govt education, -205k in state education, and -148k in private education.

The fall in unemployment was concentrated among those who need it most:

https://twitter.com/BetseyStevenson/status/1456601405805023232

Why was the October jobs report so strong?

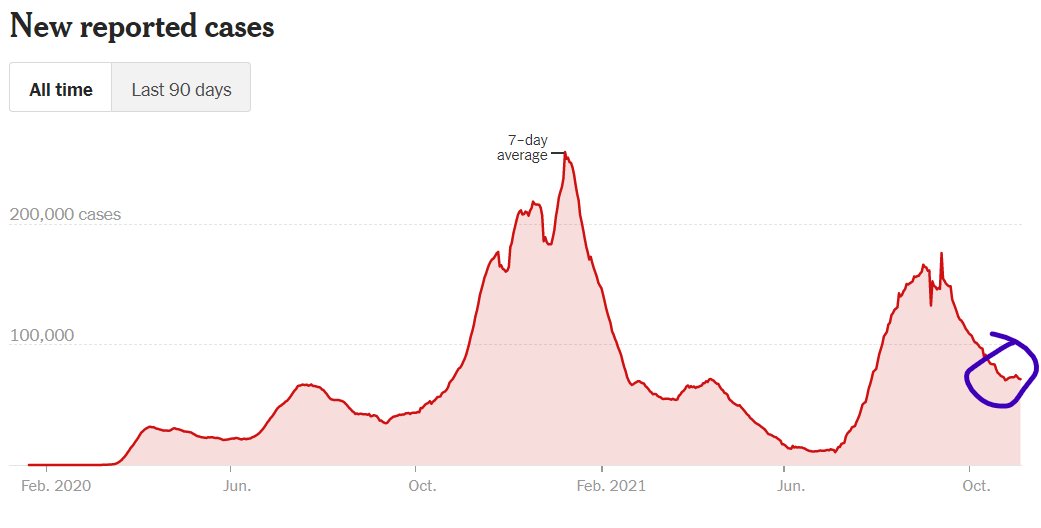

It's always hard to interpret any single monthly figure, but it's worth noting that this was a period over which covid cases were falling dramatically.

Bad news: That decline has stalled...

Good news: 5-11's can now get vaccinated...

It's always hard to interpret any single monthly figure, but it's worth noting that this was a period over which covid cases were falling dramatically.

Bad news: That decline has stalled...

Good news: 5-11's can now get vaccinated...

Home truths: We chat over breakfast about the jobs report, but come 8:30, the kids are at school & we're in our separate offices, furiously typing. I think @BetseyStevenson's in her office doing a tv spot now; I'm in mine, explaining what Betsey's doing.

https://twitter.com/marinaepelman/status/1456604014712348672

@BetseyStevenson This is an extraordinarily interesting way to summarize the state of the labor market... It's at least half right, though today's labor market is a heckuva lot more interesting -- and the stakes feel a lot higher -- than mid-2016.

https://twitter.com/besttrousers/status/1456605222487343105

@BetseyStevenson To answer a question: Revisions this big are not unheard of. But these are important, because revision for both August and September are meaningful and positive.

And given the state of the world, it's unsurprising that data collection is taking a while.

And given the state of the world, it's unsurprising that data collection is taking a while.

https://twitter.com/CJonthestreet/status/1456605389630410754

@BetseyStevenson Okay, so I'm excited that the labor market is on the mend, but don't let that hide a deeper and equally important truth: We've still got a long way to go.

We're still 6 million jobs of where we ought to be. That's still a deep hole right there.

We're still 6 million jobs of where we ought to be. That's still a deep hole right there.

https://twitter.com/jasonfurman/status/1456601579251920899

This jobs report confirms that we're all returning to the office. Gotta think vaccinations are a big part of this story.

https://twitter.com/bencasselman/status/1456604915585982467

Endorse @bencasselman's observation that while the rate of economic recovery is better than our worse fears over recent months, it's a lot slower than our pre-Delta optimism about about a rapid reopening.

Our lax vax rates have been costly.

Our lax vax rates have been costly.

https://twitter.com/bencasselman/status/1456607053758312452

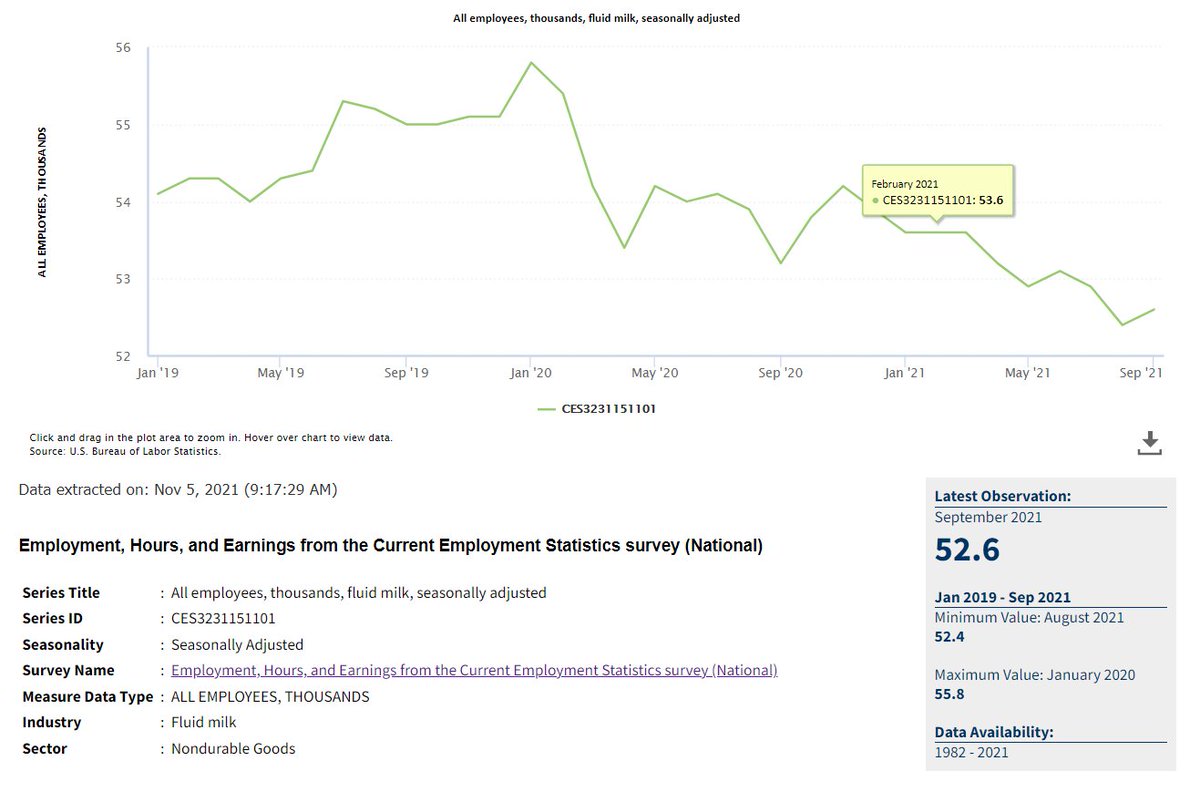

@bencasselman Can confirm STAGFLATION (in the milk industry).

CNN's got the facts on milk prices, and today's jobs report confirms that employment in the "fluid milk" industry has kept falling throughout the pandemic.

CNN's got the facts on milk prices, and today's jobs report confirms that employment in the "fluid milk" industry has kept falling throughout the pandemic.

https://twitter.com/Brotund/status/1456610940695326731

• • •

Missing some Tweet in this thread? You can try to

force a refresh