For those of you who are invested in Kadena ($KDA), thinking about investing into $KDA or have heard about it. Here are some key points to look into before you go invest (- WARNING - BE - CAREFUL -)

Y'all might have seen $KDA chart which was quite impressive to say the least.

Y'all might have seen $KDA chart which was quite impressive to say the least.

2/

Kadena $KDA aims to kill both #Bitcoin and #Ethereum in one shot. It also promises infinite scalability, upgradeable smart contracts which sound too good to be true.

If something sounds too good to be true, it probably is.

Kadena $KDA aims to kill both #Bitcoin and #Ethereum in one shot. It also promises infinite scalability, upgradeable smart contracts which sound too good to be true.

If something sounds too good to be true, it probably is.

4/

Kadena $KDA supports native oracles and decentralized bridges, unparalleled POW security, multi-chain currency and its built with Haskell like Cardano.

Sounds like it promises to kill 99.9% of all projects out there. Sounds too good to be true 🤔

Kadena $KDA supports native oracles and decentralized bridges, unparalleled POW security, multi-chain currency and its built with Haskell like Cardano.

Sounds like it promises to kill 99.9% of all projects out there. Sounds too good to be true 🤔

5/

Kadena $KDA ranked against competing blockchains is painted nothing short of impressive. Sounds too good to be true, it probably is 🤔

Kadena $KDA ranked against competing blockchains is painted nothing short of impressive. Sounds too good to be true, it probably is 🤔

7/

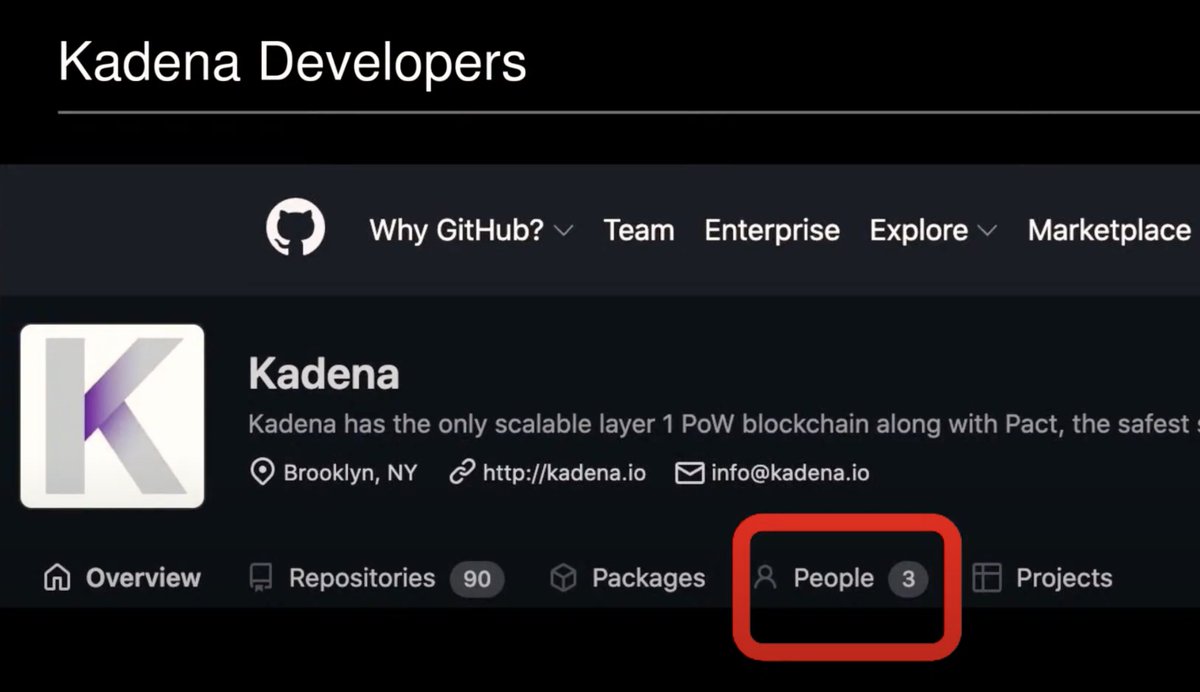

Kadena $KDA public GitHub seems to have 3 developers which sounds shady scary at best for all the problems this project promises to solve 🤔

Kadena $KDA public GitHub seems to have 3 developers which sounds shady scary at best for all the problems this project promises to solve 🤔

8/

Kadena $KDA scales like a DAG with braiding multiple chains for theoretically unlimited TPS, which sounds fancy and too good to be true. Another red flag IMHO.

Kadena $KDA scales like a DAG with braiding multiple chains for theoretically unlimited TPS, which sounds fancy and too good to be true. Another red flag IMHO.

9/

Kadena $KDA promises so minute transaction fees, it's almost impossible for miners to secure this network. If miners abandon this project, its pretty much dead 🤔

Kadena $KDA promises so minute transaction fees, it's almost impossible for miners to secure this network. If miners abandon this project, its pretty much dead 🤔

10/

Kadena $KDA token allocations currently are 57.4% allocated to insiders which is quite alarming 🤔

Kadena $KDA token allocations currently are 57.4% allocated to insiders which is quite alarming 🤔

11/

Overall this project promises everything in the world. It sounds too good to be true, it probably is.

STAY AWAY FROM KADENA $KDA TOKEN

Source: @invest_answers

Overall this project promises everything in the world. It sounds too good to be true, it probably is.

STAY AWAY FROM KADENA $KDA TOKEN

Source: @invest_answers

• • •

Missing some Tweet in this thread? You can try to

force a refresh