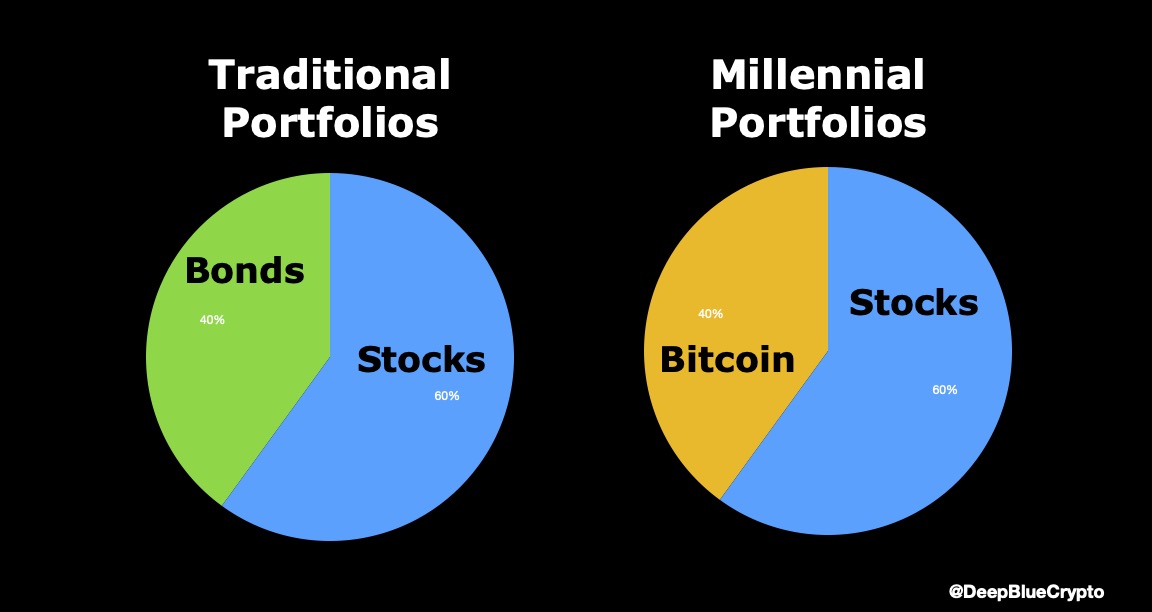

Traditional 60/40 portfolio construction (60% Stocks, 40% Bonds) does not make sense any more as bonds are broken. Most bonds around the world are either very low or negative yielding.

Millennials & GenZers would rather hold 60% stocks & 40% Bitcoin in their portfolios.

Millennials & GenZers would rather hold 60% stocks & 40% Bitcoin in their portfolios.

2/

From a Millennial & GenZer perspective...

- They trust in #Bitcoin as digital gold

- They prefer crypto over stocks & equities

- They prefer crypto over ETFs and mutual funds

- Real Estate is at all time highs, aren't interested

- They aren't interested in precious metals

From a Millennial & GenZer perspective...

- They trust in #Bitcoin as digital gold

- They prefer crypto over stocks & equities

- They prefer crypto over ETFs and mutual funds

- Real Estate is at all time highs, aren't interested

- They aren't interested in precious metals

3/

From a Millennials & GenZers perspective, an ultra conservative portfolio would look like below...

90% - #Bitcoin

10% - Crypto, Equities & other risky assets

From a Millennials & GenZers perspective, an ultra conservative portfolio would look like below...

90% - #Bitcoin

10% - Crypto, Equities & other risky assets

4/

From a Millennials & GenZers perspective, a conservative portfolio would look like below...

80% - #Bitcoin

20% - Crypto, Equities & other risky assets

From a Millennials & GenZers perspective, a conservative portfolio would look like below...

80% - #Bitcoin

20% - Crypto, Equities & other risky assets

5/

From a Millennials & GenZers perspective, an aggressive portfolio would look like below...

60% - #Bitcoin

40% - Crypto, Equities & other risky assets

From a Millennials & GenZers perspective, an aggressive portfolio would look like below...

60% - #Bitcoin

40% - Crypto, Equities & other risky assets

6/

From a Millennials & GenZers perspective, a super aggressive portfolio would look like below...

30% - #Bitcoin

70% - Crypto, Equities & other risky assets

From a Millennials & GenZers perspective, a super aggressive portfolio would look like below...

30% - #Bitcoin

70% - Crypto, Equities & other risky assets

7/

I'd suggest sticking to the two portfolio constructions for most, who aren't highly experienced with trading or investing.

- Ultra Conservative Portfolio (90/10)

- Conservative Portfolio (80/20)

Anything beyond this, you run the risk of losing capital due to inexperience.

I'd suggest sticking to the two portfolio constructions for most, who aren't highly experienced with trading or investing.

- Ultra Conservative Portfolio (90/10)

- Conservative Portfolio (80/20)

Anything beyond this, you run the risk of losing capital due to inexperience.

• • •

Missing some Tweet in this thread? You can try to

force a refresh