When you hear negative things about #Bitcoin like

- Bitcoin will go to zero

- Bitcoin is energy intensive

- Bitcoin is centralized

- Bitcoin will be shutdown

- Bitcoin is used by criminals

etc. don't pay attention, they're unaware of facts...

A small thread 🧵 👇

- Bitcoin will go to zero

- Bitcoin is energy intensive

- Bitcoin is centralized

- Bitcoin will be shutdown

- Bitcoin is used by criminals

etc. don't pay attention, they're unaware of facts...

A small thread 🧵 👇

2/

They say: #Bitcoin is going down to zero

We say: There is zero chance #Bitcoin can go to zero and there is minor chance for it to reach zero in 2018 but it survived.

#Bitcoin is anti fragile and resilient.

They say: #Bitcoin is going down to zero

We say: There is zero chance #Bitcoin can go to zero and there is minor chance for it to reach zero in 2018 but it survived.

#Bitcoin is anti fragile and resilient.

https://twitter.com/DeepBlueCrypto/status/1420422159416053760?s=20

3/

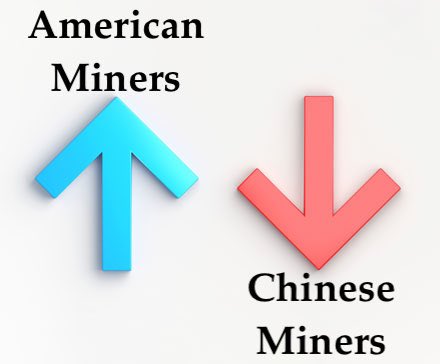

They say: #Bitcoin could go to zero, its primarily mining centralized in China 🇨🇳 and the state actors could 51% attack this network and bring it down to its knees.

We say: China 🇨🇳 banned #Bitcoin mining and the industry just moved out of China and it's growing outside.

They say: #Bitcoin could go to zero, its primarily mining centralized in China 🇨🇳 and the state actors could 51% attack this network and bring it down to its knees.

We say: China 🇨🇳 banned #Bitcoin mining and the industry just moved out of China and it's growing outside.

4/

They say: #Bitcoin is wasteful, uses tons of energy for Proof of Work mining.

We say: #Bitcoin mostly uses renewable energy for its mining operations. As much as 70% of mining happens on renewables.

Ever since @elonmusk brought up ESG concerns, there has been real progress.

They say: #Bitcoin is wasteful, uses tons of energy for Proof of Work mining.

We say: #Bitcoin mostly uses renewable energy for its mining operations. As much as 70% of mining happens on renewables.

Ever since @elonmusk brought up ESG concerns, there has been real progress.

5/

They say: #Bitcoin is used for illegal transactions, criminal activities, dark web and money laundering.

We say: Less than 2% of #Bitcoin operations are by criminal and money laundering operations. #Bitcoin is an open monetary network and its the criminals worst nightmare.

They say: #Bitcoin is used for illegal transactions, criminal activities, dark web and money laundering.

We say: Less than 2% of #Bitcoin operations are by criminal and money laundering operations. #Bitcoin is an open monetary network and its the criminals worst nightmare.

6/

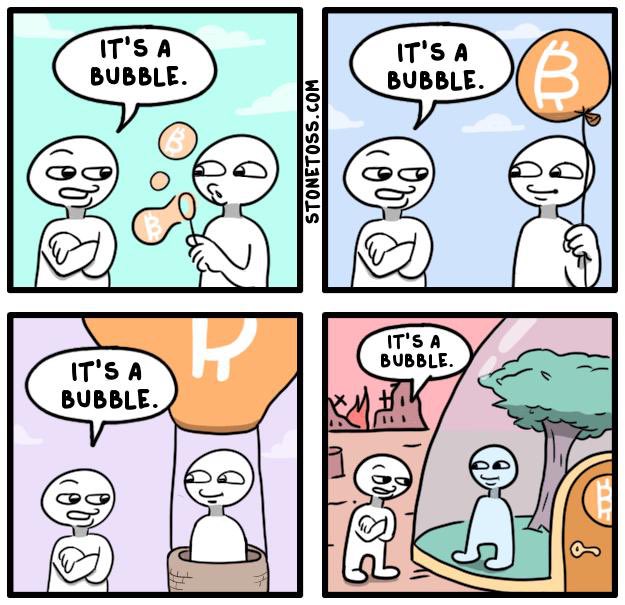

They say: #Bitcoin and crypto are used in ICOs NFTs are various other money grabbing schemes.

We say: Digital asset ecosystem is a brand new asset class and its burgeoning with rigorous activity. Its growth is marked in 4 year cycle spurts and with it comes speculation.

They say: #Bitcoin and crypto are used in ICOs NFTs are various other money grabbing schemes.

We say: Digital asset ecosystem is a brand new asset class and its burgeoning with rigorous activity. Its growth is marked in 4 year cycle spurts and with it comes speculation.

6b/

Speculation comes and goes in cycles where the speculation mania phases change from time to time

- ICO mania

- IEO/STO mania

- #DeFI mania

- NFT mania

...

It takes time for this asset class to mature and be regulated. As a result this sector is prime for speculation.

Speculation comes and goes in cycles where the speculation mania phases change from time to time

- ICO mania

- IEO/STO mania

- #DeFI mania

- NFT mania

...

It takes time for this asset class to mature and be regulated. As a result this sector is prime for speculation.

6c/

This space has many digital assets and #Bitcoin is the first & largest asset. From the applications and smart contracts perspective, there are multiple platforms concentrating on various types of applications.

This space has many digital assets and #Bitcoin is the first & largest asset. From the applications and smart contracts perspective, there are multiple platforms concentrating on various types of applications.

6d/

#Bitcoin asset itself has been transforming from use case to use case - digital P2P cash, store of value, digital gold etc.

#Ethereum ecosystem is transforming itself in phases from ICOs, IEOs, STOs, #DeFi, NFTs etc.

Oracle networks like #Chainlink have their ecosystems.

#Bitcoin asset itself has been transforming from use case to use case - digital P2P cash, store of value, digital gold etc.

#Ethereum ecosystem is transforming itself in phases from ICOs, IEOs, STOs, #DeFi, NFTs etc.

Oracle networks like #Chainlink have their ecosystems.

7/

They say: #Bitcoin and digital assets are highly volatile and its very risky.

We say: When in doubt, zoom out. Volatility is the price you pay for performance.

They say: #Bitcoin and digital assets are highly volatile and its very risky.

We say: When in doubt, zoom out. Volatility is the price you pay for performance.

https://twitter.com/DeepBlueCrypto/status/1408058755888160768?s=20

8/

They say: You could lose your funds easily, its not backed by your banks or anything.

We say: Yeah - when you're trying to disrupt the incumbent banks, central banks you have to be accountable and be responsible for your funds. You need to take precautions...

They say: You could lose your funds easily, its not backed by your banks or anything.

We say: Yeah - when you're trying to disrupt the incumbent banks, central banks you have to be accountable and be responsible for your funds. You need to take precautions...

8b/

to backup your wallet keys, backup your seed phrases, not giving out private key or wallet information on the internet etc.

Storing coins on exchanges/platforms/protocols is risky and you need to take control of your assets in your wallets.

#NotYourKeysNotYourCoins

to backup your wallet keys, backup your seed phrases, not giving out private key or wallet information on the internet etc.

Storing coins on exchanges/platforms/protocols is risky and you need to take control of your assets in your wallets.

#NotYourKeysNotYourCoins

9/

They say: #Bitcoin is not backed by anything, no banks or governments make you whole for your losses.

We say: So are most investments like gold, stocks etc. Only your Fiat money in a bank is insured up to $250,000. But fiat runs the risk of losing purchasing power over time.

They say: #Bitcoin is not backed by anything, no banks or governments make you whole for your losses.

We say: So are most investments like gold, stocks etc. Only your Fiat money in a bank is insured up to $250,000. But fiat runs the risk of losing purchasing power over time.

9b/

For example starting from just the year 2020 alone 40% of all US Dollars in circulation were added. This directly currency debasement caused asset bubbles, price inflation for most basic goods and high CPI metrics.

Look at the USD M2 money supply

For example starting from just the year 2020 alone 40% of all US Dollars in circulation were added. This directly currency debasement caused asset bubbles, price inflation for most basic goods and high CPI metrics.

Look at the USD M2 money supply

10/

They say: #Bitcoin is very slow and clunky with 5-7 TPS and it cannot ever be P2P money.

We say: Layer1 #Bitcoin network could be slow with 5-7 TPS, does not mean it cannot scale. Layer2 solution like lightning network is exploding in adoption recently after El Salvador 🇸🇻

They say: #Bitcoin is very slow and clunky with 5-7 TPS and it cannot ever be P2P money.

We say: Layer1 #Bitcoin network could be slow with 5-7 TPS, does not mean it cannot scale. Layer2 solution like lightning network is exploding in adoption recently after El Salvador 🇸🇻

10b/

and the #Bitcoin lightning network can scale up to millions of transactions per second (TPS). Although not as decentralized as the main #Bitcoin network, with time and adoption it'll slowly reach into 1000s of TPS if not millions.

and the #Bitcoin lightning network can scale up to millions of transactions per second (TPS). Although not as decentralized as the main #Bitcoin network, with time and adoption it'll slowly reach into 1000s of TPS if not millions.

11/

They say: Governments & Central Banks are threatened by #Bitcoin and they'll try to stop it or regulate it out of existence.

We say: Genie 🧞♂️ 🧞♀️ 🧞 is out of the bottle. Good Luck putting it back in.

They say: Governments & Central Banks are threatened by #Bitcoin and they'll try to stop it or regulate it out of existence.

We say: Genie 🧞♂️ 🧞♀️ 🧞 is out of the bottle. Good Luck putting it back in.

https://twitter.com/DeepBlueCrypto/status/1327256124282777601?s=20

11b/

If China 🇨🇳 bans #Bitcoin the mining industry relocates, if USA 🇺🇸 regulates or bans #Bitcoin the industry is nimble enough to just relocate to a friendlier nations like Singapore, Portugal, Puerto Rico, Malta, Bahamas etc.

If China 🇨🇳 bans #Bitcoin the mining industry relocates, if USA 🇺🇸 regulates or bans #Bitcoin the industry is nimble enough to just relocate to a friendlier nations like Singapore, Portugal, Puerto Rico, Malta, Bahamas etc.

11c/

If USA 🇺🇸 over-regulates crypto, they simply stifle innovation and lose their technical competitive advantage to other nations. Talent and corporations move out of USA 🇺🇸 in a moments notice.

Even crypto friendly states in USS like Wyoming, Texas, Florida step up.

If USA 🇺🇸 over-regulates crypto, they simply stifle innovation and lose their technical competitive advantage to other nations. Talent and corporations move out of USA 🇺🇸 in a moments notice.

Even crypto friendly states in USS like Wyoming, Texas, Florida step up.

11d/

90% of the total crypto transaction volume is outside of USA. Even if USA 🇺🇸 loses, that 10% is a drop in the crypto bucket.

Also Central & South American nations, African nations are really stepping up their #Bitcoin and crypto adoption rates massively.

90% of the total crypto transaction volume is outside of USA. Even if USA 🇺🇸 loses, that 10% is a drop in the crypto bucket.

Also Central & South American nations, African nations are really stepping up their #Bitcoin and crypto adoption rates massively.

12/

#Bitcoin with its current 125 million users, has established massive network effects & growing with each additional user added to the network.

river.com/learn/bitcoins….

#Bitcoin with its current 125 million users, has established massive network effects & growing with each additional user added to the network.

river.com/learn/bitcoins….

13/

#Bitcoin Lindy effect says Bitcoin is here to stay

#Bitcoin Lindy effect says Bitcoin is here to stay

https://twitter.com/SahilBloom/status/1331634649135779846?s=20

13/

#Bitcoin Metcalfe's law helps us predict future valuations based on the number of users in the network.

nydig.com/wp-content/upl…

#Bitcoin Metcalfe's law helps us predict future valuations based on the number of users in the network.

nydig.com/wp-content/upl…

14/

They say: #Bitcoin code can be forked 1000s of times and it’s easy to replicate its effects.

We say: Yeah — #Bitcoin open source code has been forked literally 100s of times and there are 10,000+ coins overall with various chains.

They say: #Bitcoin code can be forked 1000s of times and it’s easy to replicate its effects.

We say: Yeah — #Bitcoin open source code has been forked literally 100s of times and there are 10,000+ coins overall with various chains.

14b/

The code could be copied 1000s of times, the network built 1000s of times, but the network effects & adoption never carried over. BCH is literally 99.9% of the same code but runs on a larger block size, adoption of BCH is quite literally <2% of #Bitcoin adoption.

The code could be copied 1000s of times, the network built 1000s of times, but the network effects & adoption never carried over. BCH is literally 99.9% of the same code but runs on a larger block size, adoption of BCH is quite literally <2% of #Bitcoin adoption.

• • •

Missing some Tweet in this thread? You can try to

force a refresh