2) First, how have they (and others!) done recently?

Well, they're the yellow line. They had a mediocre Q3, but they're probably in line for a good Q4!

Well, they're the yellow line. They had a mediocre Q3, but they're probably in line for a good Q4!

3) So how did they do?

Well, they made $1.2b of revenue and $600m of EBITDA.

As always, that is nearly all retail; average retail fees were 1%. On the mobile app, average fees were probably higher, and that was probably where most of it came from.

Well, they made $1.2b of revenue and $600m of EBITDA.

As always, that is nearly all retail; average retail fees were 1%. On the mobile app, average fees were probably higher, and that was probably where most of it came from.

4) How about the other ~20% of their reveune?

Well, ~8% ($80m) came from 'blockchain rewards', which here mostly means staking revenue (e.g. ETH2).

But: they also booked $1978 of "transaction expenses", mostly from ETH2 staking.

Because it was *gross* revenue. Net was lower.

Well, ~8% ($80m) came from 'blockchain rewards', which here mostly means staking revenue (e.g. ETH2).

But: they also booked $1978 of "transaction expenses", mostly from ETH2 staking.

Because it was *gross* revenue. Net was lower.

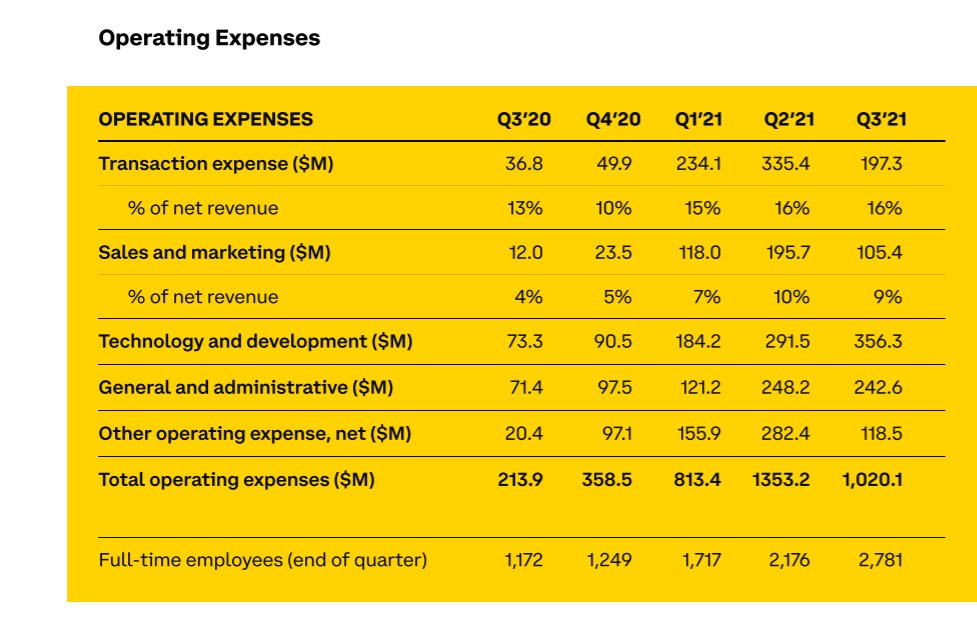

5) And the expenses?

They're paying ~$4b/year in expenses.

~60% of that is 'Tech' or 'G&A', both of which seem to probably most be headcount?

There are ~2.7k full-time employees, so ~$1m/year/FTE.

They're paying ~$4b/year in expenses.

~60% of that is 'Tech' or 'G&A', both of which seem to probably most be headcount?

There are ~2.7k full-time employees, so ~$1m/year/FTE.

6) But the most interesting is 'Other operating expenses', a cool $500m/year.

And those seem to be user compensation from downtime.

That's a lot of user compensation!

And those seem to be user compensation from downtime.

That's a lot of user compensation!

7) So, the TL;DR:

Coinbase is doing pretty well.

They made $600m EBITDA last quarter, and next quarter is likely to be higher.

Coinbase is doing pretty well.

They made $600m EBITDA last quarter, and next quarter is likely to be higher.

• • •

Missing some Tweet in this thread? You can try to

force a refresh