1/ Some quick takeaways from this morning's @NAC_Kazatomprom management call with new CEO Mr. Mazhit Sharipov. Note that due to the Russian to English translation, some of the transcript is choppy.

#uranium #nuclear #nuclearpower

kazatomprom.kz/en/media/view/…

#uranium #nuclear #nuclearpower

kazatomprom.kz/en/media/view/…

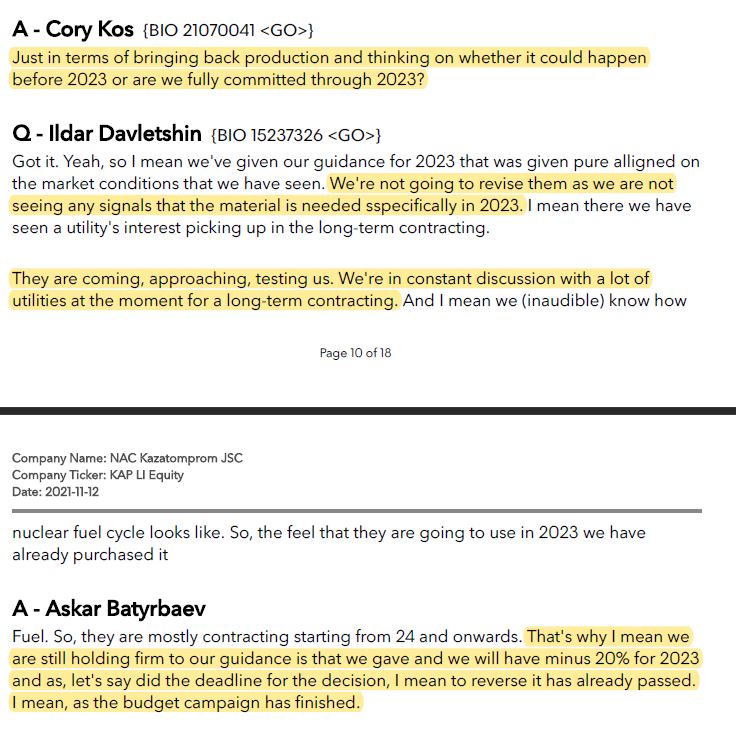

2/ First, the Sharipov opens by clearly stating that their strategy of value over volume will not change and cuts will continue as planned. They are also seeing supply chain impacts to their production and cost base. Also seeing tightening supply and increased customer interest.

3/ While not many details were disclosed on today's China term contract news, they remain comfortable with market related pricing today (i.e., remain bullish price). Will consider hybrid fixed / market contracts in future but need higher prices to make them comfortable

4/ Re: Anu physical fund - opportunity driven by investor interest outside the U.S. and Europe. Listing and buying strategy will be driven by manager - they are a passive investor. Storage will begin at existing converters (so doesn't seem connected to Alashankou at this stage)

5/ In response to repeated questions on bringing production back faster, management is clear that the ship has already sailed from a budgeting and operations standpoint. Currently focused on opportunities 2024+ and no decision made on that production yet.

6/ No plans to increase free float above 25%. Government views their investment as a strategic asset of the state. Does seem like they have worked on a western listing but are balancing cost and operational complexity of quarterly reporting. Seems like this is a work in progress.

7/ Overall a solid call from the new management team - continue to stay disciplined, focus on customers and execution. They understand supply and demand and remain leveraged to a improving market. They have a good handle on the macro and are focused on investor value creation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh