New @resfoundation analysis by @MikeBrewerEcon & @charliejmccurdy Post-furlough blues: What happened to furloughed workers after the end of the Job Retention Scheme? Highlights 🧵resolutionfoundation.org/publications/p…

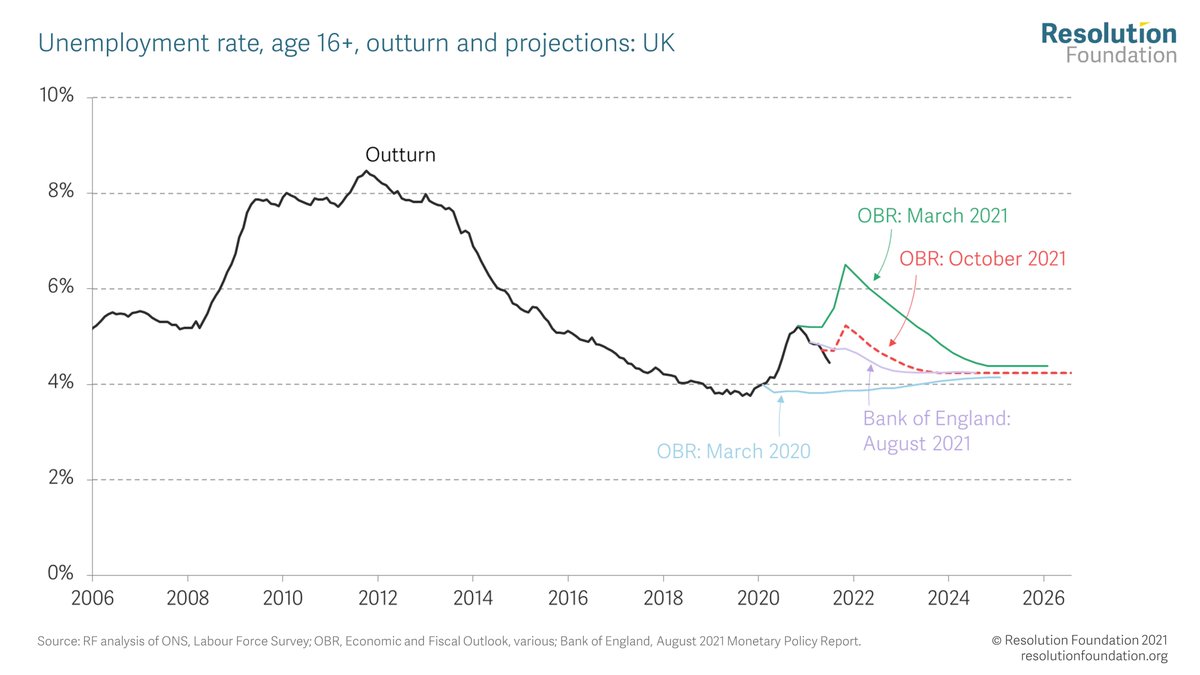

The context: the UK labour market is in a strong position, in terms of unemployment – it is both falling, and its peak has been revised down hugely by @OBR_UK

Still, when the Coronavirus Job Retention Scheme (JRS) closed on 30 September 2021 around 1.1 million employees were either fully or partially furloughed – particularly in sectors like aviation and among older aged workers.

Recent @ONS survey evidence – taken from businesses – suggests that post-furlough scheme 3 per cent of workers left voluntarily, and 3 per cent were made redundant.

A new RF survey overseen by @YouGov – the first of its kind collected from workers after the JRS scheme closed – suggests 88% of those furloughed in September were in work, but 12% (equivalent to 136,000 people) were jobless.

Why?

1) Lots of furloughed workers already had another job to return to.

2) 44 per cent of those on furlough in Sep were partially furloughed. They were no more likely to lose their job than those employed normally in Sep. Joblessness has been for the fully furloughed.

1) Lots of furloughed workers already had another job to return to.

2) 44 per cent of those on furlough in Sep were partially furloughed. They were no more likely to lose their job than those employed normally in Sep. Joblessness has been for the fully furloughed.

Summary: Job well done for the furlough scheme. While its closure saw higher job loss risks for some individual workers, it had little effect on overall unemployment.

We will publish further research on the UK's post-pandemic labour market on Tuesday 23rd November as part of The Economy 2030 Inquiry in collaboration with @CEP_LSE and funded by @NuffieldFound . Launch event details here resolutionfoundation.org/events/back-to…

• • •

Missing some Tweet in this thread? You can try to

force a refresh