The numbers are in for $PROG, and whooooooooo boy is it tilted as hell.

6 Million FTDs on 10/29, and we've been on the threshold list ever since 10/20. T+19 days.

$SPRT squeezed on T+21 days on threshold. Just saying.

This is gonna be a long DD thread. Fuckle the buck up.

6 Million FTDs on 10/29, and we've been on the threshold list ever since 10/20. T+19 days.

$SPRT squeezed on T+21 days on threshold. Just saying.

This is gonna be a long DD thread. Fuckle the buck up.

TL;DR: #SqueezePROG is looking bigger, badder, and more likely than ever.

First, covering the above screenshot, we see that SI% is 30% even after a net return of 2.13M shares today so far. Shorts are now fleeing the stock as we are running up towards $3.50.

First, covering the above screenshot, we see that SI% is 30% even after a net return of 2.13M shares today so far. Shorts are now fleeing the stock as we are running up towards $3.50.

If you missed the space call this morning, we talked about $3.50 and $4 being significant levels for us. $3.50 is the major resistance, but $4 is the target to trigger the gamma ramp toward $7.50, which is obviously what we'd all love to happen.

On the Options Chain today, we saw a drastic drop in Open Interest for ITM calls, but almost no volume. What could that possibly mean?

Exercising, baby.🏋️♀️

Almost all calls below $1.5 strike have been exercised early, which means we can expect those delivered by T+2 (Wed)

Exercising, baby.🏋️♀️

Almost all calls below $1.5 strike have been exercised early, which means we can expect those delivered by T+2 (Wed)

With those tendies safely secured, we still have 65,614 calls still ITM which have yet to be exercised, so bulls are waiting to see what the price does this week before deciding. Again, early exercising is good for the gamma, and only helps to #SqueezePROG

We still have 175,072 calls OTM on the options chain, which means some hedging has already taken place by buying-to-close or rolling calls to DEC and JAN expirations

Pretty much par for the course when it comes to options monthly expiration week.

Pretty much par for the course when it comes to options monthly expiration week.

Still, the gamma ramp is VERY much intact from $4 to $5, with $5.50 and $7.50 being a very solid "maybe" if we manage to threaten those levels of resistance.

It's going to be a bit questionable whether we touch these this week, but if we do, then shorts would be 500%+ underwater

It's going to be a bit questionable whether we touch these this week, but if we do, then shorts would be 500%+ underwater

Today's Short Volume data for $PROG:

Short Exempts: 161,467

Short Volume: 12,448,619

Total Volume: 26,189,683

Short Exempt Ratio: 1.3%~

Short Ratio: 47.5%

With 2.13M shares returned total, it's safe to say that shorts are definitely feeling a bit nervous now.

Short Exempts: 161,467

Short Volume: 12,448,619

Total Volume: 26,189,683

Short Exempt Ratio: 1.3%~

Short Ratio: 47.5%

With 2.13M shares returned total, it's safe to say that shorts are definitely feeling a bit nervous now.

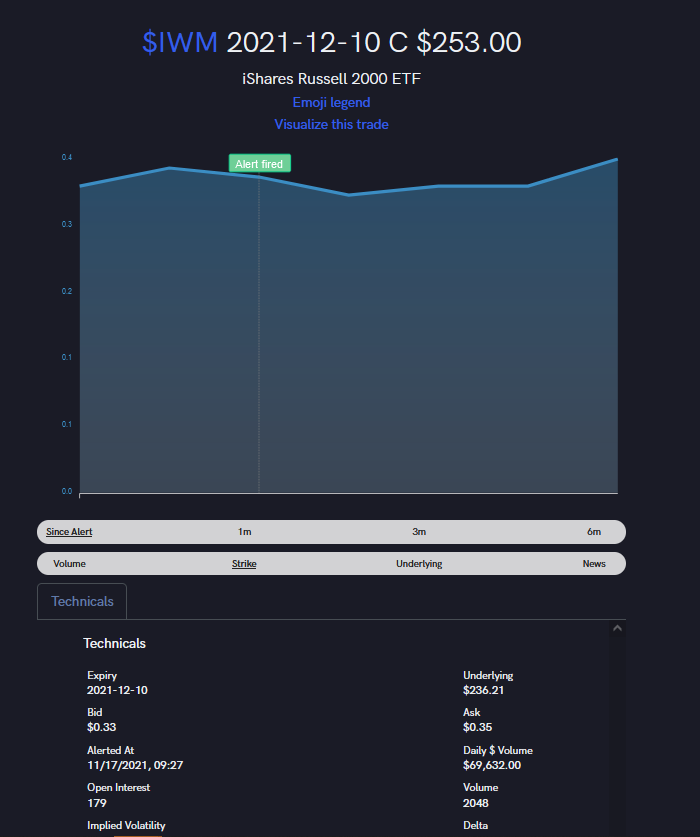

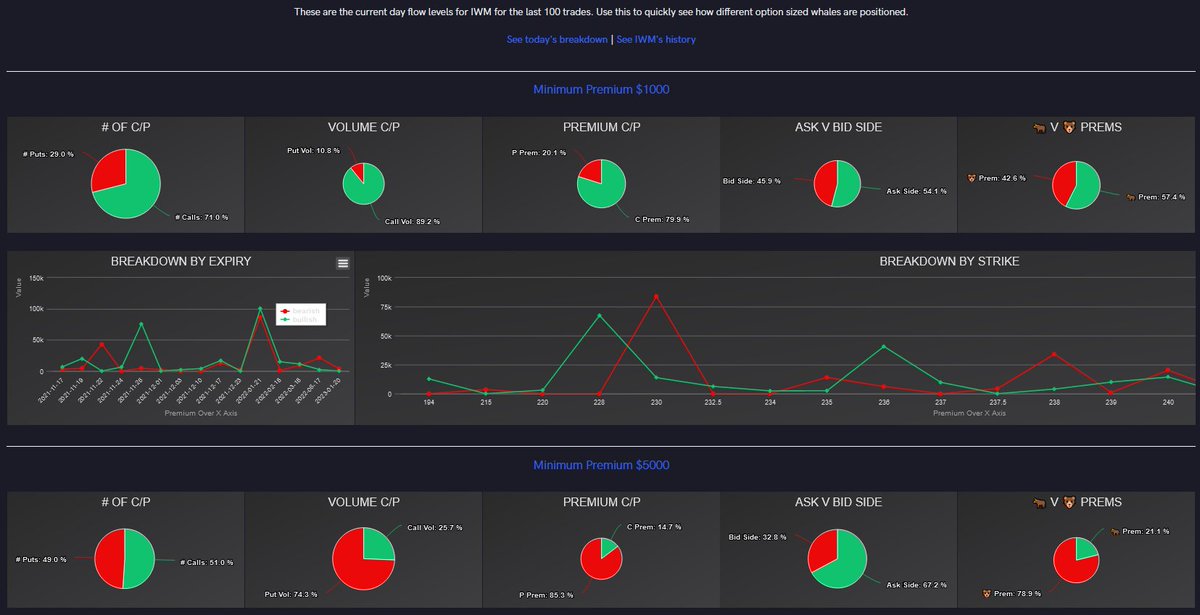

Moving onto the @unusual_whales flow, we see that

1. Calls make up 86% of the options chain.

2. Bulls make up 54% of premium

3. Bears/shorts have, in an effort to maintain a short position, bought puts against $7.5 for January

Something similar happened to GME and AMC in Jan...

1. Calls make up 86% of the options chain.

2. Bulls make up 54% of premium

3. Bears/shorts have, in an effort to maintain a short position, bought puts against $7.5 for January

Something similar happened to GME and AMC in Jan...

@AlderLaneeggs pointed out to me on a space call that shorts like Melvin Capital, when $GME ran out of shares to short and their shorts were underwater, they bought a ton of puts in order to continue shorting it, with the help of Citadel (supposedly) as the market maker.

When those puts ran OTM and started becoming dangrously close to worthless, shorts completely melted down, which may have contributed to (if not the direct cause) for the squeeze to begin.

$7.50 is that level to beat.

$7.50 is that level to beat.

This happened to $SPRT too, when the entire options chain ran in the money at $10 and the exchanges opened up the chain to $18 strikes. People bought $18 calls, and shorts bought $18 puts, and then the price went parabolic past $18. As soon as it did, the momentum was unstoppable

This can happen again, though it is far from certain, and I'm not even close to sure what price it would go to if it did happen. What I do know is this... If we break $7.50 before January 21, 2021, then $PROG shorts are absolutely hosed.

A LOT of FTDs are on the table, and $PROG is still on the threshold list for longer than T+13 days. This places any outstanding FTDs in the realm of forced closure / margin calls in the event of continued delivery failure.

Those 6M FTDs on 10/29 may or may not still be there...

Those 6M FTDs on 10/29 may or may not still be there...

... but with $PROG still being on the threshold list, and the stock price still holding strong above $3 tells me that there are probably a LOT of them at the very least, and shorts are scared of something.

The borrowed share returns alone say as much, but the FTDs say a lot more

The borrowed share returns alone say as much, but the FTDs say a lot more

I can't tell ya'll how excited I am for tomorrow. I'm fully loaded up. I bought early this morning and am ready to go.

Just want to say, no matter what happens tomorrow, I'm extremely proud to be part of this community, and what we're doing to change the markets.

Just want to say, no matter what happens tomorrow, I'm extremely proud to be part of this community, and what we're doing to change the markets.

I truly believe that what we're achieving here is a good and necessary thing to put financial freedom back into the hands of average retail investors, blue-collar workers, the average Joes and plain Janes.

We're changing lives and building futures here, and I'm proud of that.

We're changing lives and building futures here, and I'm proud of that.

I'm obviously bullish for the near future, but I still don't know what's gonna happen. Good luck to you all, and hopefully all the research and DD will pay off in the end.

Thanks for trusting, supporting, and believing in me and my research. It's beyond humbling.

Godspeed.

Thanks for trusting, supporting, and believing in me and my research. It's beyond humbling.

Godspeed.

@threadreaderapp If you could unroll this thread, that'd be amazing. Thanks. :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh