Peak earnings age stays almost constant at around 45-50 years old in the U.S.

but decreases sharply from 55 to around 35 years old in China over the last 40 years.

but decreases sharply from 55 to around 35 years old in China over the last 40 years.

https://twitter.com/ruima/status/1460679964676669442

Another way to look: life-cycle age-earnings cycle and see the extreme changes for China the last 60 years on how 35 becomes the new "golden age" or peaking earnings for Chinese males.

Job posts specifying age requirements are normal staples. e.g. this job post for China Life Insurance, title says age 25-45, inside post, actually says 22-35, but could be flexible up to 45.

jobs.51job.com/hangzhou-jgq/1…

jobs.51job.com/hangzhou-jgq/1…

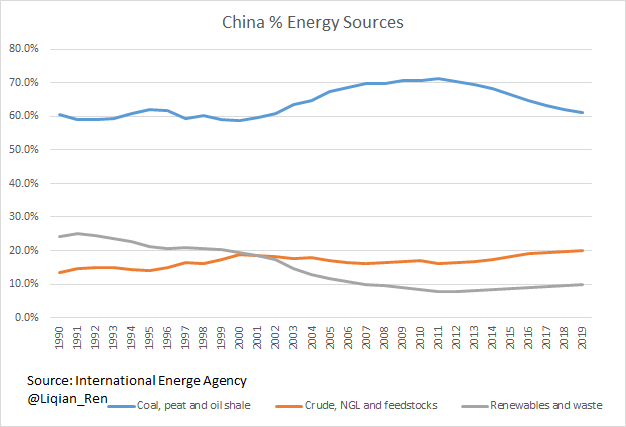

It's also likely that the decreasing peak earning age of 35 is on the cusp of being reversed, as Korean data showed increased of peaking earning age to about 45 the last 20 years.

conference.iza.org/conference_fil…

conference.iza.org/conference_fil…

Data is cohort study, meaning following the same group over time, thus no change in education.

Author: "suggests China has experienced a much larger inter-cohort productivity growth & increase in return to human capital vs. US, but return to experience is higher in the U.S."

Author: "suggests China has experienced a much larger inter-cohort productivity growth & increase in return to human capital vs. US, but return to experience is higher in the U.S."

• • •

Missing some Tweet in this thread? You can try to

force a refresh