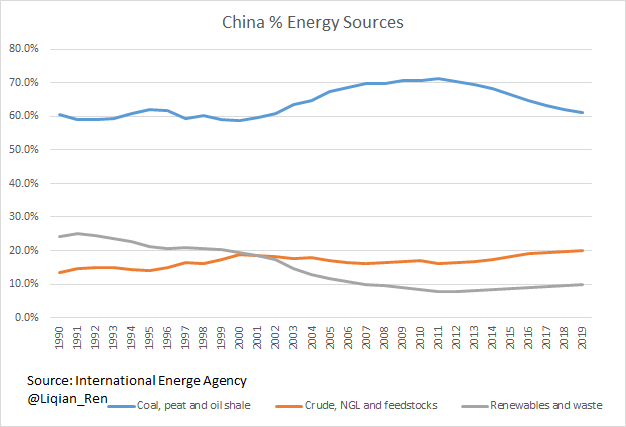

A thread: What is China’s energy import/export makeup? Have they historically been net importers? Starting in 2000s, as the economy grows, China becomes less energy dependent. 1/5

For total energy supply, both domestic and imports increased. China obviously likes to have some self-reliance, but it exports a lot, and imports a lot. It needs the world in many areas. The narrative of complete self-reliance is just narrative. 4/5

When push comes to shuffle, Coal imports <10% of Coal supply, is one energy resource China has most control, in production and domestic coal futures trading. Last few days it restricted financial speculation in onshore coal futures market which lead to coal price decline. 5/5

China becomes less energy independent over time, in 2019 with 1/4 energy supply imported. @Twitter when will you allow a word edit in a tweet?

@threadreaderapp unroll #China #Energy #import #domestic #production #crude #oil #NDRC #coal #futures #speculation

• • •

Missing some Tweet in this thread? You can try to

force a refresh