1. DingDing just put out a very long essay(in Chinese) on slowly improving China-US relationship. We talked on the difficulties of starting/running thinktank in China. Intl. Relations not an area of my research so my skepticism is qualified but here are some interesting charts.

https://twitter.com/ChenDingding/status/1452093867705057283

2. This chart illustrated the way Chinese experiences America differently from how Americans experience China, which is mainly brandless "made in China" goods.

Chinese didn't consume as much "made in America" goods as they buy more goods from American firms operating in China.

Chinese didn't consume as much "made in America" goods as they buy more goods from American firms operating in China.

3. As I have tweeted before on a China/India supermarket chain comparison, Walmart is the 4th largest supermarket chain in China. And this is true across many other industries where US firms have top brand recognition.

https://twitter.com/liqian_ren/status/1447276840628985860

4. And significant share of US firms are profitable in their Chinese business, with expectation of revenue increasing.

5. For all the politics behind the trade conflicts, the hard number negotiated is the best starting point.

The pandemic derailed many China imports but it is an area with hard numbers that Chinese effort can be assessed objectively as the world gets back to more normal.

The pandemic derailed many China imports but it is an area with hard numbers that Chinese effort can be assessed objectively as the world gets back to more normal.

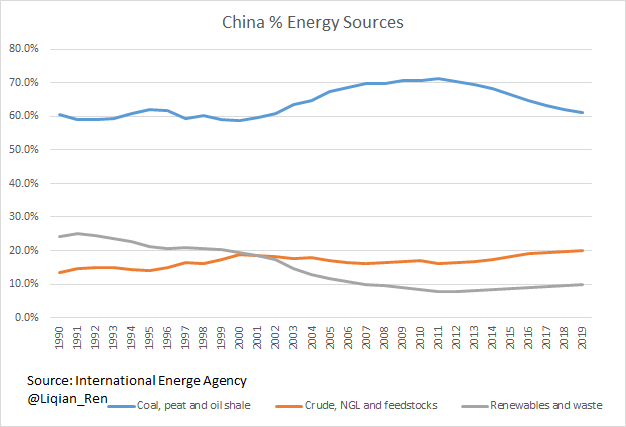

6. With Energy crunch in China, it is not hard to see China could ramp up energy imports. China is on track to hit target for farm imports.

Of course the chronic complaint of a Chinese businessman is they want to buy high-tech US manufactured goods but are not allowed.

Of course the chronic complaint of a Chinese businessman is they want to buy high-tech US manufactured goods but are not allowed.

7. I am open but not yet convinced that the relationship will get better. But several macro strategists we talked believe both US and China will grow with surprise on the positive side, with an investment race on, even if relationship didn't get better.

8. Where public opinion is a guide but fickle. Environmental regulations and taxes are two big complaints of Chinese businessmen I talked the last 5 years.

9. UBS forecast Q4 GDP 2.7%, Normura 3%. UBS 2020 forecast 5.6%, suggesting more on Q4 slow from supply chain/energy but back to trend growth in 2022.

A buy side economist joked Bloomberg is one of the top opposite signal. We'll find out in 6 months.

A buy side economist joked Bloomberg is one of the top opposite signal. We'll find out in 6 months.

https://twitter.com/next_china/status/1452025547807150081

• • •

Missing some Tweet in this thread? You can try to

force a refresh