🚨 China Is Stuck... Introducing "The Mundell-Fleming Trilemma"

Why are they banning #Bitcoin and #Crypto again?

A nation can keep only 2 of 3 Econ Policies at same time

1. a managed (fixed) currency

2. managed interest rates

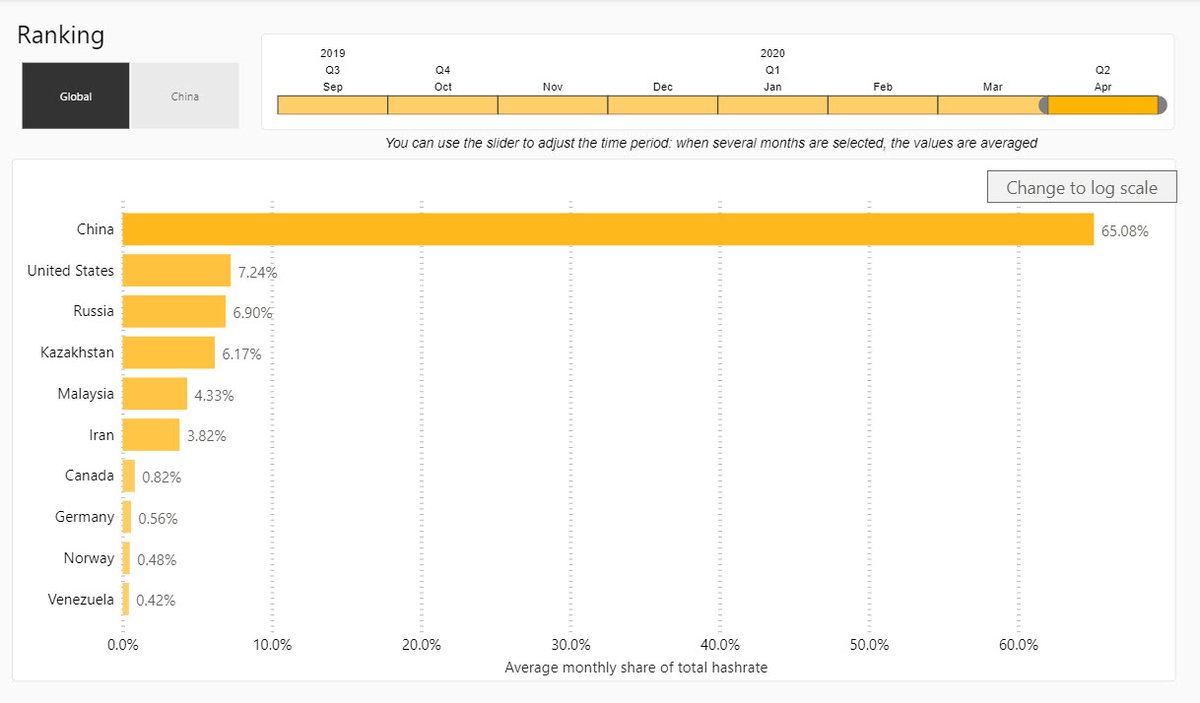

3. free capital flows with other nations

A Thread👇

Why are they banning #Bitcoin and #Crypto again?

A nation can keep only 2 of 3 Econ Policies at same time

1. a managed (fixed) currency

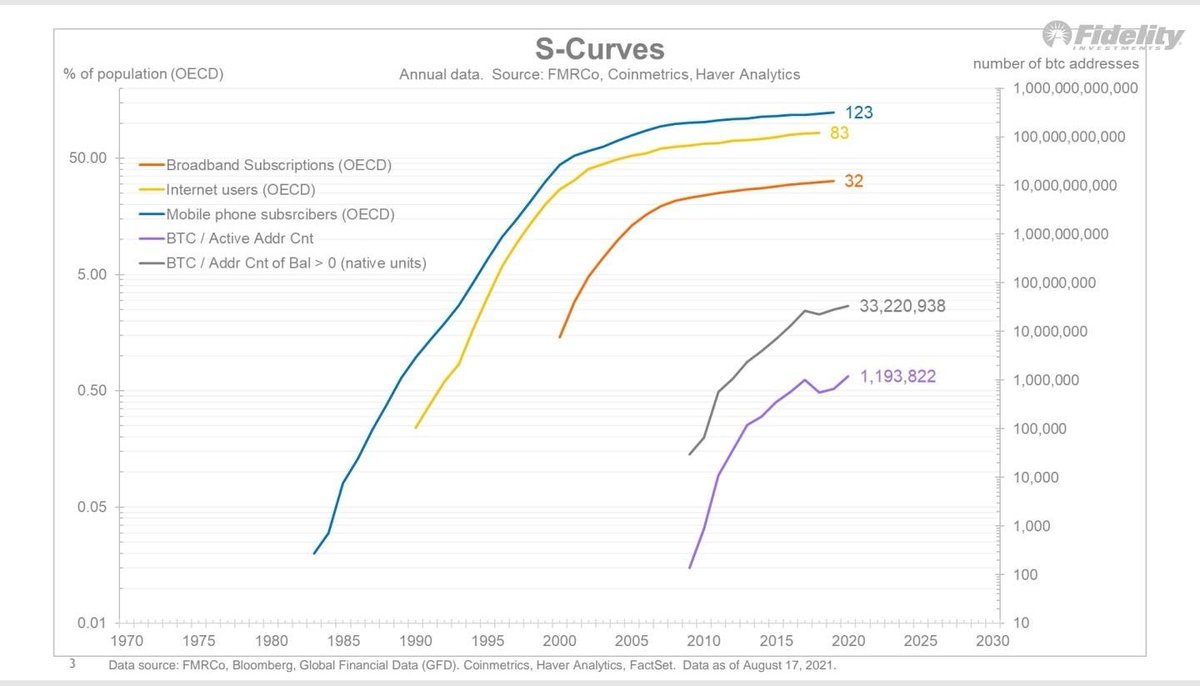

2. managed interest rates

3. free capital flows with other nations

A Thread👇

1/ Nations must choose. They can’t have the “good stuff” that evens out your economy (fixed currency and managed interest rates) and still have free-flowing capital in and out of the country. At some point, your policies will be at odds with the world

And that is now...

And that is now...

2/ when currency valuations and/or interest rates get out of whack, then capital will either:

- flow in so fast as to overwhelm the financial system - flow out so fast, sending economy to a death spiral.

History gives us examples, Asia in the 1990s

- flow in so fast as to overwhelm the financial system - flow out so fast, sending economy to a death spiral.

History gives us examples, Asia in the 1990s

3/ The Chinese want it all but, per the Trilemma, they can't have it all

When they manage their currency and interest rates and keep an iron grip on capital flows, this causes friction in their economy, because people and businesses WILL ALWAYS try to maximize their wealth...

When they manage their currency and interest rates and keep an iron grip on capital flows, this causes friction in their economy, because people and businesses WILL ALWAYS try to maximize their wealth...

4/ If you want to hedge your risk on the Chinese yuan losing value against the U.S.D, you're stuck, you can’t move your money to USD. This causes investors to become hesitant to put money into China, because they don't know if they can get it back out...

5/ This is why the Chinese are cracking down so hard on Crypto, which makes it easy for people and companies inside China to move wealth outside China, and the government cannot allow this, because it reduces their economic control.

6/It's not a coincidence China is doing this at the same time they are rolling out their digital renminbi (e-CNY), #CBDC which is controlled by the PBOC. They claim this is just like #Crypto but without "the risks" but of course, you can't move your e-CNY outside the countries...

7/ Now that you understand the Mundell-Fleming Trilemma, ask yourself, could this be coming to a country near you? To your own country?

The US Gov faces the same problem, "If a large number of people move to crypto, then central banks lose power over monetary policy"

The US Gov faces the same problem, "If a large number of people move to crypto, then central banks lose power over monetary policy"

8/ which of course is OUR point,

"Separate Money and State"

but of course, they don't want this

While I don't think we see the US Gov, Fed, ECB, try to outright "ban" Crypto as China did, they can do other things and most likely will...

"Separate Money and State"

but of course, they don't want this

While I don't think we see the US Gov, Fed, ECB, try to outright "ban" Crypto as China did, they can do other things and most likely will...

9/ We are already seeing the US Gov start to implement restrictions and overbearing tax policies to make crypto difficult and less appealing to some. But... this doesn't make Crypto less appealing, in fact, it has the opposite action as we have seen

10/ The more people are told they can't have control over their own wealth, money, sovereignty, the more they want it. So the harder a Gov tries to squeeze, the more the people will push into alternative ways to store wealth, like #Bitcoin and #Crypto

11/ This could lead nation-states to try to shut down Crypto as they have easy choke points with private companies, foundations, leaders, and centralized servers running on AWS. #Bitcoin is the only network without any of those issues and we can already see the US Gov, focusing..

12/ on all the other's, Stablecoins and Cryptos which they know they have the ability to choke off or control at the least.

What you store your wealth in matters, so choose wisely, as the Gov gets more restrictive, you need to move sooner than later

Please LIKE and RETWEET 🙏

What you store your wealth in matters, so choose wisely, as the Gov gets more restrictive, you need to move sooner than later

Please LIKE and RETWEET 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh