🚨My Prediction Of Global Energy Crisis Coming True

Energy prices are skyrocketing, shortages are happening all around the world… A year ago, I made a video predicting this, And, unfortunately, it is now!

How I was able to predict this and what comes next?

A Thread 👇

Energy prices are skyrocketing, shortages are happening all around the world… A year ago, I made a video predicting this, And, unfortunately, it is now!

How I was able to predict this and what comes next?

A Thread 👇

1/ Last year I made a video explaining how blackouts in CA were coming for the country and the world, the video has almost 3/4 mil views

How did I know it was coming for the world?

Because, the problems were caused by POLICY, and those same policies are now all over the world!

How did I know it was coming for the world?

Because, the problems were caused by POLICY, and those same policies are now all over the world!

2/ The EU leaders met with the UN last week, "doubling down" on their push to switch from Fossil Fuels to "Renewables"

British PM Boris Johnson said "UK will lead by example"

So let's look at the example the UK is setting and whats to come

British PM Boris Johnson said "UK will lead by example"

So let's look at the example the UK is setting and whats to come

3/ UK, like CA, been shutting down abundant energy sources. Shut down coal, nat gas, The plan, just get energy from France and move to wind. But... it hasn't been very windy this year, France hasn't had as much to spare, and now the UK is having serious problems, Nat Gas up 800%

4/ UK needs nat gas to run Elec Plants, prices sky-high has caused Elec prices up 300%, but worse, now lack of fertilizer, which creates Co2 needed for food production, shortages coming, and people will be freezing this winter

5/ This is being done by Choice / Policy.

Over last decade, UK & EU shot down 100's of coal plants, UK has only 2 remaining, Spain shut down half. Goals: 72% closed by 2025, 100% by 2031.

The EU spent Trillions subsidizing renewables

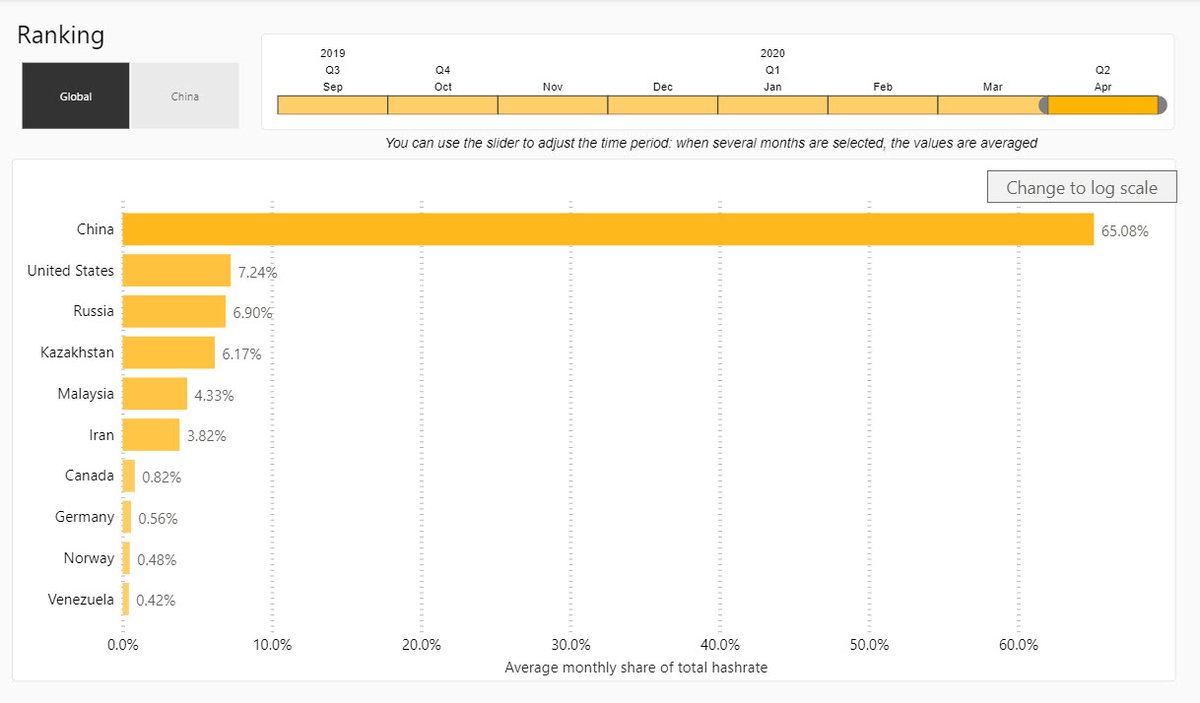

While, China, Asia, India, adding coal plants

Over last decade, UK & EU shot down 100's of coal plants, UK has only 2 remaining, Spain shut down half. Goals: 72% closed by 2025, 100% by 2031.

The EU spent Trillions subsidizing renewables

While, China, Asia, India, adding coal plants

6/ Problem: renewables haven't replaced what's lost, they are "un-reliable"

EU windmills didn't work, had low wind this year, Asia / S. Amer hydro didn't work, had droughts this year, un-reliables didn't produce enough

Reliable sources (nat gas, coal, nuclear) have been shut down

EU windmills didn't work, had low wind this year, Asia / S. Amer hydro didn't work, had droughts this year, un-reliables didn't produce enough

Reliable sources (nat gas, coal, nuclear) have been shut down

7/ More Policies Make It Worse!

EU's "cap-n-trade" forces suppliers to buy carbon credits to offset their energy production. Demand for these CC have spiked, regulators tightened supply, pushing production costs sky high, crumpling producers, and driving costs high for consumers

EU's "cap-n-trade" forces suppliers to buy carbon credits to offset their energy production. Demand for these CC have spiked, regulators tightened supply, pushing production costs sky high, crumpling producers, and driving costs high for consumers

8/ More Policies Make It Worse!

Nat gas is vital and is in short supply while massive gas shale resources go to waste! The Netherlands shut down EU's biggest field = 20% of production. UK and Germany banned fracking. So now EU has become dependant on Russia for nat gas

Nat gas is vital and is in short supply while massive gas shale resources go to waste! The Netherlands shut down EU's biggest field = 20% of production. UK and Germany banned fracking. So now EU has become dependant on Russia for nat gas

9/ The domino effect is now happening. Dozens UK elect providers collapsed over the last few weeks, also German energy producers going insolvent.

Germanys elec prices, already highest in EU have doubled again because of heavy reliance on un-reliables

Germanys elec prices, already highest in EU have doubled again because of heavy reliance on un-reliables

10/ Warning: "three day work week" coming, says Andrew Large, former UK energy advisor! Referring to coal and rail worker strike of 1974, causing the Gov to "ration" energy. This lead to energy shortages around the world, then lack of production, then supply shortages everywhere

11/ Supply chains already breaking down, this "policy-driven" energy crisis makes it much worse

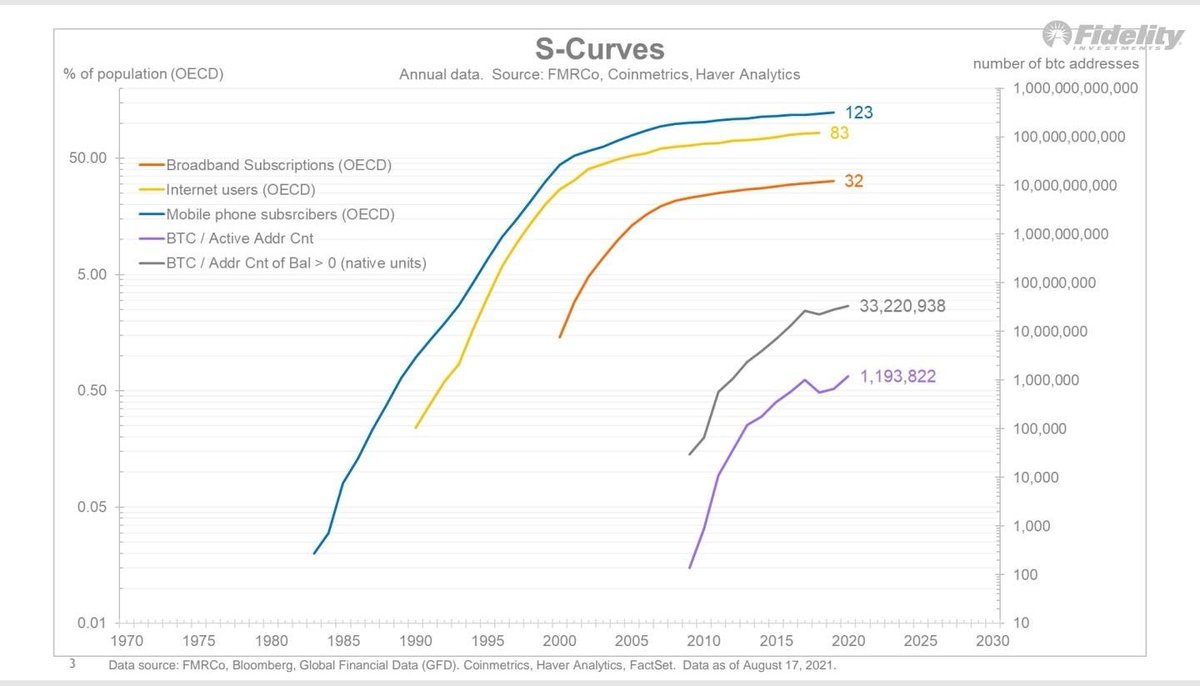

This energy crisis is caused by Central Planning. #Bitcoin is leading the decentralized revolution!

Please like and RT 🙏

Watch Vid 👇

This energy crisis is caused by Central Planning. #Bitcoin is leading the decentralized revolution!

Please like and RT 🙏

Watch Vid 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh