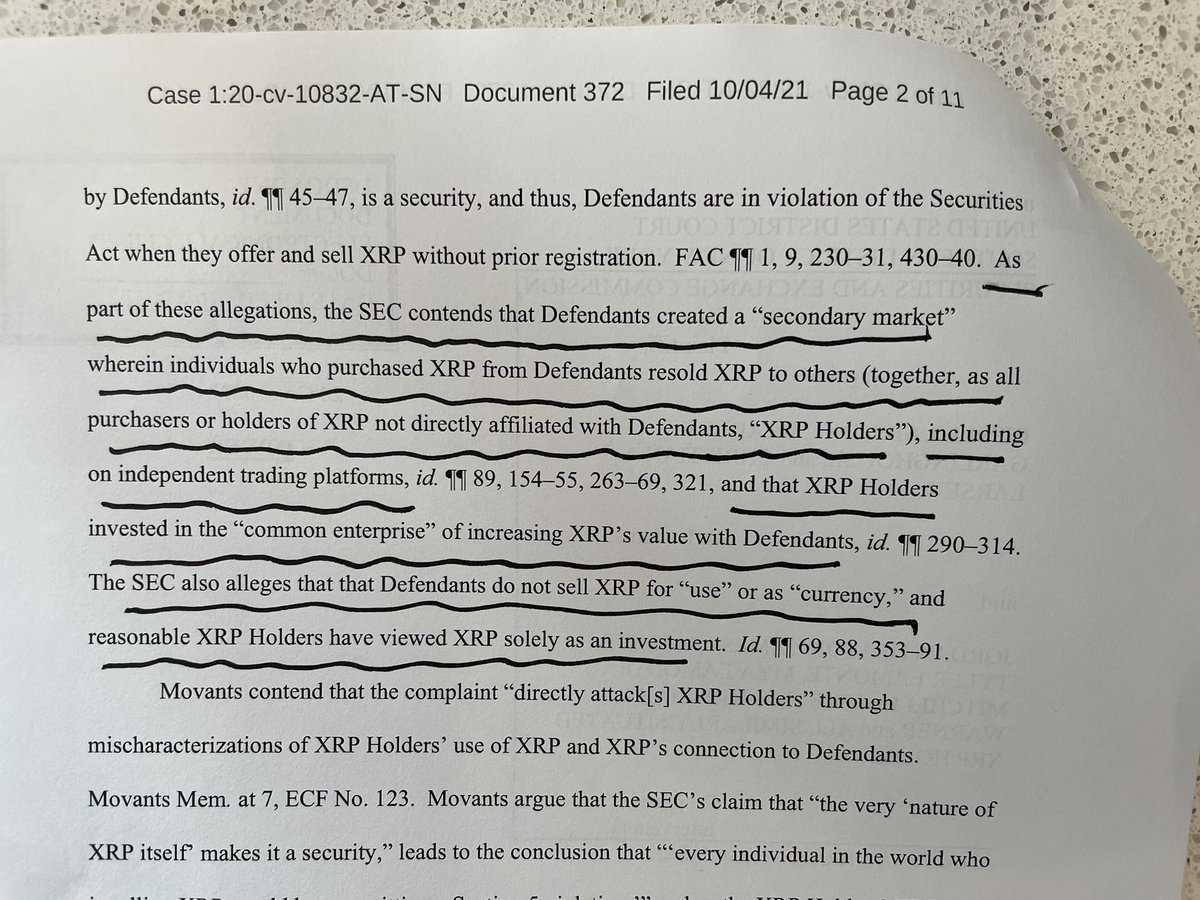

The @SECGov’s argument that all XRP, even XRP traded in the secondary market, are unregistered securities, is simply unconscionable. #XRPHolders’ brief will include statements and admissions made by the SEC itself supporting #XRPHolders’ position.

For example, take the infamous Hinman Speech itself. Read what’s said almost immediately:

“To start, we should frame the question differently and focus not on the digital asset itself, but on the circumstances surrounding the digital asset and the manner in which it is sold.”

“To start, we should frame the question differently and focus not on the digital asset itself, but on the circumstances surrounding the digital asset and the manner in which it is sold.”

To start, he says don’t focus on the Token itself. He goes further:

“Returning to the ICOs I am seeing, strictly speaking, the token – or coin or whatever the digital information packet is called – all by itself is not a security, just as the orange groves in Howey were not.”

“Returning to the ICOs I am seeing, strictly speaking, the token – or coin or whatever the digital information packet is called – all by itself is not a security, just as the orange groves in Howey were not.”

If the orange groves weren’t securities, then the oranges 🍊 certainly weren’t securities either.

Hinman also explains:

“Central to determining whether a security is being sold is how it is being sold and the reasonable expectations of purchasers.”

Hinman also explains:

“Central to determining whether a security is being sold is how it is being sold and the reasonable expectations of purchasers.”

That’s why #XRPHolders perspective is so critical and why we needed amicus status granted in this case. Who better to discuss what #XRPHolders’ expectations were when acquiring #XRP?

Hinman made it crystal clear:

“The digital asset itself is simply code.”

Hinman made it crystal clear:

“The digital asset itself is simply code.”

“But the way it is sold – as part of an investment; to non-users; by promoters to develop the enterprise – can be, and, in that context, most often is, a security – because it evidences an investment contract.”

A significant percentage of #XRPHolders are users of the network.

A significant percentage of #XRPHolders are users of the network.

The 61K XRPHolders I represent did not buy XRP from the promoters (@Ripple). Finally, the 💰 we used to purchase XRP didn’t go to develop the enterprise (XRPL already built).

There is much more in that speech that proves what the SEC is alleging related to XRP is in bad faith.

There is much more in that speech that proves what the SEC is alleging related to XRP is in bad faith.

Statements by Clayton will be used as well. In his March 7, 2019 letter to Congressman Budd, Clayton writes:

“I agree that the analysis of whether a digital asset is offered or sold as a security is not static and does not strictly inhere to the instrument.”

Shame on the SEC.

“I agree that the analysis of whether a digital asset is offered or sold as a security is not static and does not strictly inhere to the instrument.”

Shame on the SEC.

• • •

Missing some Tweet in this thread? You can try to

force a refresh