COMMON SENSE EVIDENCE THE SEC LAWSUIT WAS USED AS A WEAPON

On the last day in power, you file a lawsuit against the #1 competitor of your law firm’s significant client;

You don’t limit the allegations to include only what you can actually prove (early & specific distributions);

On the last day in power, you file a lawsuit against the #1 competitor of your law firm’s significant client;

You don’t limit the allegations to include only what you can actually prove (early & specific distributions);

https://twitter.com/johnedeaton1/status/1462052858099126273

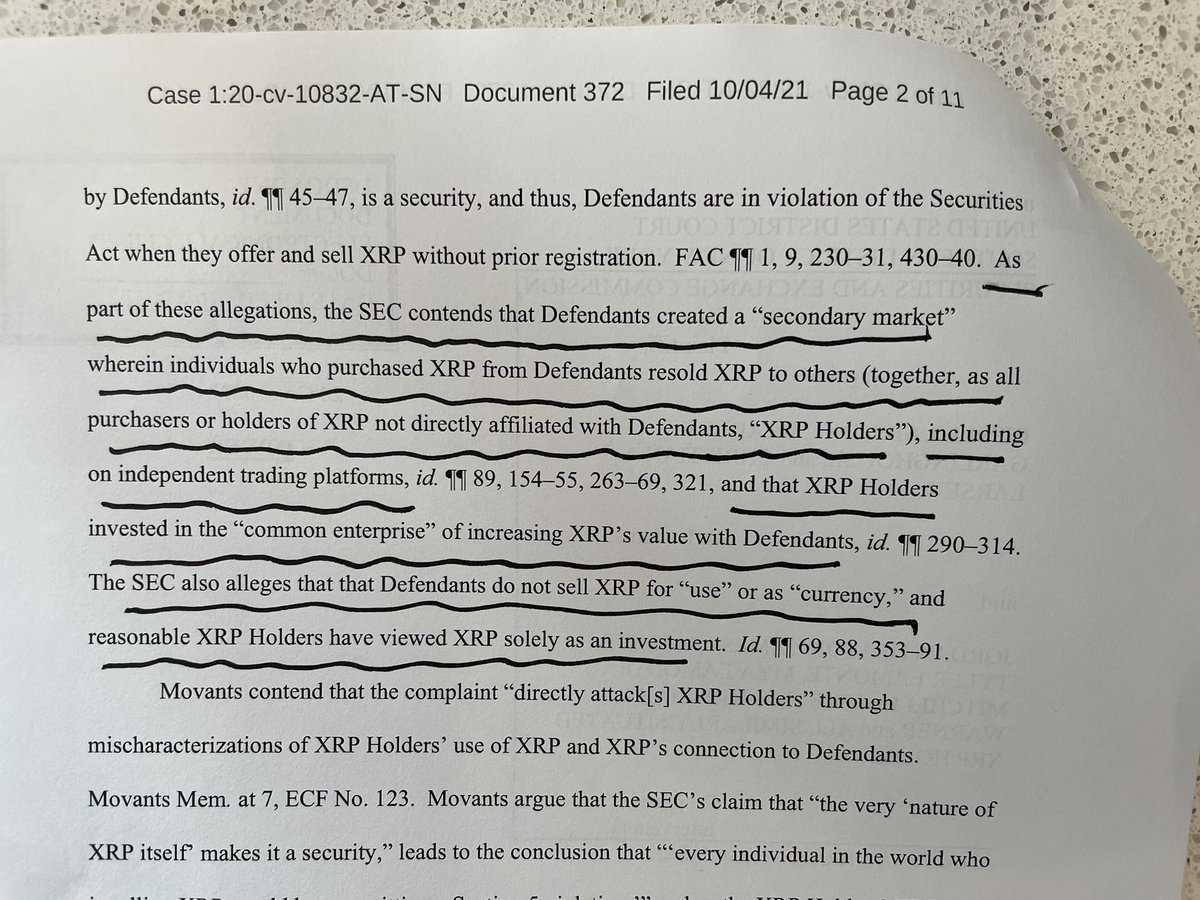

Instead, you inflict the most damage possible against the competition by alleging all XRP are securities;

Even though you claim all XRP are securities w/o utility, you don’t seek an injunction like you have previously, b/c you know it will expedite the case and you will lose;

Even though you claim all XRP are securities w/o utility, you don’t seek an injunction like you have previously, b/c you know it will expedite the case and you will lose;

If all XRP are securities, as alleged, why has Ripple been allowed to continue to sell XRP - which includes selling XRP to pay legal fees to defend the lawsuit;

Why is the cofounder allowed to sell $2.6B worth of XRP since the lawsuit was filed (2x what the SEC seeks 🆚 Ripple);

Why is the cofounder allowed to sell $2.6B worth of XRP since the lawsuit was filed (2x what the SEC seeks 🆚 Ripple);

After filing the most significant SEC enforcement action in modern history, the top people leave the SEC - the Chairman, the Director of Corporation Finance, and the Director of Enforcement;

Several weeks later, the Chairman goes to a $1B #BTC & #ETH fund;

Several weeks later, the Chairman goes to a $1B #BTC & #ETH fund;

The Director of Corporation Finance goes to the world’s largest $2.2B crypto fund led by the investors who helped ✍️ the ETH free pass speech;

The Enforcement Director goes to the law firm that promotes ALL enterprise applications be developed on the Ethereum Blockchain;

The Enforcement Director goes to the law firm that promotes ALL enterprise applications be developed on the Ethereum Blockchain;

Later, we find out that the person who gave the regulatory free pass to Ether, was paid $15m, while at the SEC, from the same law firm that promotes ALL enterprise applications on the Ethereum Blockchain;

We find out this person didn’t actually ✍️ the free pass speech himself;

We find out this person didn’t actually ✍️ the free pass speech himself;

We learn Ether investors helped ✍️ the speech;

We learn the only SEC commissioner to read the speech before publishing is the Chairman, who’s law firm is representing the cofounder of Ethereum and founder of ConsenSys which just happened to buy Quorum - a competitor of Ripple;

We learn the only SEC commissioner to read the speech before publishing is the Chairman, who’s law firm is representing the cofounder of Ethereum and founder of ConsenSys which just happened to buy Quorum - a competitor of Ripple;

We learn that Crypto-Mom, @HesterPeirce, who wrote and promoted a proposed SEC Safe Harbor Provision, wasn’t even included in the drafting of the free pass speech or in reviewing a Safe Harbor Proposal offered by the Ether investors; 🤔

We learn that two weeks before the lawsuit was filed, Clayton received a grave ⚠️ warning ⛔️ from a former SEC Chief who informed Clayton that no exigency existed that would justify filing a lawsuit as he walked out the door - less than 30 days from a new administration;

This former SEC Chief warned Clayton that innocent investors with no connection to Ripple would lose multiple billions of dollars;

He made clear that the SEC has made no material distinction between Ether and XRP and filing the case would call into question the SEC’s MOTIVE;

He made clear that the SEC has made no material distinction between Ether and XRP and filing the case would call into question the SEC’s MOTIVE;

We know the SEC and the players involved have refused to answer any questions posed by @CGasparino @EleanorTerrett & @LizClaman all of whom have given them all the benefit of the doubt;

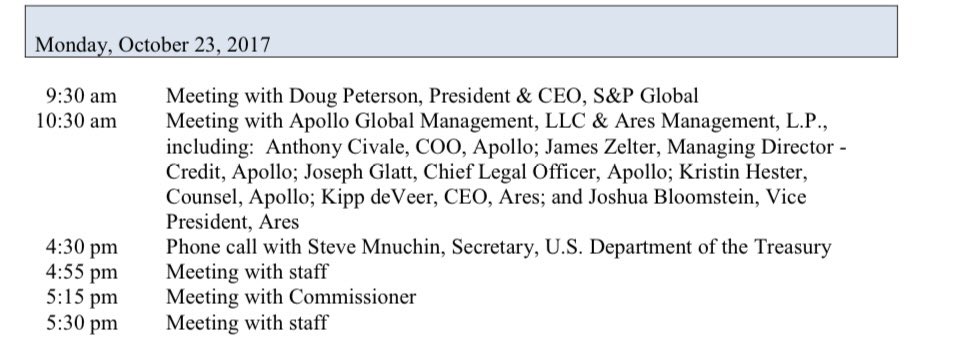

Incredibly, the only comment made was a self-serving denial of any conflicts of interests based on Clayton’s claim that he hadn’t met any of his post-SEC employers until after he left the SEC - a statement that is demonstrably FALSE.👇

https://twitter.com/JohnEDeaton1/status/1460718625233461248

There’s so much more but the above facts alone show that the filing of this lawsuit wasn’t about enforcing securities laws. If enforcing securities laws were the true motive then the allegations would’ve been tailored to specific sales by Ripple during specific transactions.

Former SEC Chief Joseph Grundfest stated himself that if Clayton and the SEC filed the case against Ripple AND XRP - considering it gave Ether a regulatory free pass - would “call into question the Commission’s exercise of discretion.”

That means THE MOTIVE behind the lawsuit!

That means THE MOTIVE behind the lawsuit!

During this case, SEC attorneys have argued the motive behind the filing of the lawsuit is irrelevant. Yet, before Deaton or @digitalassetbuy or others raised the issue of MOTIVE, Grundfest did.

61K #XRPHolders disagree motives’ irrelevant b/c the facts are indisputable.👇

61K #XRPHolders disagree motives’ irrelevant b/c the facts are indisputable.👇

https://twitter.com/johnedeaton1/status/1447400529534066692

• • •

Missing some Tweet in this thread? You can try to

force a refresh