(Thread) Trading Ratio Spreads (Part 2)

The main bit!

I’ll mostly focus on credit put ratio spread in this thread.

(yesterday's thread below for linking both)

First let's look at best time to enter the trade.

+

The main bit!

I’ll mostly focus on credit put ratio spread in this thread.

(yesterday's thread below for linking both)

First let's look at best time to enter the trade.

+

https://twitter.com/muskk/status/1462086837938184193?s=20

Trade entry point: Two scenarios. One safe and one aggressive. See pic below (pasting pic to reduce length of this thread).

https://twitter.com/muskk/status/1457215816894582785?s=20

Once we enter, how does the price of PRS behave?

Let’s focus on expiry trading as this is the easier bit compared to trading them on other days or entering positional (which I'll cover in future posts).

First let me quickly mention what I did last Thursday.

+

Let’s focus on expiry trading as this is the easier bit compared to trading them on other days or entering positional (which I'll cover in future posts).

First let me quickly mention what I did last Thursday.

+

I started off with Bnf 37800pe-37500pe PRS at 1:4 & Nifty CRS expecting Bnf to make a recovery or atleast outperform Nifty. Bnf didn’t quite behave as expected first half so reduced that ratio to 1:2 and shifted down puts to 37300pe (1:5 with 37800) i.e. changed it to a ladder

+

+

For a PRS let’s see how PnL would’ve behaved over the day.

Fig below shows how price of a PRS evolves with time to expiry. When we enter a credit PRS, the entry price is negative (below the x-axis in the pic) and later on depending on the price being above or below this level +

Fig below shows how price of a PRS evolves with time to expiry. When we enter a credit PRS, the entry price is negative (below the x-axis in the pic) and later on depending on the price being above or below this level +

we are in a profit or a loss on the trade (obviously!)

Let’s say we enter a 1:3 PRS on BNF with the long put at the money (K1) and short puts out of the money (K2). Let’s say overall delta is slightly positive and we collect a credit. How does PnL evolve?

+

Let’s say we enter a 1:3 PRS on BNF with the long put at the money (K1) and short puts out of the money (K2). Let’s say overall delta is slightly positive and we collect a credit. How does PnL evolve?

+

Refer pic below. Purple lines are profits made with Bnf staying flat or around the level after entry ending up just collecting premium at expiry. Red lines are losses if Bnf moves down much further.

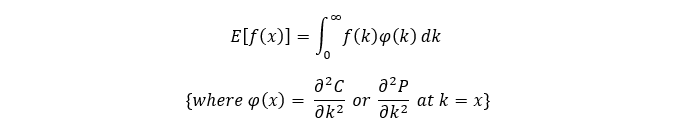

What is driving the Pnl?

+

What is driving the Pnl?

+

Let’s look at the different components driving the PnL. See pic below (pasting pic to reduce length of this thread)

+

+

Hence, if Bnf remains flat and delta turns slight negative we can add more shorts to make it delta neutral or if Bnf keeps moving up we can book profits on the whole position and shift the PRS up and maintain a delta neutral position (I prefer not to make the new position

+

+

delta positive again as that might be too aggressive). Important to maintain the same “range” as earlier till first half. Range can be reduced as we are closer to expiry.

And what if Bnf keeps moving down? Keep shifting short puts into lower strikes (not all at once) and

+

And what if Bnf keeps moving down? Keep shifting short puts into lower strikes (not all at once) and

+

create a ladder(ratios with shorts at multiple strikes). I suggest against shifting the long put down! Why? With market going down and position making a loss prudent to accept the bearish sentiment & make delta slightly negative overall and staying in the long put does that.

+

+

One can adjust delta to neutral if index stabilizes. If index keeps going down one can further defend the position by:

Making position delta negative or turning it into a put spread OR

Make it an asymmetrical fly by buying further away OTM puts (say 100 away from K2)

+

Making position delta negative or turning it into a put spread OR

Make it an asymmetrical fly by buying further away OTM puts (say 100 away from K2)

+

Stop-Losses- Can be placed more conservatively compared to what one places on the put leg of a short strangle. This is due to the long option leg present as an “upfront” hedge.

Ok expiry case done!

Finally, the best scenario to trade RS!

See pic below

+

Ok expiry case done!

Finally, the best scenario to trade RS!

See pic below

+

https://twitter.com/muskk/status/1452503660294852608?s=20

In a follow up thread in the future (not anytime soon!!), I’ll discuss trading RS (incl. CRS) on non-expiry days which is a little challenging & very interesting given vol comes into play.

(END)

(END)

• • •

Missing some Tweet in this thread? You can try to

force a refresh