1/ The US dollar index is ripping higher. Some people are worried that this is bad news for #Bitcoin.

Don’t. There is no direct relationship between the DXY and BTC.

Quick 🧵

Don’t. There is no direct relationship between the DXY and BTC.

Quick 🧵

2/ The US dollar index is a weighted average of the exchange rates between the USD and the currencies of some selected trading partners.

3/ The composition of this weighted average is:

🟠 57.6% EUR

🟠 13.6% JPY

🟠 11.9% GBP

🟠 9.1% CAD

🟠 4.2% SEK

🟠 3.6% CHF

I don’t see no #BTC in there.

🟠 57.6% EUR

🟠 13.6% JPY

🟠 11.9% GBP

🟠 9.1% CAD

🟠 4.2% SEK

🟠 3.6% CHF

I don’t see no #BTC in there.

4/ The point of the DXY is that it reflects the relative strength of the USD with respect to other currencies.

This strength is based on differential monetary policies, relative deficits, trade balance and so on.

This strength is based on differential monetary policies, relative deficits, trade balance and so on.

5/ E.g. the big move from 80 to 95 that started around 2014 was largely driven by the big difference in the monetary policies of the ECB vs the Fed at the time.

6/ So the factors affecting changes in the US dollar index are pretty far removed from what’s driving the value of Bitcoin.

7/ There could be secondary mechanisms that would make BTC and the DXY somehow anti-correlated.

For the most part Bitcoin exchanges operate with stablecoins that are stable with respect to the USD...

For the most part Bitcoin exchanges operate with stablecoins that are stable with respect to the USD...

8/ ... so you could argue there is something to do with non US actors being influenced by the strength of the dollar in their trading behaviour.

But honestly I can’t come up with anything convincing.

But honestly I can’t come up with anything convincing.

9/ And actually if you stare long enough at the chart below, there does not seem to be any consistent correlation between trends in the DXY and trends in BTC.

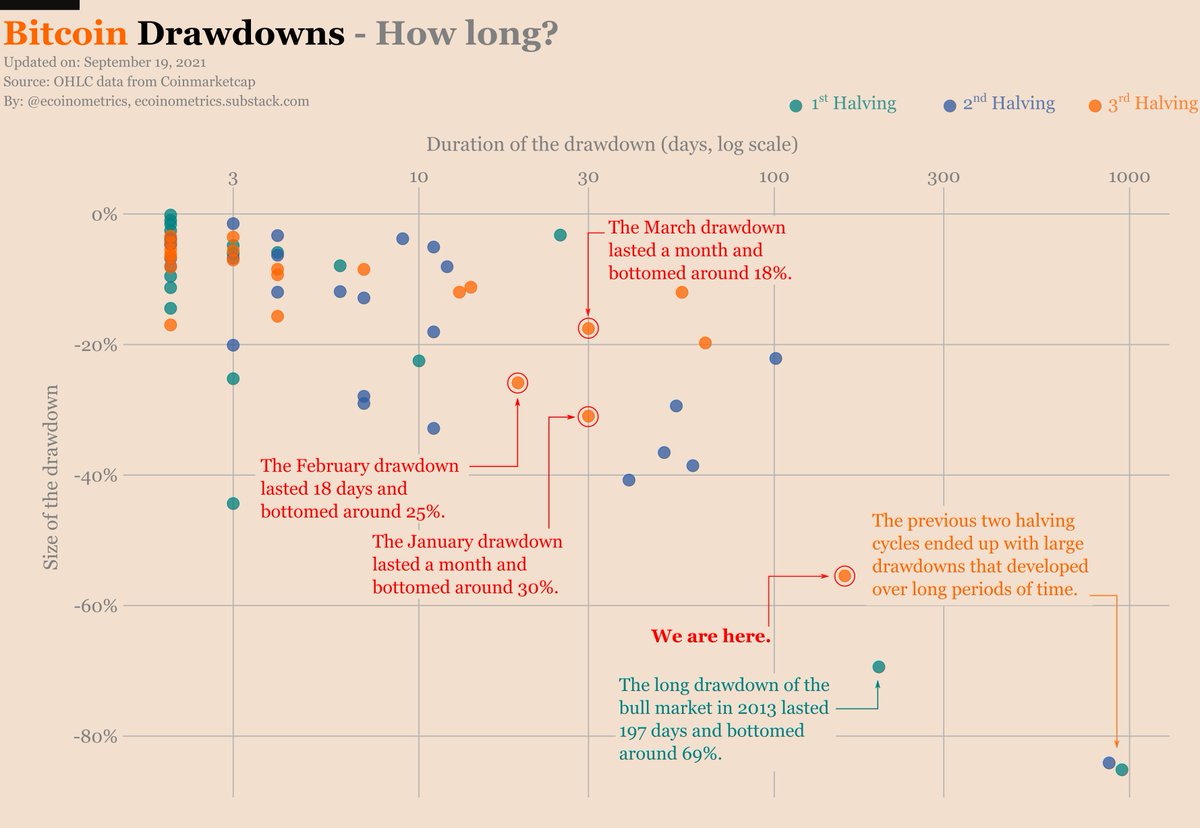

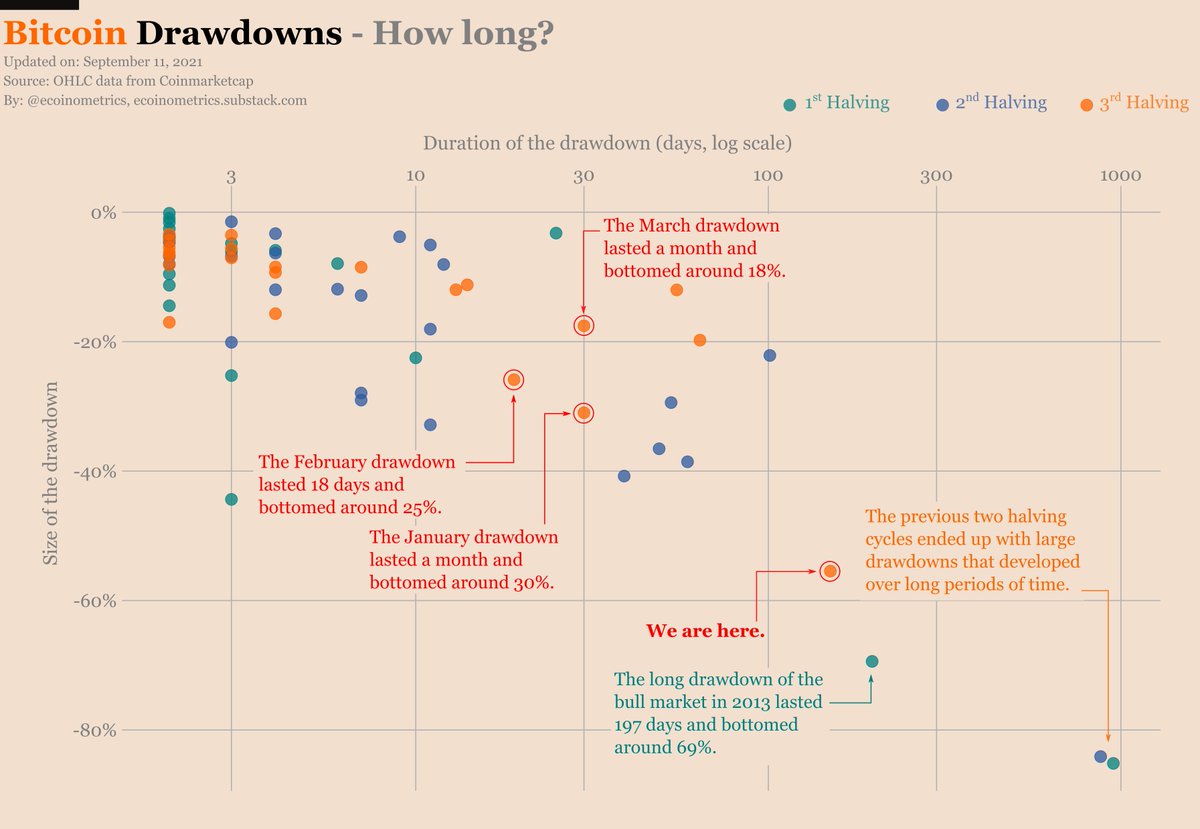

10/ So at best the US dollar index is a secondary driver for BTC/USD and not something to be worried about compared to say:

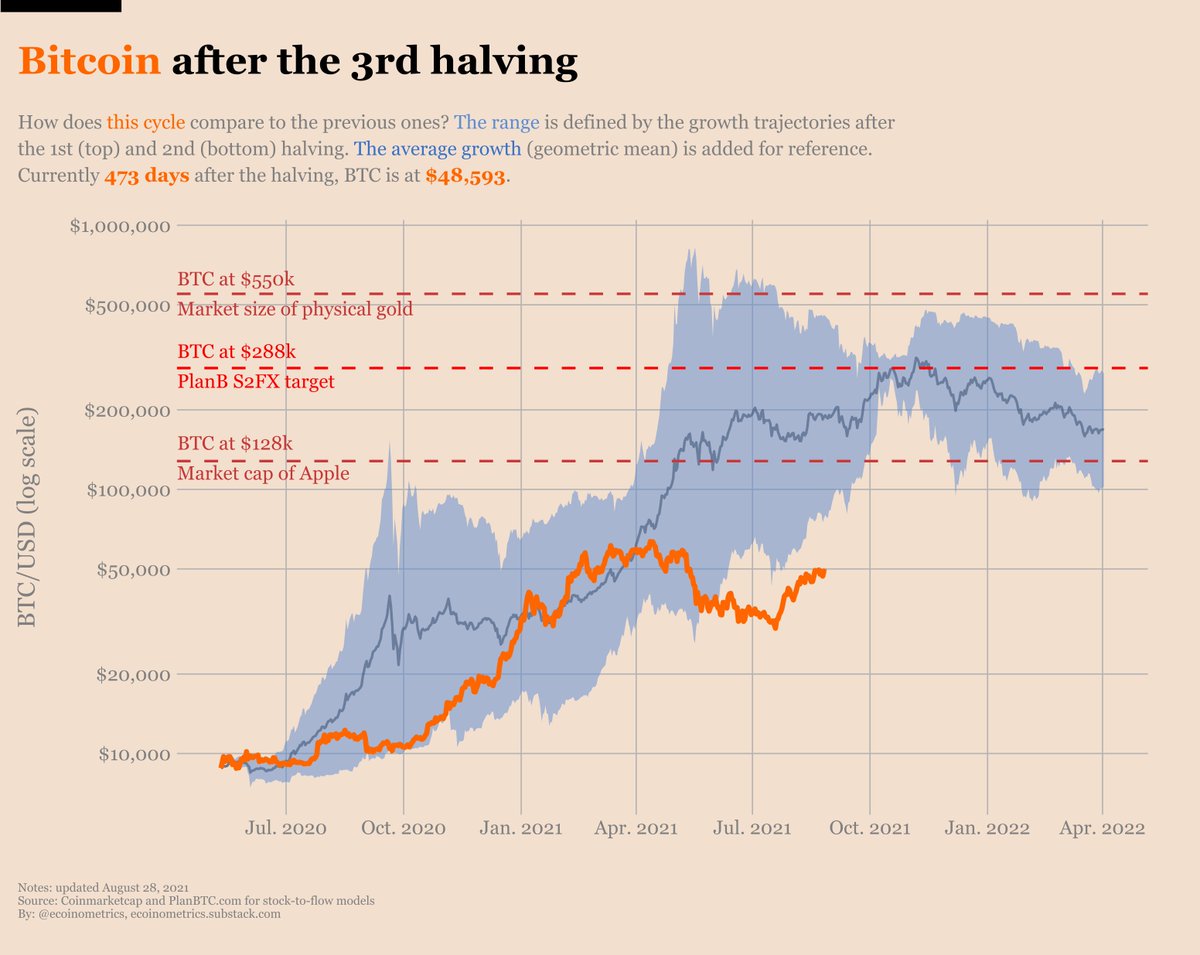

🟠 The supply shock.

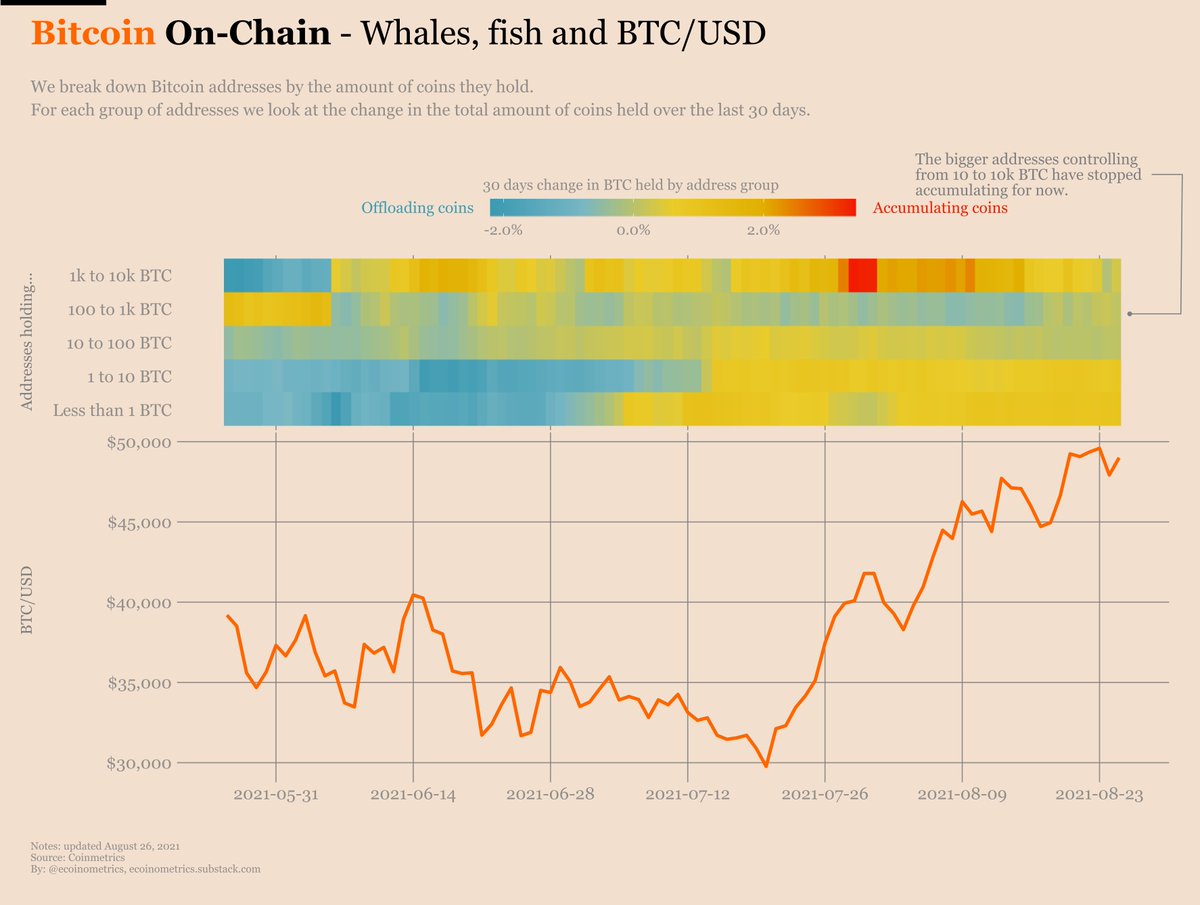

🟠 Whales making moves.

🟠 The amount of leverage in the market.

🟠 ...

🟠 The supply shock.

🟠 Whales making moves.

🟠 The amount of leverage in the market.

🟠 ...

END/ So that’s it. If you want more macro analysis on Bitcoin and digital assets then go checkout the newsletter, I write about these topics twice a week 👇

ecoinometrics.substack.com/p/ecoinometric…

ecoinometrics.substack.com/p/ecoinometric…

• • •

Missing some Tweet in this thread? You can try to

force a refresh