#Bitcoin after the Halving

Sep. 11, 2021

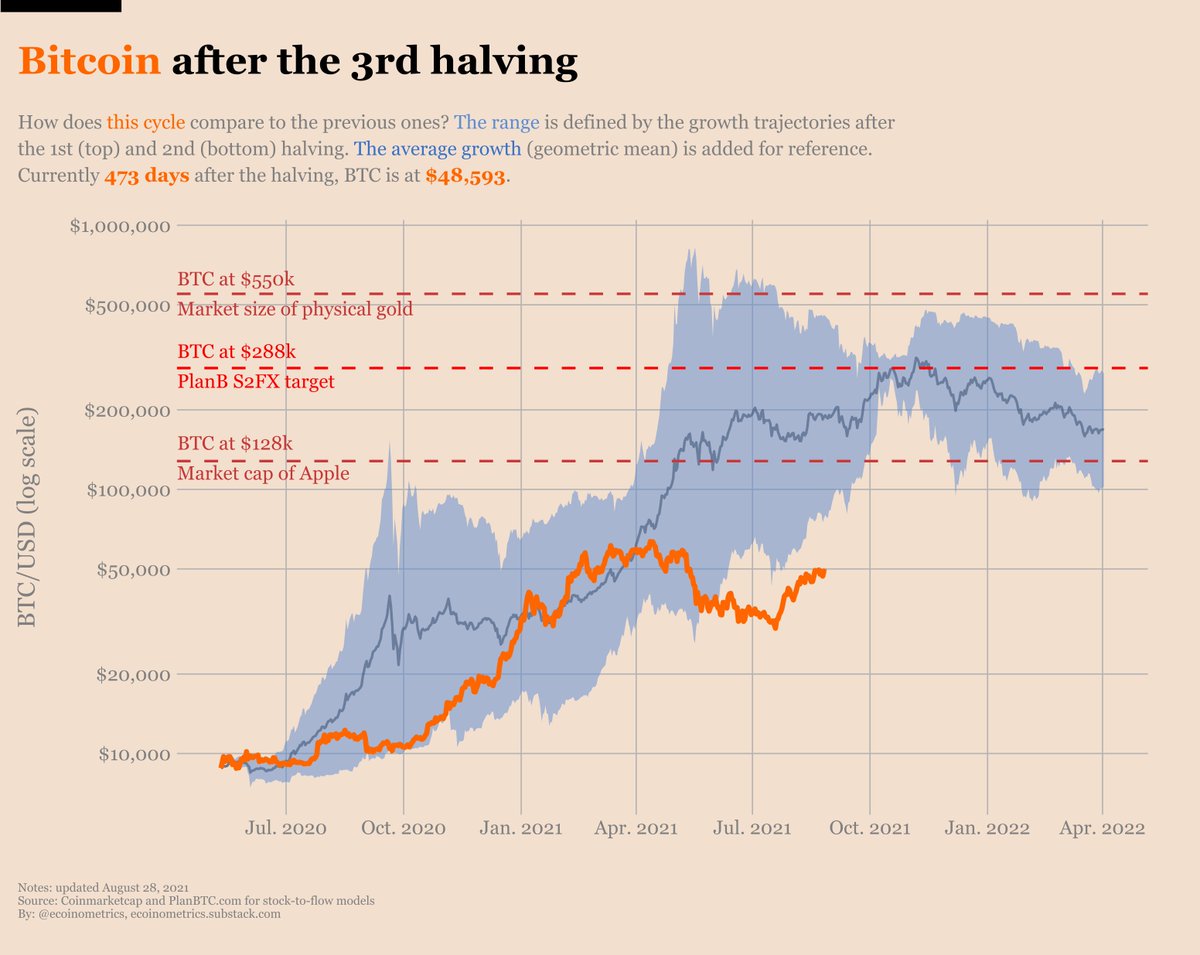

487 days after the 3rd halving

#BTC at $45,596

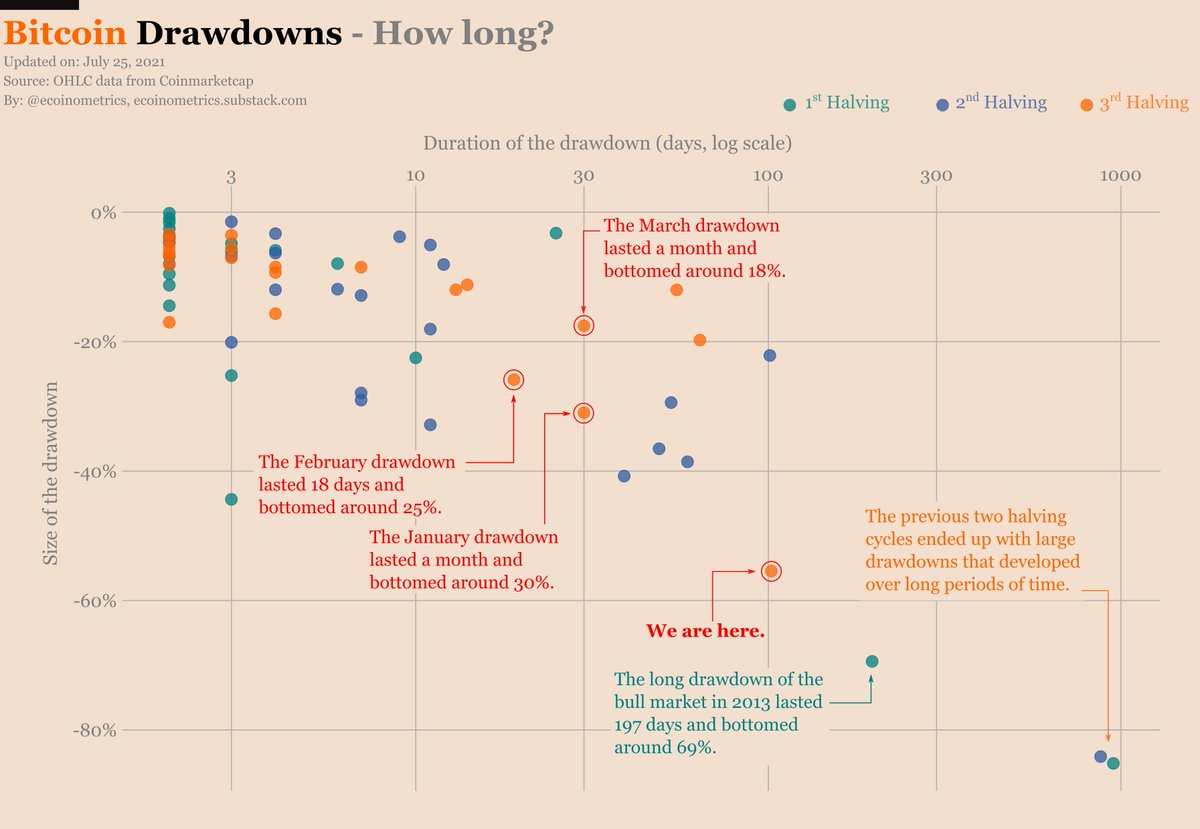

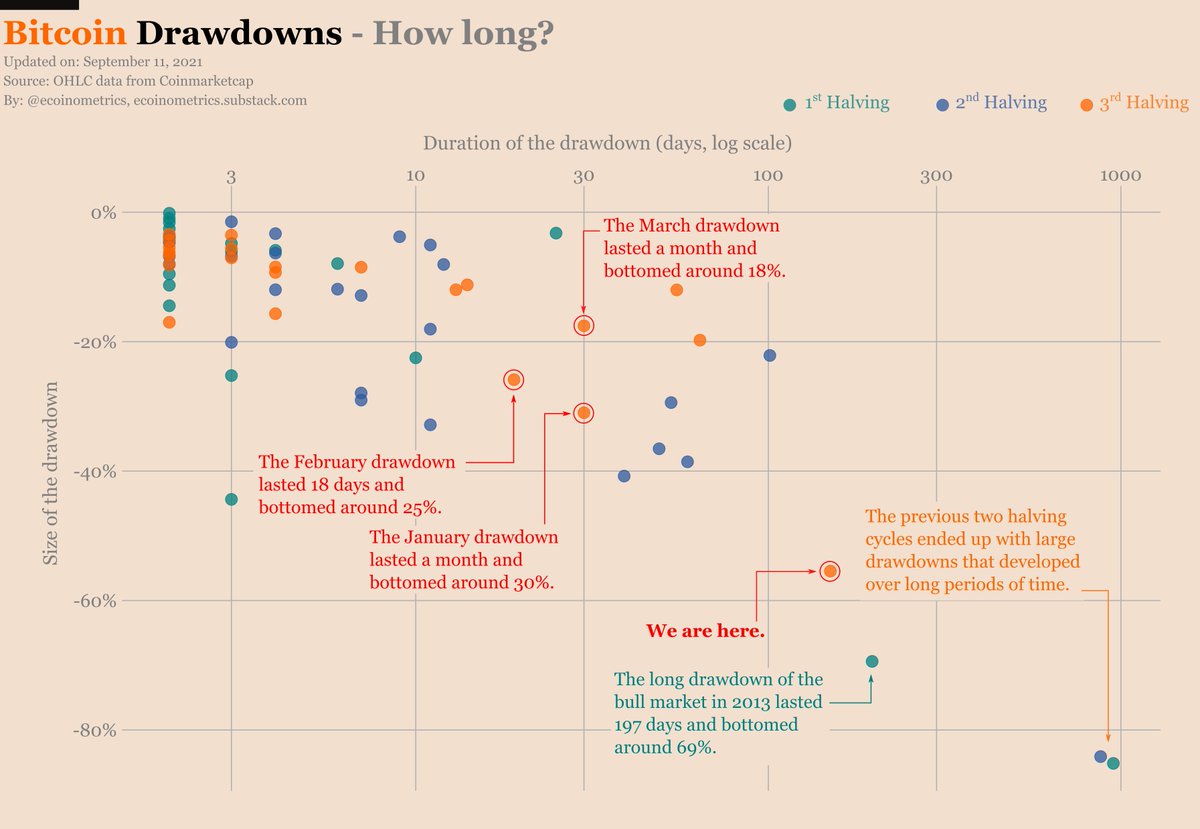

1/ It has been 151 days since BTC hit its all-time high... 👇

Sep. 11, 2021

487 days after the 3rd halving

#BTC at $45,596

1/ It has been 151 days since BTC hit its all-time high... 👇

2/ We are 50 days away from this correction being the longest drawdown #Bitcoin experienced in a post-halving bull market... 👇

3/ But the recovery is well underway. If we get some catalyst for FOMO to kick in, who knows, #Bitcoin could even do a repeat of 2013. 🚀

One can hope🤞...

One can hope🤞...

• • •

Missing some Tweet in this thread? You can try to

force a refresh