Monthly updates for all 3 portfolios for the month of Nov- 2021:

No recommendations, just sharing my journey!!

#MostlyMomentum #stockmarkets #StockMarket #stocks #investing #trading

⬇️ ⬇️ ⬇️ ⬇️ ⬇️ ⬇️

No recommendations, just sharing my journey!!

#MostlyMomentum #stockmarkets #StockMarket #stocks #investing #trading

⬇️ ⬇️ ⬇️ ⬇️ ⬇️ ⬇️

1/

#MOSTLYMOMENTUM- FLEXI CAP (DAILY RECONSTITUTION) MONTHLY UPDATE: NOV-21

Starting NAV (12-03-2021): 100.00

Current NAV (30-11-2021): 150.49

Compounded Annualised Returns: 90.23%

Annualised Standard Deviation (Based on daily closing): 24.76%

Maximum Drawdown: -12.80%

#MOSTLYMOMENTUM- FLEXI CAP (DAILY RECONSTITUTION) MONTHLY UPDATE: NOV-21

Starting NAV (12-03-2021): 100.00

Current NAV (30-11-2021): 150.49

Compounded Annualised Returns: 90.23%

Annualised Standard Deviation (Based on daily closing): 24.76%

Maximum Drawdown: -12.80%

Trailing Returns:

Since Inception:

#MostlyMomentum (Daily Reconstitution) Portfolio: 50.49%

#NIFTY100: 12.99%

#NIFTYMidcap100: 22.42%

#NIFTYSmallcap100: 26.32%

Since Inception:

#MostlyMomentum (Daily Reconstitution) Portfolio: 50.49%

#NIFTY100: 12.99%

#NIFTYMidcap100: 22.42%

#NIFTYSmallcap100: 26.32%

6 Months:

#MostlyMomentum (Daily Reconstitution) Portfolio: 26.59%

#NIFTY100: 9.31%

#NIFTYMidcap100: 15.03%

#NIFTYSmallcap100: 15.04%

3 Months:

#MostlyMomentum (Daily Reconstitution) Portfolio: 3.50%

#NIFTY100: -0.59%

#NIFTYMidcap100: 4.34%

#NIFTYSmallcap100: 3.88%

#MostlyMomentum (Daily Reconstitution) Portfolio: 26.59%

#NIFTY100: 9.31%

#NIFTYMidcap100: 15.03%

#NIFTYSmallcap100: 15.04%

3 Months:

#MostlyMomentum (Daily Reconstitution) Portfolio: 3.50%

#NIFTY100: -0.59%

#NIFTYMidcap100: 4.34%

#NIFTYSmallcap100: 3.88%

1 Month:

#MostlyMomentum (Daily Reconstitution) Portfolio: -0.09%

#NIFTY100: -3.41%

#NIFTYMidcap100: -2.69%

#NIFTYSmallcap100: -0.98%

Check the attached chart for comparison:

#MostlyMomentum (Daily Reconstitution) Portfolio: -0.09%

#NIFTY100: -3.41%

#NIFTYMidcap100: -2.69%

#NIFTYSmallcap100: -0.98%

Check the attached chart for comparison:

Sector wise portfolio allocation:

#TextilesandApparel: 20.05%

#RAJESHEXPO: 5.32%

#KDDL: 5.20%

#MONTECARLO: 4.80%

#TCNSBRANDS: 4.73%

#MachineryEquipmentandComponents: 14.67%

#VOLTAMP: 5.02%

#ELGIEQUIP: 5.01%

#BBL: 4.64%

#Chemicals: 10.06%

#BORORENEW: 5.09%

#NEOGEN: 4.97%

#TextilesandApparel: 20.05%

#RAJESHEXPO: 5.32%

#KDDL: 5.20%

#MONTECARLO: 4.80%

#TCNSBRANDS: 4.73%

#MachineryEquipmentandComponents: 14.67%

#VOLTAMP: 5.02%

#ELGIEQUIP: 5.01%

#BBL: 4.64%

#Chemicals: 10.06%

#BORORENEW: 5.09%

#NEOGEN: 4.97%

#AutomobilesandAutoParts: 9.61%

#JBMA: 5.02%

#SUNCLAYLTD: 4.59%

#HealthcareProvidersandServices: 5.31%

#APOLLOHOSP: 5.31%

#MediaandPublishing: 5.13%

#TVTODAY: 5.13%

#BankingServices: 5.12%

#HOMEFIRST: 5.12%

#HouseholdGoods: 5.09%

#SFL: 5.09%

#JBMA: 5.02%

#SUNCLAYLTD: 4.59%

#HealthcareProvidersandServices: 5.31%

#APOLLOHOSP: 5.31%

#MediaandPublishing: 5.13%

#TVTODAY: 5.13%

#BankingServices: 5.12%

#HOMEFIRST: 5.12%

#HouseholdGoods: 5.09%

#SFL: 5.09%

#RenewableEnergy: 5.07%

#MTARTECH: 5.07%

#SoftwareandITServices: 5.05%

#LTTS: 5.05%

#CashandCashEquivalent: 5.04%

#LIQUIDBEES: 5.04%

#FreightandLogisticsServices: 4.99%

#TCIEXP: 4.99%

#InvestmentBankingandInvestmentServices: 4.81%

#UGROCAP: 4.81%

#MTARTECH: 5.07%

#SoftwareandITServices: 5.05%

#LTTS: 5.05%

#CashandCashEquivalent: 5.04%

#LIQUIDBEES: 5.04%

#FreightandLogisticsServices: 4.99%

#TCIEXP: 4.99%

#InvestmentBankingandInvestmentServices: 4.81%

#UGROCAP: 4.81%

2/

#MOSTLYMOMENTUM- FLEXI CAP (WEEKLY RECONSTITUTION) MONTHLY UPDATE: NOV-21

Starting NAV (28-10-2021): 100.00

Current NAV (30-11-2021): 99.48

Compounded Annualised Returns: -5.60%

Annualised Standard Deviation (Based on daily closing): 27.02%

Maximum Drawdown: -6.65%

#MOSTLYMOMENTUM- FLEXI CAP (WEEKLY RECONSTITUTION) MONTHLY UPDATE: NOV-21

Starting NAV (28-10-2021): 100.00

Current NAV (30-11-2021): 99.48

Compounded Annualised Returns: -5.60%

Annualised Standard Deviation (Based on daily closing): 27.02%

Maximum Drawdown: -6.65%

Trailing Returns :

Since Inception :

#MostlyMomentum (Weekly Reconstitution) Portfolio : -0.52%

#NIFTY100 : -6.09%

#NIFTYMidcap100 : -4.74%

#NIFTYSmallcap100 : -3.27%

Since Inception :

#MostlyMomentum (Weekly Reconstitution) Portfolio : -0.52%

#NIFTY100 : -6.09%

#NIFTYMidcap100 : -4.74%

#NIFTYSmallcap100 : -3.27%

1 Month :

#MostlyMomentum (Weekly Reconstitution) Portfolio : 0.90%

#NIFTY100 : -3.41%

#NIFTYMidcap100 : -2.69%

#NIFTYSmallcap100 : -0.98%

Check the attached chart for comparison :

#MostlyMomentum (Weekly Reconstitution) Portfolio : 0.90%

#NIFTY100 : -3.41%

#NIFTYMidcap100 : -2.69%

#NIFTYSmallcap100 : -0.98%

Check the attached chart for comparison :

Sector wise portfolio allocation :

#Chemicals: 15.46%

#BORORENEW: 5.34%

#NEOGEN: 5.15%

#SOLARINDS: 4.97%

#AutomobilesandAutoParts: 15.24%

#PRECAM: 5.40%

#JBMA: 5.04%

#TIINDIA: 4.80%

#TextilesandApparel: 15.01%

#GOKEX: 5.18%

#TITAN: 5.02%

#MONTECARLO: 4.81%

#Chemicals: 15.46%

#BORORENEW: 5.34%

#NEOGEN: 5.15%

#SOLARINDS: 4.97%

#AutomobilesandAutoParts: 15.24%

#PRECAM: 5.40%

#JBMA: 5.04%

#TIINDIA: 4.80%

#TextilesandApparel: 15.01%

#GOKEX: 5.18%

#TITAN: 5.02%

#MONTECARLO: 4.81%

#HouseholdGoods: 9.78%

#SFL: 5.17%

#BOROLTD: 4.61%

#InvestmentBankingandInvestmentServices: 9.65%

#BSE: 4.94%

#SHAREINDIA: 4.70%

#Beverages: 5.16%

#RADICO: 5.16%

#MachineryEquipmentandComponents: 5.09%

#ESABINDIA: 5.09%

#FreightandLogisticsServices: 5.09%

#TCIEXP: 5.09%

#SFL: 5.17%

#BOROLTD: 4.61%

#InvestmentBankingandInvestmentServices: 9.65%

#BSE: 4.94%

#SHAREINDIA: 4.70%

#Beverages: 5.16%

#RADICO: 5.16%

#MachineryEquipmentandComponents: 5.09%

#ESABINDIA: 5.09%

#FreightandLogisticsServices: 5.09%

#TCIEXP: 5.09%

#SoftwareandITServices: 5.05%

#TECHM: 5.05%

#HomebuildingandConstructionSupplies: 4.92%

#ACRYSIL: 4.92%

#ConstructionMaterials: 4.83%

#GRASIM: 4.83%

#PaperandForestProducts: 4.73%

#CENTURYPLY: 4.73%

#TECHM: 5.05%

#HomebuildingandConstructionSupplies: 4.92%

#ACRYSIL: 4.92%

#ConstructionMaterials: 4.83%

#GRASIM: 4.83%

#PaperandForestProducts: 4.73%

#CENTURYPLY: 4.73%

3/

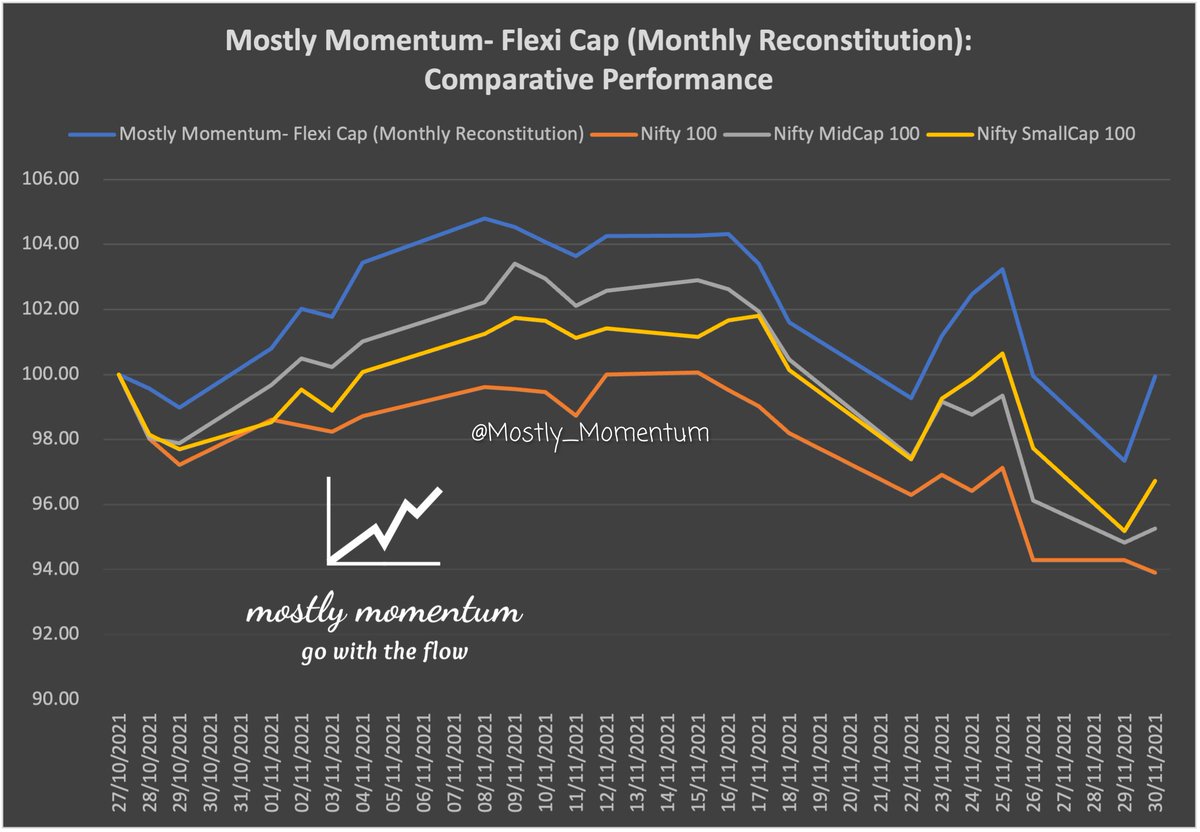

#MOSTLYMOMENTUM- FLEXI CAP (MONTHLY RECONSTITUTION) MONTHLY UPDATE: NOV-21

Starting NAV (18-10-2021): 100.00

Current NAV (30-11-2021): 99.94

Compounded Annualised Returns: -0.62%

Annualised Standard Deviation (Based on daily closing): 23.74%

Maximum Drawdown: -7.11%

#MOSTLYMOMENTUM- FLEXI CAP (MONTHLY RECONSTITUTION) MONTHLY UPDATE: NOV-21

Starting NAV (18-10-2021): 100.00

Current NAV (30-11-2021): 99.94

Compounded Annualised Returns: -0.62%

Annualised Standard Deviation (Based on daily closing): 23.74%

Maximum Drawdown: -7.11%

Trailing Returns :

Since Inception :

#MostlyMomentum (Weekly Reconstitution) Portfolio : -1.01%

#NIFTY100 : -6.09%

#NIFTYMidcap100 : -4.74%

#NIFTYSmallcap100 : -3.27%

Since Inception :

#MostlyMomentum (Weekly Reconstitution) Portfolio : -1.01%

#NIFTY100 : -6.09%

#NIFTYMidcap100 : -4.74%

#NIFTYSmallcap100 : -3.27%

1 Month :

#MostlyMomentum (Weekly Reconstitution) Portfolio : 0.97%

#NIFTY100 : -3.41%

#NIFTYMidcap100 : -2.69%

#NIFTYSmallcap100 : -0.98%

Check the attached chart for comparison :

#MostlyMomentum (Weekly Reconstitution) Portfolio : 0.97%

#NIFTY100 : -3.41%

#NIFTYMidcap100 : -2.69%

#NIFTYSmallcap100 : -0.98%

Check the attached chart for comparison :

Sector wise portfolio allocation :

#MachineryEquipmentandComponents: 15.64%

#KEI: 5.30%

#KABRAEXTRU: 5.25%

#ESABINDIA: 5.09%

#AutomobilesandAutoParts: 14.57%

#JBMA: 5.04%

#TIINDIA: 4.88%

#JAMNAAUTO: 4.65%

#Chemicals: 10.33%

#BORORENEW: 5.37%

#SOLARINDS: 4.96%

#MachineryEquipmentandComponents: 15.64%

#KEI: 5.30%

#KABRAEXTRU: 5.25%

#ESABINDIA: 5.09%

#AutomobilesandAutoParts: 14.57%

#JBMA: 5.04%

#TIINDIA: 4.88%

#JAMNAAUTO: 4.65%

#Chemicals: 10.33%

#BORORENEW: 5.37%

#SOLARINDS: 4.96%

#TextilesandApparel: 10.07%

#RELAXO: 5.05%

#TITAN: 5.01%

#Beverages: 10.04%

#RADICO: 5.15%

#VBL: 4.89%

#InvestmentBankingandInvestmentServices: 9.64%

#BSE: 4.94%

#SHAREINDIA: 4.70%

#HouseholdGoods: 5.16%

#SFL: 5.16%

#FreightandLogisticsServices: 5.08%

#TCIEXP: 5.08%

#RELAXO: 5.05%

#TITAN: 5.01%

#Beverages: 10.04%

#RADICO: 5.15%

#VBL: 4.89%

#InvestmentBankingandInvestmentServices: 9.64%

#BSE: 4.94%

#SHAREINDIA: 4.70%

#HouseholdGoods: 5.16%

#SFL: 5.16%

#FreightandLogisticsServices: 5.08%

#TCIEXP: 5.08%

#SoftwareandITServices: 5.04%

#TECHM: 5.04%

#HomebuildingandConstructionSupplies: 4.92%

#ACRYSIL: 4.92%

#ConstructionMaterials: 4.78%

#JKCEMENT: 4.78%

#PaperandForestProducts: 4.73%

#CENTURYPLY: 4.73%

#TECHM: 5.04%

#HomebuildingandConstructionSupplies: 4.92%

#ACRYSIL: 4.92%

#ConstructionMaterials: 4.78%

#JKCEMENT: 4.78%

#PaperandForestProducts: 4.73%

#CENTURYPLY: 4.73%

DISCLAIMER : NO RECOMMENDATIONS! Just sharing my journey. (Updated every month end.)

#MostlyMomentum #stockmarkets #StockMarket #stocks #investing #trading

#MostlyMomentum #stockmarkets #StockMarket #stocks #investing #trading

@threadreaderapp please unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh