Top 6 Rules of #PaulTudorJones

Who is Paul Jones ?

Paul Tudor Jones II is an American billionaire hedge fund manager, With net worth of around $8 Billion .

Famously known for predicting the Black Monday in 1987, during which he tripled his money on his large short positions

Who is Paul Jones ?

Paul Tudor Jones II is an American billionaire hedge fund manager, With net worth of around $8 Billion .

Famously known for predicting the Black Monday in 1987, during which he tripled his money on his large short positions

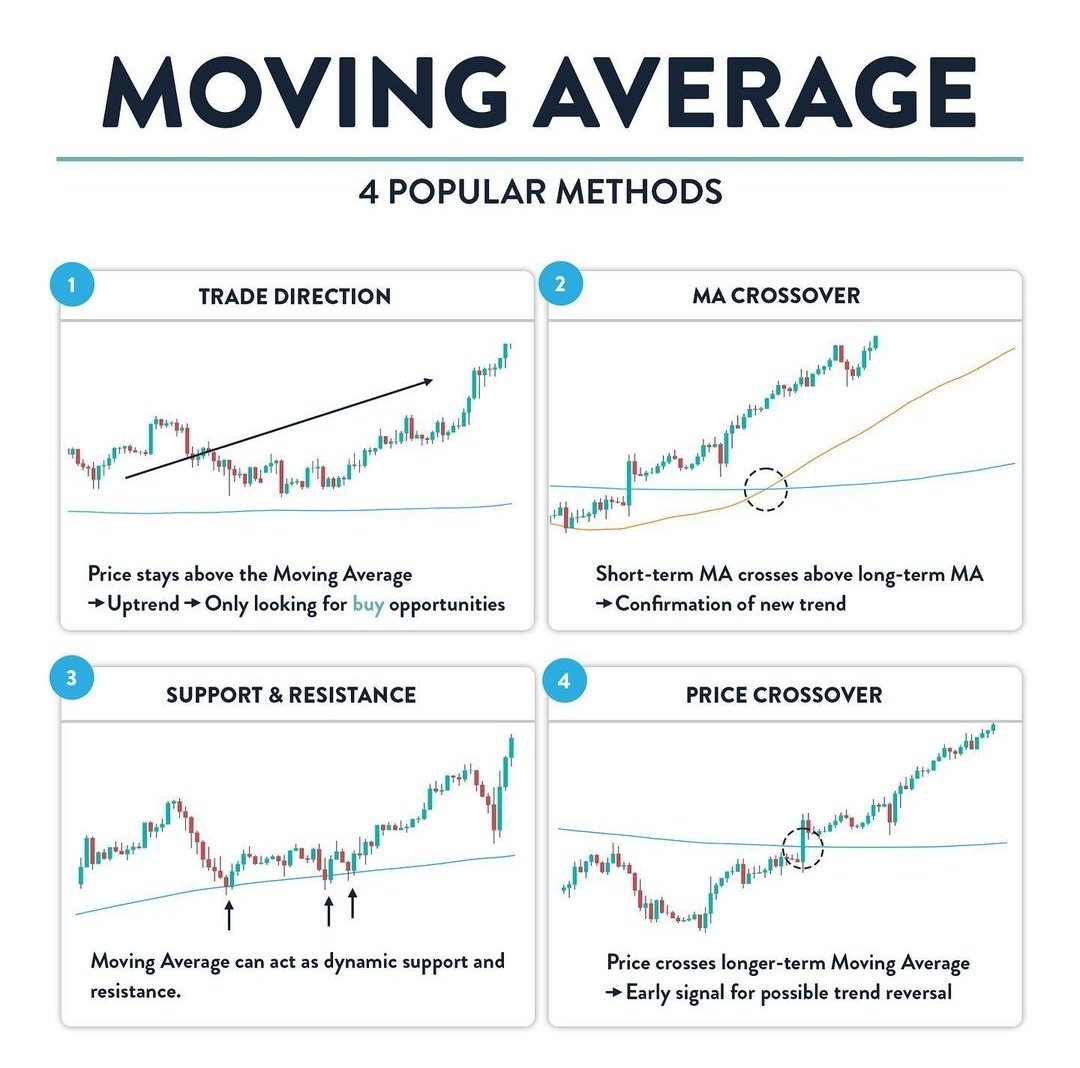

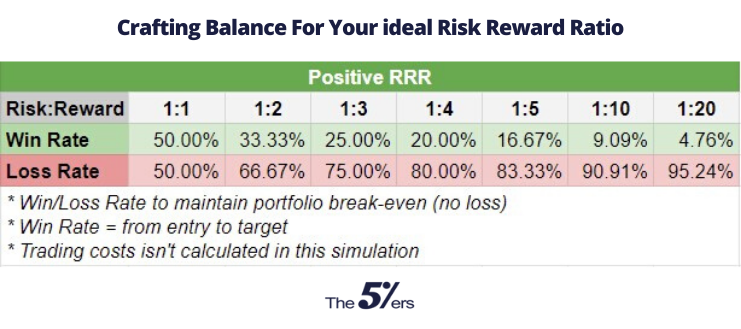

1."Look for tremendously skewed reward-risk opportunities"

Rather than focusing on win rate , Focus on Risk Reward

A risk Reward > 1:2 is always favourable for trader

Rather than focusing on win rate , Focus on Risk Reward

A risk Reward > 1:2 is always favourable for trader

2. “There is no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market.”

No Strategies can be copied , until the trader himself has his own observation and experience and applies

No Strategies can be copied , until the trader himself has his own observation and experience and applies

3. “The most important rule of trading is to play great defense, not offense.”

Your first focus should not be on making money but rather protecting what you have .

Most people think of rewards first rather then thinking about the risk involved.

Your first focus should not be on making money but rather protecting what you have .

Most people think of rewards first rather then thinking about the risk involved.

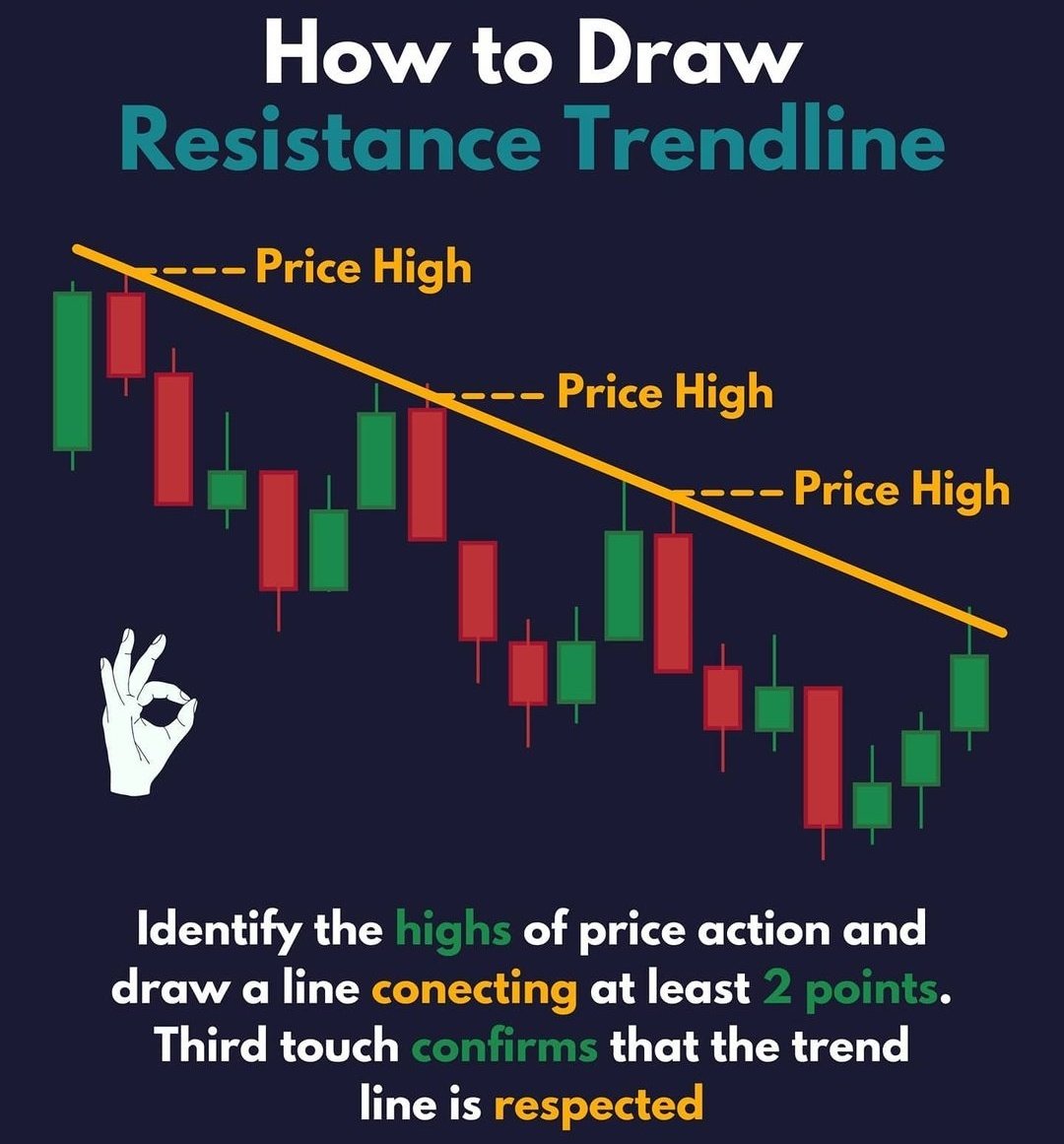

4. “You always want to be with whatever the predominant trend is.”

His Main rule was not buying stocks below 200 ema and not selling stocks above 200 ema.

Trend is your friend and that is how he predicted the 1987 crash when the index broke 200 ema

His Main rule was not buying stocks below 200 ema and not selling stocks above 200 ema.

Trend is your friend and that is how he predicted the 1987 crash when the index broke 200 ema

5. “At the end of the day, your job is to buy what goes up and to sell what goes down.”

To be successful in trading all you need to do is buy stocks that will go up and sell them at a higher price.

BUY HIGH SELL HIGHER

SELL LOW BUY LOWER

To be successful in trading all you need to do is buy stocks that will go up and sell them at a higher price.

BUY HIGH SELL HIGHER

SELL LOW BUY LOWER

6.“Every day I assume every position I have is wrong.”

You should know what us the maximum drawdown you will face if all the stocks hit your stop loss .

If the risk is bigger , cut your lossess fast and ride the trend

@AdityaTodmal @Rishikesh_ADX @kuttrapali26

You should know what us the maximum drawdown you will face if all the stocks hit your stop loss .

If the risk is bigger , cut your lossess fast and ride the trend

@AdityaTodmal @Rishikesh_ADX @kuttrapali26

• • •

Missing some Tweet in this thread? You can try to

force a refresh