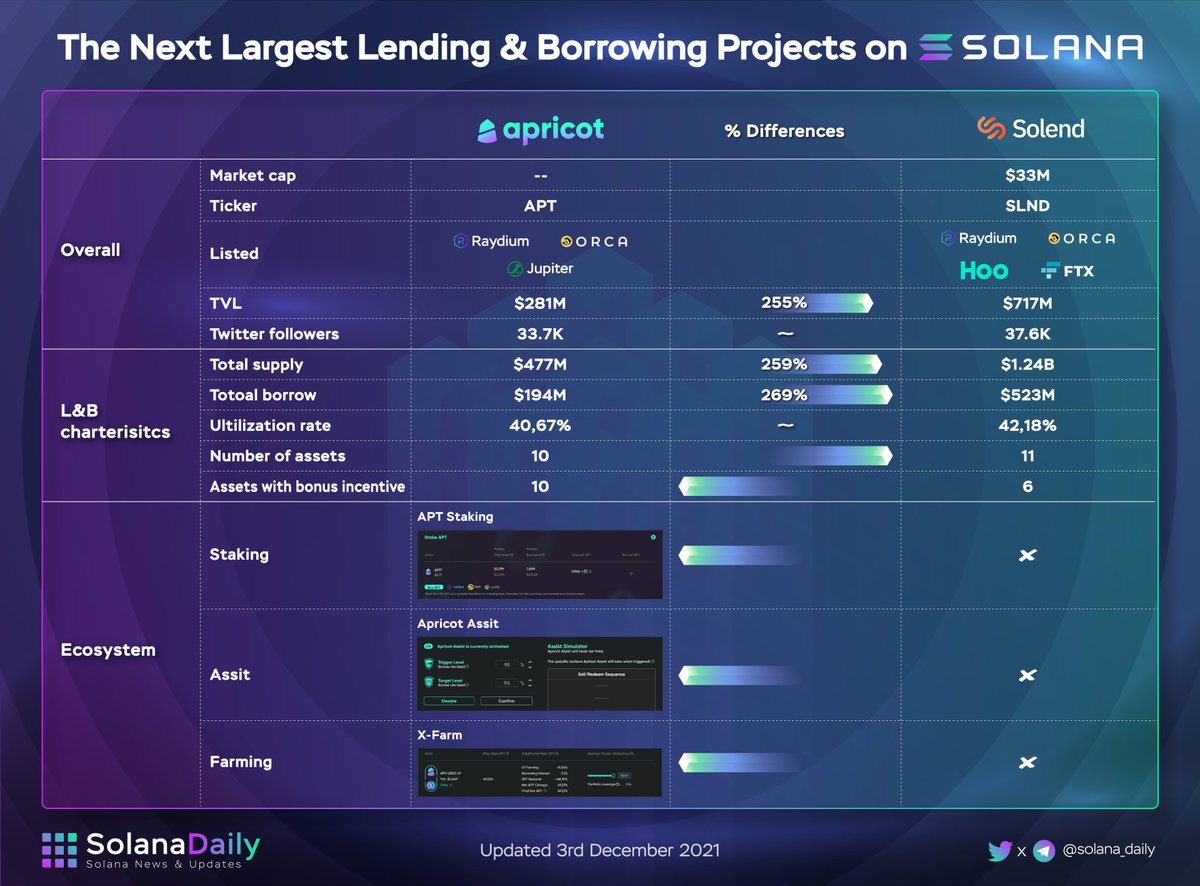

THE NEXT LARGEST LENDING AND BORROWING PROJECTS ON #SOLANA

1. The largest lending and borrowing project on Solana now is @solendprotocol . However, as history taught us, nothing lasts forever (expect BTC). Shall @ApricotFinance be able to overthrow solend?

#Solanaszn #compare

1. The largest lending and borrowing project on Solana now is @solendprotocol . However, as history taught us, nothing lasts forever (expect BTC). Shall @ApricotFinance be able to overthrow solend?

#Solanaszn #compare

@solendprotocol @ApricotFinance 2. In the overall section, the statistics of both projects showed the same/ relatively small differences between two projects, except for the TVL.

The TVL of solend outperforms the TVL of apricot up to 255%. What a differences.

#Solanaszn #compare

The TVL of solend outperforms the TVL of apricot up to 255%. What a differences.

#Solanaszn #compare

@solendprotocol @ApricotFinance 3. On the L&B characteristics, the total supply and total borrow of @ApricotFinance cannot compare with the Solend. This phenomenon may happen due to the time of incentive programs between two projects.

#Solanaszn #compare

#Solanaszn #compare

@solendprotocol @ApricotFinance 4. ..Solend had the program prior to Apricot and was the right place to pick up the next stage of money flow of Solana.

However , after the end of the incentive program, what do attract user is the value of the project itself and the ecosystem along with it.

#Solanaszn #compare

However , after the end of the incentive program, what do attract user is the value of the project itself and the ecosystem along with it.

#Solanaszn #compare

@solendprotocol @ApricotFinance 5. With @ApricotFinance, their ecosystem is definitely much more impressive than solend. They have an APT staking program, Assist program and even the X-farm program.

#Solanaszn #compare

#Solanaszn #compare

@solendprotocol @ApricotFinance 6. On staking aspects, with 18% APY, users have more than a way to earn profit with apricot rather than just depositing or borrowing then selling the APT right away. In the long term, this policy even supports the price of APT when users tend to stake APT rather than selling it.

@solendprotocol @ApricotFinance 7. @ApricotFinance has the assist program to protect users from the hazard movement of the market. Only one thing i know that, the more program tends to put concentration on users, the more successful the project become.

#Solanaszn #compare

#Solanaszn #compare

@solendprotocol @ApricotFinance 8. They even have the X-farm program. Being connected to Saber and Orca, users can deposit their LP tokens on the platform to earn passive income, creating more choices for users.

#Solanaszn #compare

#Solanaszn #compare

@solendprotocol @ApricotFinance 9. In conclusion, with the current ecosystem, I believe users and money flow would be attracted by these utilizations of Apricot and outperform Solend, becoming the largest L&B project in Solana.

Let the time prove it.

This only showed the researcher's perspective, NFA.

Let the time prove it.

This only showed the researcher's perspective, NFA.

• • •

Missing some Tweet in this thread? You can try to

force a refresh