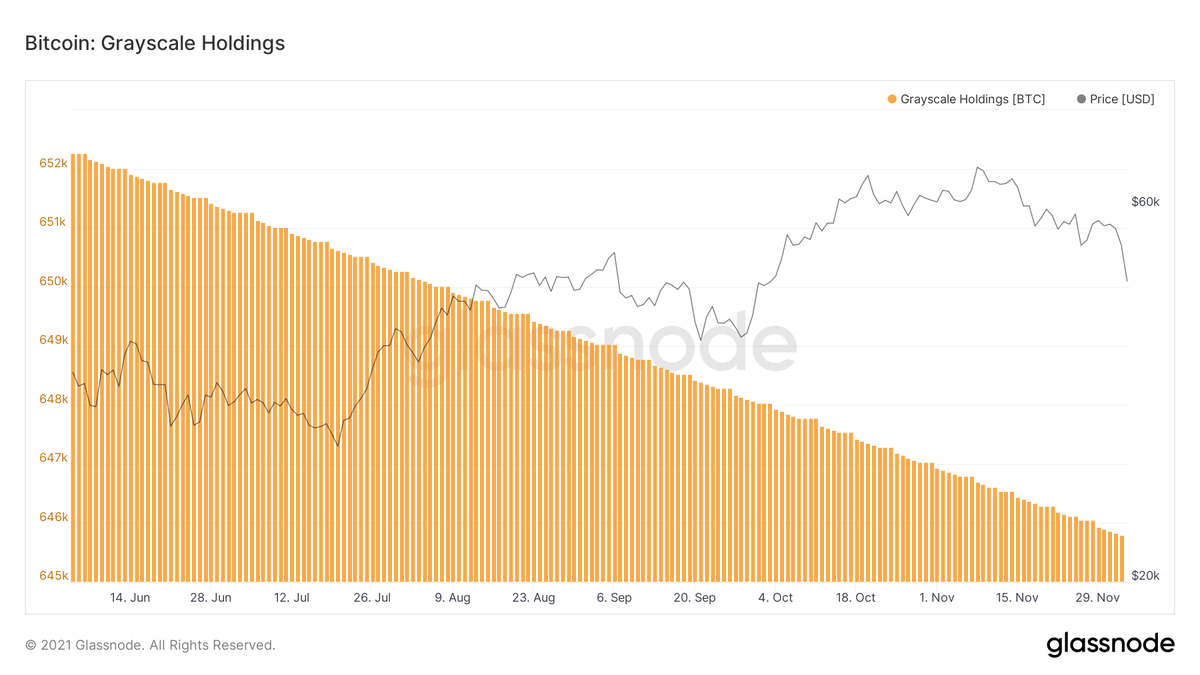

Due to the @Grayscale trust discount, #Grayscale had been selling their #Bitcoin bit by bit for almost 10 months now, on average selling 30-50 #BTC a week.

In contrast, last December, #Grayscale was buying BTC aggressive due to their trust premium.

For example, from #Bitcoin's $20k to $40k move from Dec 2020 to Feb 2021, @Grayscale played an instrumental role, they purchased 60,240 #BTC during that period ($1.8B USD worth of BTC).

For example, from #Bitcoin's $20k to $40k move from Dec 2020 to Feb 2021, @Grayscale played an instrumental role, they purchased 60,240 #BTC during that period ($1.8B USD worth of BTC).

Similar story for #ETH, Grayscale had been selling on average 200-250 $ETH per week for months now.

The sooner #Grayscale trust be can be turned into ETF, the sooner will they start buying #BTC and ETH again.

They could become the largest spot ETF in the world, if SEC approves.

The sooner #Grayscale trust be can be turned into ETF, the sooner will they start buying #BTC and ETH again.

They could become the largest spot ETF in the world, if SEC approves.

This is holding for Canadian purpose ETF, as you can see they had been consistently buying.

Imo, Grayscale went from buying pressure to selling pressure in the past 12 months plays a role in setting the $60k top for #Bitcoin and exhaust other #BTC buyers.

Imo, Grayscale went from buying pressure to selling pressure in the past 12 months plays a role in setting the $60k top for #Bitcoin and exhaust other #BTC buyers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh