If you think #Bitcoin cycle will continue and this is just a mid-cycle correction, then historically, this large drawdown (30% from ATH) should be an excellent buy.

Each time after new ATH, there are several >25% corrections, other than the last one in the cycle, all good buys.

Each time after new ATH, there are several >25% corrections, other than the last one in the cycle, all good buys.

In the 2017 cycle, after #BTC passed the previous ATH of $1k, there were 7 corrections that are >25% (3 of them are >35%), except for the last one, the first 6 were all good buying opportunities. After the 6th correction, BTC went from $6k -> $19k ATH.

In current cycle, after #BTC passed previous ATH of $20k, there were 3 corrections >25% (last one was the May 2021), except for that one, the first two were excellent buy points. $30k ->$57k, $45k->$61k

Now we are in the first >25% correction after passing previous ATH of $65k.

Now we are in the first >25% correction after passing previous ATH of $65k.

So the question is, do you think this is cycletop or mid-cycle correction?

Bullish evidence: #BTC bounced back from $30k to new ATH again within 6 months, that's massively bullish

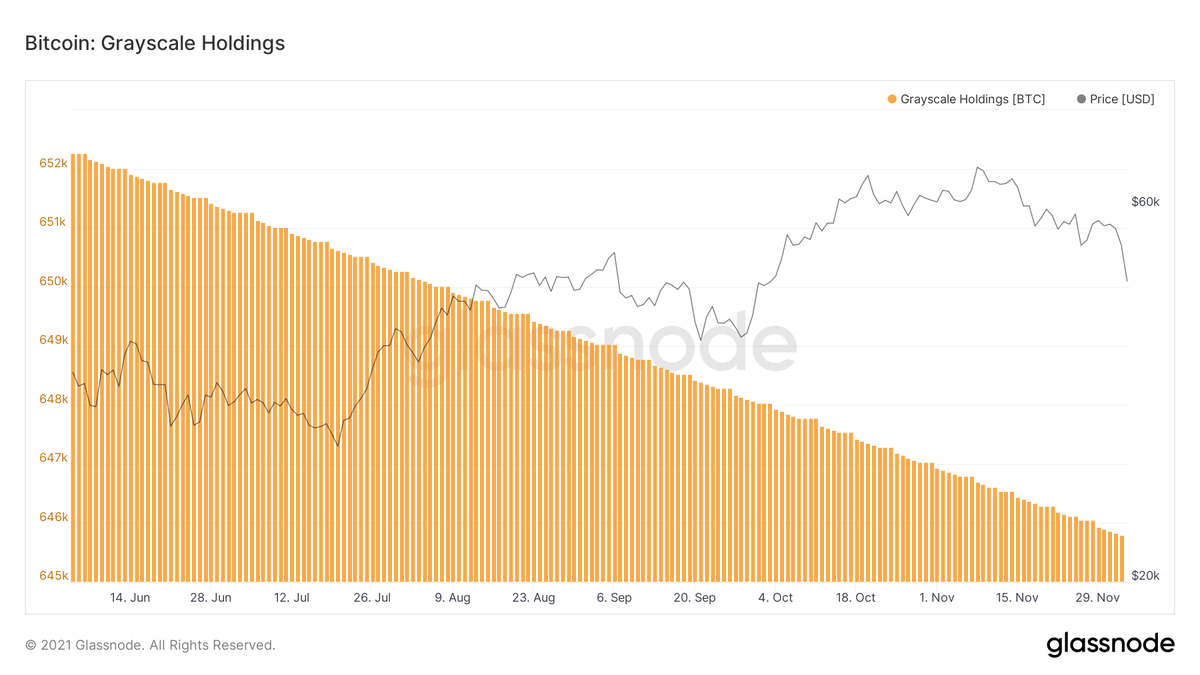

Bearish evidence: BTC price is lower today than Feb 2021 (10 months ago), momentum seems exhausted

Bullish evidence: #BTC bounced back from $30k to new ATH again within 6 months, that's massively bullish

Bearish evidence: BTC price is lower today than Feb 2021 (10 months ago), momentum seems exhausted

• • •

Missing some Tweet in this thread? You can try to

force a refresh